MR2s: Shorter trips for ships

Owners shouldn’t despair at short term spot market performance of clean tankers; the underlying fundamentals still look sound, argues Court Smith from VesselsValue.

The clean tanker markets are depressed as ton mile demand across the MR2 to LR2 markets remains stagnant. Fundamentally this is due to the addition of new ships to the fleet and the flat ton mile demand created. Higher oil prices appear to be discouraging some global consumption of clean product consumption. A breakdown across each market segment is shown below.

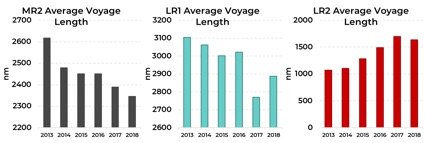

A deeper dive into the data shows that the average voyage length for MR2s, which account for about half of all ton mile demand, has been steadily declining since the start of 2013. This is a result of the rise in US product exports, which has amplified the number of short haul cargoes from the US Gulf to Latin America. The length of LR2 voyages has surged upwards at the same time, along with the ton mile demand for the larger clean tankers. This has contributed to the flat MR2 trend, as the larger tankers displace over two MR2 cargoes per fixture.

The uncertainty around the clean product trade in 2020 should cause ton mile demand for distillate to explode as most owners in the dry bulk and tanker segments appear to be choosing compliance options other than scrubbers. This will require the movement of distillate fuels from refining hubs to bunkering hubs. Singapore receives most of its current bunker fuel supplies on large crude tankers. The need to resupply these hubs will fall on larger clean tankers, while creating some longer haul opportunities for MR2s as well.

The state of the spot market undoubtably has some market participants spooked. Atlantic Basin market returns currently stand at under $3,000/day according to the Baltic Exchange. However, the expected market dynamics in the run up to stockpile MGO ahead of 2020 should cause a large swing in market rates. The expected uptick in demand should cause spot market rates and term hire asking numbers, which should support asset values.

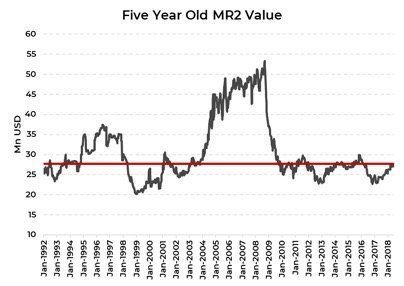

The asset value for a five-year-old MR2 has just now returned to its 25-year median. This suggests that the shipping cycle still has natural room to the upside and could be boosted substantially higher if rates rebound as expected over the next year and a half. Owners shouldn’t despair at short term spot market performance of clean tankers; the underlying fundamentals still look sound.