Queue of bulk carriers grows off China waiting to offload Australian coal

Bulk carriers carrying Australian coal have been lining up at major coal ports in north China, waiting to unload cargo for around three months, raising concerns of a new round of import restrictions China might have implemented on Australian coal.

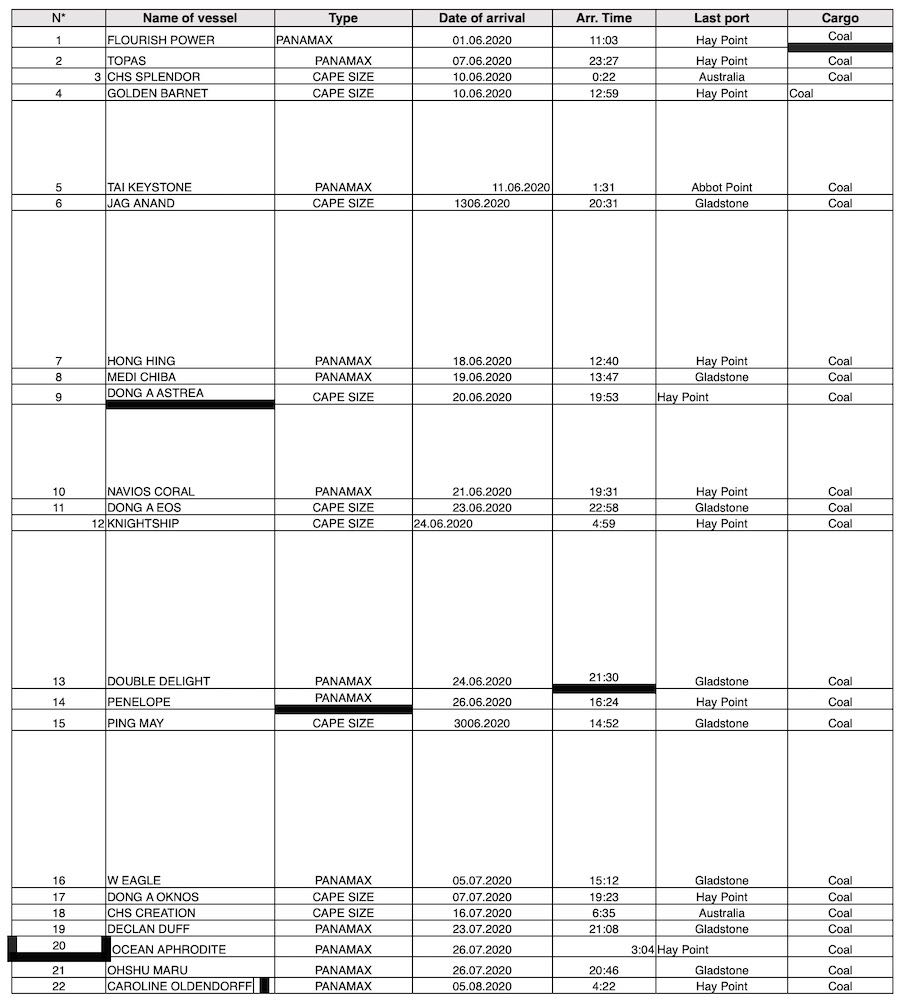

Splash understands that there are more than 20 bulk carriers including capesizes and panamaxes, carrying coal from Australia, which have been waiting to unload at Tangshan’s Jingtang Port for about three months, and there are also many ships under the same situation at nearby Caofeidian Port and Huanghua Port.

When contacted by Splash, an official at Tangshan Port declined to comment on the issue.

A Chinese coal trader confirmed with Splash that there has been tighter import coal regulations this year comparing with the situation in previous years, and the control measures include prolonged custom clearance times and stricter import quota controls.

In 2019, China’s global purchases of coal totalled $18.9bn, with almost 50% coming from Australia.

China has often adjusted its coal import policies in the past couple of years as a tool to control its domestic market and occasionally impose restrictions on import shipments to encourage demand for domestic supply.

The Chinese and Australian governments last year denied reports that Australian coal was banned, but confirmed shipments were being held up by up to 45 days.

The coal trade restrictions are also believed to be linked to the political tensions between China and Australia. China has already imposed trade restrictions on Australian barley and beef in May.

News of the Australian coal impasse follows on from concern raised Down Under earlier this year that China is also trying to ween itself off its reliance on Australian iron ore.

Splash reported in July how China’s decision to construct a raft of new very large ore carrier (VLOC) terminals was being interpreted by some analysts as part of a bigger geopolitical play to cut the nation’s reliance on Australia for its iron ore imports amid a severe souring of diplomatic ties between the two Asia-Pacific nations.

Beijing’s National Development and Reform Commission (NDRC) has given the green light for four new VLOC terminals to be built in Rizhao, Yantai and Lanshan in Shandong province, and Sanduao in Fujian province to go alongside the existing seven VLOC terminals.

“Commentary on the move has speculated that Beijing is seeking to ensure greater ‘iron ore security’ for the future, not only by opening itself to a wider range of of markets, including Brazil, but also to countries where there is less chance of political disagreement,” Alphabulk pointed out in a report from July.

Australia, which exports 90% of its iron ore to China, has been a vocal opponent of China’s telecoms company Huawei, and has also joined the US in opposing China’s maritime claims in the South China Sea. It was also the first country to come out and call for an international enquiry into China’s handling of Covid-19.

Ships waiting to offload coal at Jingtang Port