Centerbridge Partners, which holds over 2.5 million shares in Hercules Offshore, have challenged the drilling company’s decision to file for Chapter 11 bankruptcy earlier this week claiming it was unnecessary, according to the Wall Street Journal.

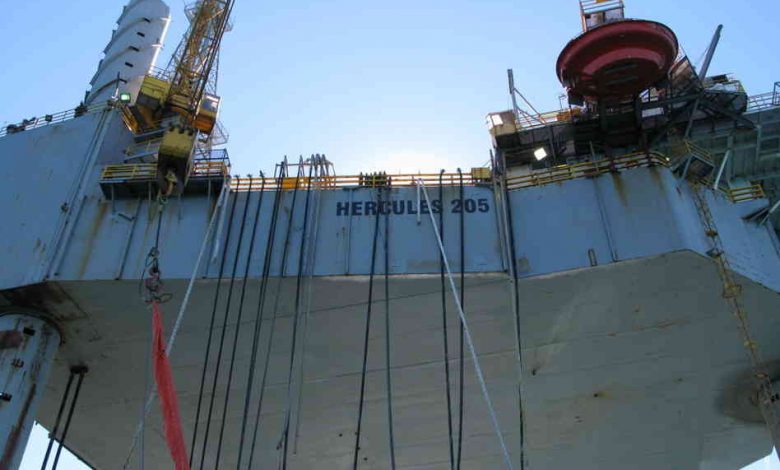

Hercules Offshore filed for Chapter 11 on Monday backed by lenders, with a restructuring plan to put all its assets put of for sale. It intends to operate normally while the sale process is being conducted, and any assets left unsold at the completion of the process will be placed into a wind-down vehicle.

Centerbridge has asked the Delaware bankruptcy court to give equity holders time to form a committee to look into the Chapter 11 filing and take a position on the future of the company. It has accusing senior lenders of manufacturing an unnecessary bankruptcy in order to collect a premium for early payoff of their debt.

Centerbridge also questions the bankruptcy on the basis that Hercules has over $400m in cash and oil prices have rebounded back above the $50 level.

Hercules only emerged from its previous Chapter 11 in November 2015.