Pangaea tops new dry bulk study

Rhode Island-based Pangaea Logistics has been crowned the best listed dry bulk company in terms of its time charter earnings (TCE) performance, according to a new report from Denmark. This marks the second year in a row the Ed Coll-led company has topped the Vesselindex Performance Report carried out by consultants Liengaard & Roschmann with two Asian companies – Pacific Basin and Thoresen – in second and third place respectively. The top three companies in the report all have an owner-operator approach to business.

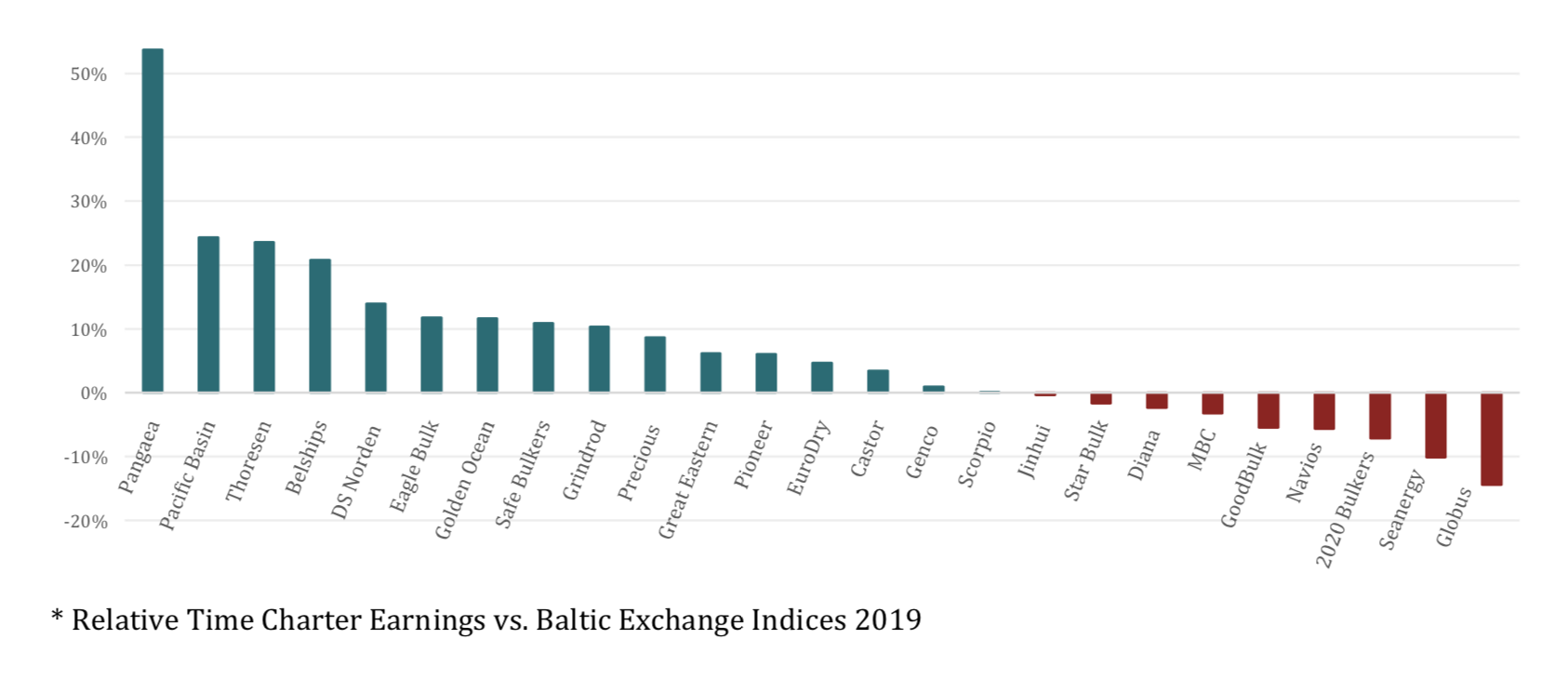

The report looks at 25 listed bulker companies and how they fared from a TCE point of view last year.

The report measures the TCE performance of individual companies in relation to the earning potential of their respective fleets, making sure that no company is neither penalised nor getting an advantage from inferior or superior fleet compositions. The study also indirectly measures the effectiveness of the commercial departments on their strategies and ability to utilise the full potential of their asset base.

“Relative TCE performance should be a must-have KPI in every company,” commented Liengaard & Roschmann partner, Søren Roschmann. “There is no point in comparing against competitors and industry peers unless you baseline TC earnings against earning potential.”

More than 950 individual vessels, distributed over more than 160 different ship designs, are covered by the report. All these vessels have been allocated an index using the online platform Vesselindex.com, as well as having been individually assessed from a naval architecture point of view with respect to speed and consumption performance.

In addition to presenting the overall standings on how the companies have performed against each other, the report also presents the performance in relation to the Baltic Exchange indices.

The study further breaks down performance into segment levels, pointing to larger variations within some companies. As an example, Genco Shipping & Trading managed to rank as top performer in the supramax segment, whereas they rank last in the capesize segment.

The report has also looked into TCE performances in relation to fleet size. Companies often talk about the importance of critical mass but the study does not support that notion.

The chartering department at Globus Maritime will look at the report with some shock, the Greek outfit coming in last place, underperforming the Baltic Exchange Indices by 14.4% last year. In total, nine out of the 25 companies surveyed performed worse than the Baltic indices in 2019.