Offshore wind spending to pass $100bn mark in 2030

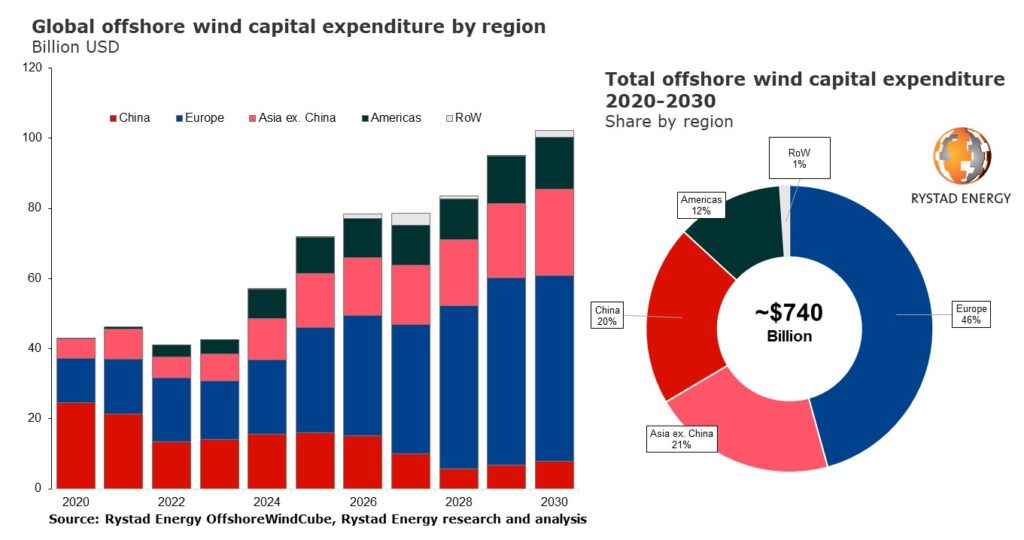

The offshore wind industry is expected to experience a surge in installations and investments this decade, with total capital expenditure projected to more than double from $46bn in 2021 to $102bn in 2030, a new Rystad Energy analysis suggests.

Driving this growth is a significant uptick in capacity installations in Europe, with capital expenditure in 2030 forecast to approach the $53bn mark, up from $15bn last year. The Americas region is projected to spend $3.3bn this year and rise further to almost $15bn by 2030.

China has been a major player in the offshore wind market to date, but according to Rystad, the powerhouse’s investments are set to slow towards the 2030s. In 2020, China invested almost $25bn, but the country’s total expenditure is forecast to gradually decline to a comparatively small $7.7bn in 2030.

Of the billions of dollars of capital expenditure that developers are lining up for projects, more than 50% is expected to go towards the manufacturing and installation of turbines and foundations, the two largest financial components of an offshore wind farm.

“The offshore wind industry is set for substantial growth this decade, with over 265 GW of operational capacity expected by 2030. As the world moves towards a greener energy mix, investments in the offshore wind sector are set to soar and provide ample opportunities for suppliers to cash in,” said Anubhav Venkatesh, offshore wind analyst with Rystad Energy.