Regional liner squeeze takes harsh toll on developing nations

Regional liner trades are being squeezed further with the impact of higher freight rates on consumer prices now five times stronger in many less well connected countries.

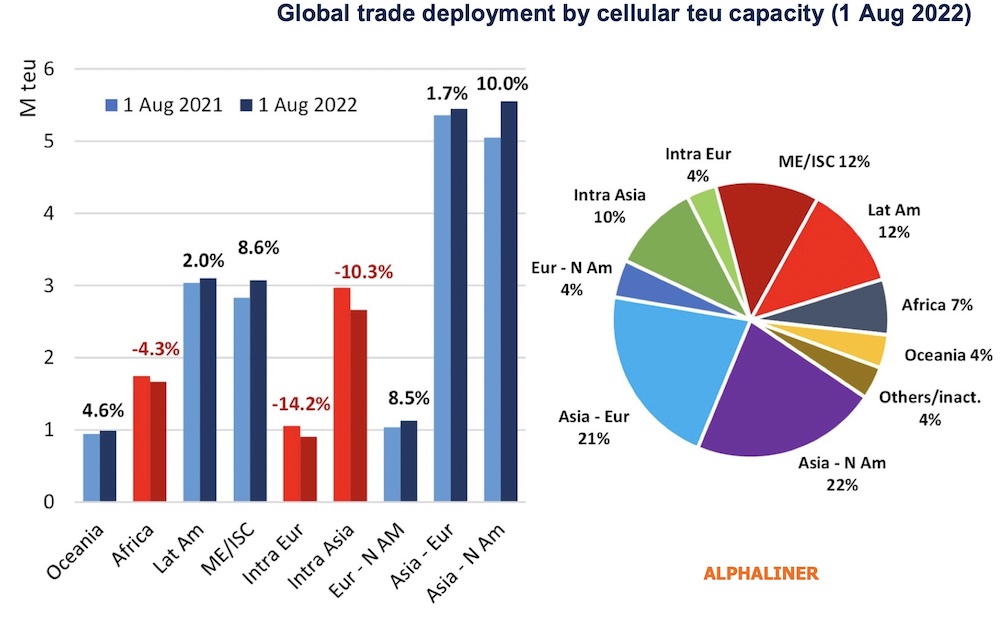

Despite a year-on-year cellular fleet growth of 3.8% as of August 1, three trades have shown a significant reduction over the past 12 months, according to Alphaliner. The intra-Europe trade was the worst hit as the total capacity of cellular ships deployed in dedicated intra-European services was down 14.2% on August 1 compared to last year.

The two other regions with a reduced offering are intra-Asia services, down by 10.3%, and all Africa-related services, which are down by 4.3% year-on-year, according to data from Alphaliner.

“It is obvious that carriers have continued to shift relatively small vessels from regional trades to East West or big North South services to take advantage of the high freight rates,” Alphaliner stated in its most recent weekly report, returning to a topic that has been covered repeatedly over the past two years.

Jan Hoffmann, head of the trade logistics branch at the United Nations Conference on Trade and Development (UNCTAD), said the ongoing shift of tonnage to the bigger tradelanes was hurting smaller and developing countries.

Capacity, price and service quality of regional trades is highly dependent on what happens in other trades and jurisdictions

“As capacity is redeployed, small island states and least developed countries are confronted with higher freight rates and lower connectivity,” Hoffman told Splash.

UNCTAD calculations show that the impact of higher freight rates on consumer prices is five times stronger in small island states than the world average. UNCTAD’s simulation shows a 1.6% increase of global consumer prices caused by the higher container freight rates, vis-à-vis an 8.2% increase in small island developing states.

Splash columnist Kris Kosmala said the real loser during the pandemic in terms of liner connectivity had been Africa.

“Between consolidation which saw disturbance in services by NileDutch and Bollore, availability of equipment, and problematic scheduling of calls, African economies got the short stick of the upheaval inflicted on global shipping,” Kosmala said, adding that he could see carriers making further redeployment decisions soon as western consumers stop spending amid worsening economic conditions.

“Rapid cancellations of import orders by retailers in response to consumers closing up their wallets will see shipping capacity returning to the market and another re-allocation of capacity,” Kosmala predicted.

However, he reckoned the risks flowing from the zero covid policies pursued by China will hamper the intra-Asia capacity and frequency decisions.

“Return to normal in Africa is going to play out differently, as consolidation among the carriers has reduced the flexibility to serve African economies better,” Kosmala suggested.

The lack of connectivity for many nations is something regulators need to investigate, urged Olaf Merk, shipping expert at the OECD-affiliated think tank International Transport Forum (ITF).

“Liner shipping is now clearly a global business, with global carriers repositioning capacity to trades with highest demand, or highest potential for profits. Regulators need to catch up with this situation: most of them do not realise that capacity, price and service quality of regional trades is highly dependent on what happens in other trades and jurisdictions,” Merk said.

I respectfully disagree with my learned friend @Kris Komala in his assessment that Africa is / was worst effected due to capacity deployment over the last year and thereby the impact on consumer price and inflation.

Alphaliners graphic is very single dimensional, but a economic inference should be taken with great caution for the simple reason that a) measuring trade deployment is an in-exact science b) trade deployment is simply the assignment of ships but not of the load factors and c) this is a Pandemic year where business remain unsettled.

were the premise to be true, then the inflation in North America would have no logistics impact considering the added capacity / slots are more than 10%.