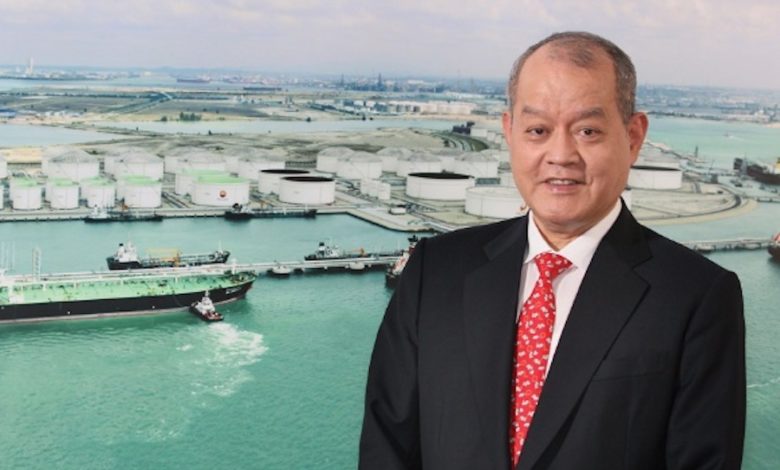

Lim Oon Kuin, the founder of the defunct Singapore oil trader Hin Leong Trading, is facing 105 new charges of cheating and forgery filed by Singapore’s public prosecutor yesterday.

In addition to the previous forgery-related charges filed last year and in April this year, the 79-year-old former oil tycoon is now looking at a total of 130 charges involving around $2.7bn in alleged fraudulent loans disbursed.

The new charges comprise 68 counts of cheating, 36 counts of conspiracy to commit forgery and one count of abetment of forgery of a valuable security.

Abetment of forgery for the purpose of cheating is said to carry a jail term of up to 10 years and a fine, while abetment of forgery of a valuable security could bring a jail term of up to 15 years.

The collapse of Hin Leong was one of the largest corporate failures seen in Southeast Asia in a decade. Lim’s $3m court bail was reportedly raised to $4m as the poilce claimed the new charges saw more financial institutions, larger sums disbursed and large sums outstanding.

“We are looking at 130 charges involving vast amounts in fraud perpetrated against local and international banks in Singapore. The numbers are eye-watering. The first 25 charges involve $540m in fraudulent loans being disbursed. The latest 105 charges involve $2.2bn in fraudulent loans disbursed. The 130 charges involve a total of about $2.7bn,” the deputy public prosecutor G. Kannan was quoted saying.