Navios loan draws investor ire

Angeliki Frangou’s move to shore up her dry bulk operations by taking $50m from a tanker sister firm has drawn the ire of investors.

Earlier this week, Splash reported tanker owner Navios Maritime Acquisition (NNA) had agreed to provide a revolving loan facility of up to $50m to dry bulk owner Navios Maritime Holdings (NM), a move that has been slammed by Wells Fargo as well as some shareholders who argue the cash switch was not highlighted properly and it will hit the financial fundamentals of the tanker owner.

“There is potential for a shareholder lawsuit,” J Mintzmyer, president of Mintzmyer Investments, told Splash. In a report for the website Seeking Alpha, Mintzmyer had earlier described the loan as a “total disgrace”.

Wells Fargo analyst Michael Webber was the first analyst to make public his concerns about the loan.

“The credit investment from NNA comes amid pervasive weakness within NM’s principal dry bulk market — we don’t expect dry bulk fundamentals to recover until 2018 — and has been greeted by scepticism from investors (and ourselves),” Webber wrote in a note to clients.

“NNA is largely viewed as the healthiest Navios vehicle, with the risk of importing weakness from the parent entity potentially weighing on the stock and broader Navios sentiment.”

For his part, Mintzmyer, who owns shares in NNA, estimates the probable direct damage of this credit facility at up to $50m in capital misappropriation and/or destruction (if any of Frangou’s dry bulk entities go bust), and the indirect damage via destruction of NNA’s reputation to exceed $300m.

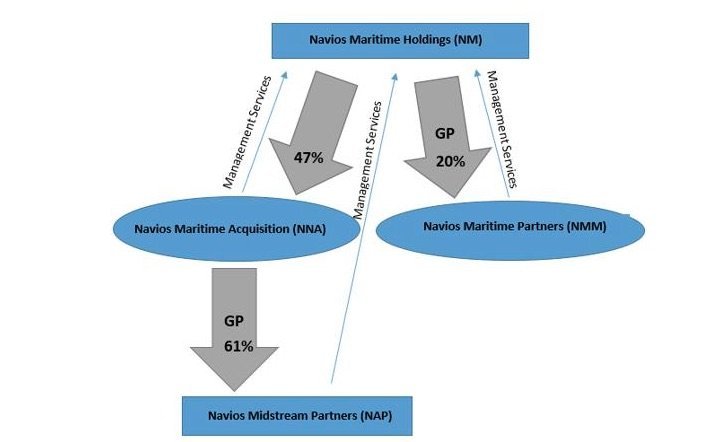

Mintzmyer also laid out a diagram of the Navios corporate empire (pictured).

“In the 21st century, it is wholly unacceptable that management teams can get away with blatant abuses and destruction of capital,” Mintzmyer wrote in a widely read article on Seeking Alpha this week.

“This latest development represents a direct abuse of external NNA shareholders by Navios management. In light of these actions, both NNA and Navios Midstream Partners should be considered extremely high-risk equities,” Mintzmyer told Splash. Navios Midstream Partners is Frangou’s listed VLCC firm.