More than 40 ships waiting outside LA and Long Beach setting new record

The number of ships at anchor, waiting for berth space to open up at America’s two largest boxports has hit a new record today with more than 40 ships now forming queues further and further away from the terminals at Los Angeles and Long Beach.

The extraordinary congestion seen at America’s main two west coast ports is far worse than the port lockout days of 2002 and 2004.

When the ports of Los Angeles and Long Beach were locked out for 10 days and eight days in 2002 and 2004 respectively, ship queues never exceeded 30 vessels, and yet the the port lockdowns caused significant economic chaos. The situation today is far more grave.

Splash has identified 41 containerships at or near to the San Pedro anchorage awaiting a berth today in a peak season like none other in the 65-year history of containerisation.

The Los Angeles port data for August showed that 90% of vessels headed straight to anchor, joining a queue averaging 7.8 days of anchor time.

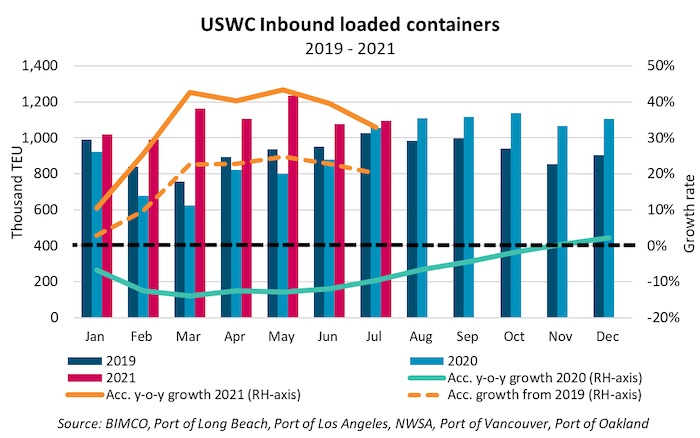

Peter Sand, chief shipping economist at global shipowning organisation BIMCO, told Splash: “Shippers, some of which are already low on inventories, are frontloading to secure goods in stock for upcoming key sales seasons such as Black Friday and Christmas.”

Sand said longshoremen at both ports have been unable to get containers out of the port – loaded inbound as well as empties outbound – fast enough.

“As yard density is now quite high, the efficiency of the logistics comes down,” Sand explained.

A lack of chassis across the US is also making the line of ships waiting longer.

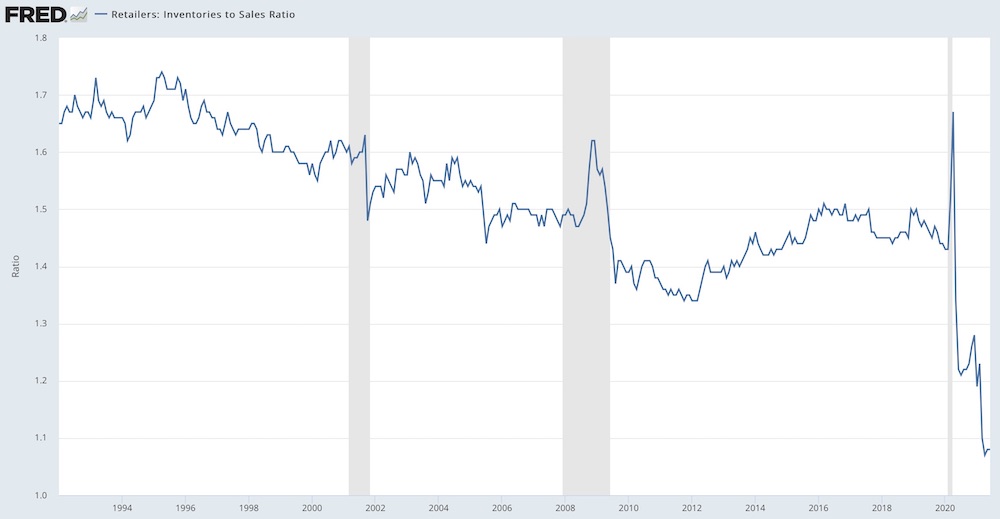

Retailers in the US are battling record low inventories, likely meaning the container crunch will worsen in the coming weeks.

The inventories to sales ratios show the relationship of the end-of-month values of inventory to the monthly sales. These ratios can be looked at as indications of the number of months of inventory that are on hand in relation to the sales for a month. For example, a ratio of 2.5 would indicate that the retail stores have enough merchandise on hand to cover two and a half months of sales. This ratio currently stands at just 1.08.

Commenting on this lack of inventory, Steve Ferreira, CEO of New York-based Ocean Audit, wrote on LinkedIn: “This is the reason importers/retailers are paying top dollar for private vessel charters and $15,000 / 40′ space. The reason why little green dots on the satellite show dozens of ocean vessels trying to berth.”

Giving an update on operations earlier in the month, Gene Seroka, the executive director of the Port of Los Angeles, said the challenge facing the entire supply chain amounts to “squeezing 10 lanes of freeway traffic into five lanes.”

The port boss advised consumers to get their Christmas shopping plans in place far earlier this year or risk having some very disappointed family members come December 25.

The Marine Exchange of Southern California has been forced this month to open drift areas as both the bay’s primary and overflow anchorages are full.

Drewry’s weekly World Container Index, published today, registered more steep climbs on the transpacific, with rates from Shanghai to Los Angeles climbing by nearly $400 over the past week to stand at $11,362 per feu while rates from Shanghai to New York leapt by more than $600 to $14,136 per feu.

The maps below show the ships at anchor in San Pedro Bay, and at the bottom, courtesy of eeSea, all boxships heading to Los Angeles and Long Beach in the coming 28 days.

Longshoreman did not strike in 2002 and 2004. The employers locked all the gates. They refused to allow us to come in to do jobs that we were hired to do.

Please fact check your information before you print it.

Thanks for that. The truth always comes out.

Fixed – well spotted!

Is it fine to feature your news article on LinkedIn?

How about the lockout of 2012 and slowdown of 2015, can’t recall but also quite the queue. Hoot shifts might help, also hiring more casuals if jobs are hanging. Then it comes down to intermodal constraints of truckers and equipment.

The article mentions a “lack of chassis across the U.S” as one reason for the backup. A box ship arrives in the Los Angeles/Long Beach Harrbor. Dockside a crane lifts the containers off the ship. The container is then loaded on a chassis (a truck trailer) and taken to the Intermodal Freight Terminal about five miles up the road. There the container comes off the “chassis” and is loaded on a railcar, and ultimately hauled across the country by train to say Dallas or Chicago where the container is taken off the railcar, put on another “chassis” and trucked to its final destination.

Youi need lots of truckers and trucks to make this thing work. And of course on any continuouis throughput system–China factory-China port-load on box ship-cross Pacific–unload box ship; on chassis to internmodal terminal; load on rail car–across country–put on chassis–deliver to final destination–any “lump” makes things go haywire. It’s the old pig in a python problem–takes a while to work it out.

When two or more get in a labor fight like this, there is plenty of blame to go around. Once the socialists take-over, then all the blame goes to the government. Ask Venezuela how much blame the government deserves.

Let’s not forget how hard California has been bringing a chassis into their state from other states. Emission rules, chassis weights, taxes. Once again, more bureaucracy leads to more bumps in the road.