The risk of further tanker market downside

Despite the positive consensus on medium-term fundamentals, a scenario-based analysis reveals the fragility of such assumptions, writes Tim Smith from Maritime Strategies International.

Tanker freight markets have seen little to get excited about in Q1 2018, though if we can call a winner for the period it is product tankers, with MRs and smaller product tankers demonstrating what has become characteristic resilience.

The question on the market’s mind now is how low can it go? Arguably this weighs more heavily on the crude sector, given that product markets have either been recovering or hit long-term historic lows already in the case of LR1/2s. There is conceivable downside for the coated sector, but when we look at the market in context of 2013’s depression and compression, it would appear that the risks are centred around crude.

Testing expectations

Scenarios provide useful conditional or policy–driven alternative views of the market outlook enabled by MSI’s proprietary modelling systems.

However, over recent years MSI’s Base Case forecasts have been tracking the tanker freight cycle well, particularly given the volatility, complexity and innate uncertainty intrinsic to this market.

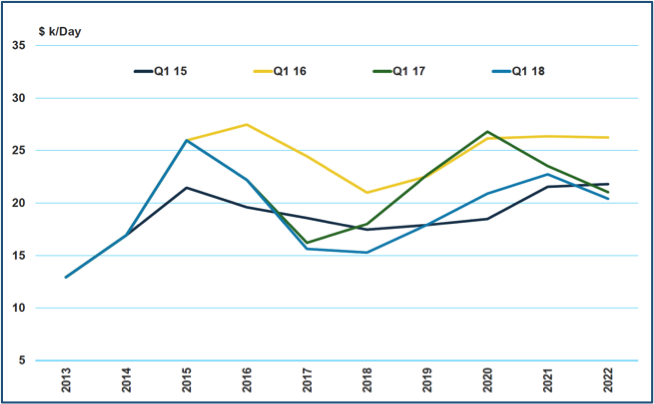

Chart 1 shows our forecast for aframax 1 Yr T/C rates made in the first quarter of each year since 2015.

There is notable variation in the levels of the forecasts – 2016 stands out in this respect. However, two features are consistent – firstly the expectation of a 2-3 year period of declining earnings from 2015 (now effectively realised) and secondly a subsequent cyclical upturn.

The second expectation is about to be tested – a 2-3 year cyclical upturn. What are the factors which could deepen and prolong the current downturn, derailing our forecast?

What if scrapping is deferred?

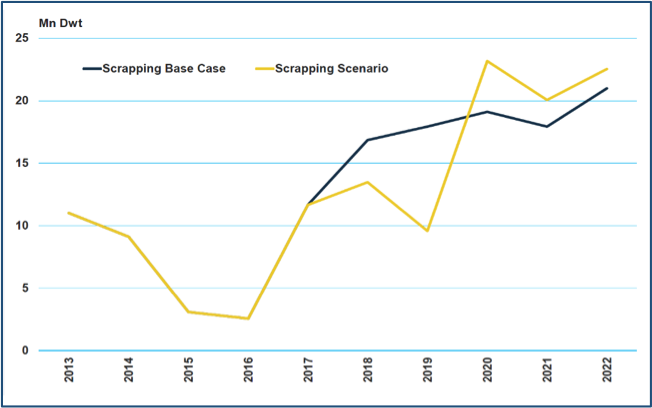

Clearly, scrapping volumes are high on the list. The ageing fleet provides little room for manoeuvre on long-term scrapping volumes but deferral could, at least in the short-term, affect the timing of a recovery.

Sticking with the aframax as a representative vessel type, Chart 2 shows an alternative scrapping profile, in which total (+10,000 dwt) 2018 volumes are reduced by 20% to 13.5m dwt.

The brunt of the reduction comes in 2019 though, where scrapping activity is reduced to just over 50% of our Base Case, at 9.6m dwt. It is effectively deferred – the period 2020-2022 sees higher scrapping volumes offset from 2018-2019.

The result of this is fairly predictable. T/C rates are negatively impacted – aframax earnings are on average 10% lower across the period 2019-2021. Importantly, this scale of downgrade is replicated across the tanker market – both crude and products.

The macroeconomic environment contains greater downside potential in the near-term – underpinning our forecast is global GDP growth at an average of 2.8% over the period 2021.

Slowing global GDP growth?

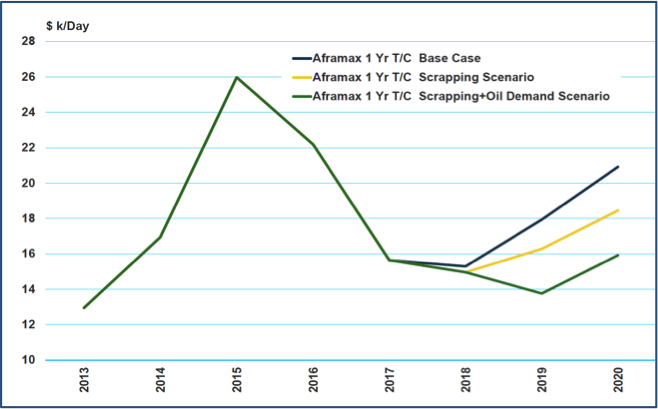

In the second stage of the scenario, we have built on the deferred scrapping by reducing global oil demand growth over the forecast, effectively simulating a macroeconomic slowdown.

This chops off on average 0.5% from global GDP growth over the period 2019- 2021 with the impact concentrated in 2019 and 2020 (in this case we have held 2018 at the same rate as our Base Case). We will focus the analysis on these two years as they form the basis of our cyclical upturn.

The impact of the GDP scenario on global oil demand growth is a reduction by close to 0.5% in 2019 and 2020. The influence of this additional pressure on the tanker market is shown in Chart 3.

This shows our Base Case alongside the impact of just the scrapping scenario, and the combined effect of the weaker demand-side. Now we see no recovery in 2019 with rates falling further next year. Moreover, in 2020 1 Yr T/C earnings are 25% lower than the Base Case and fail to escape the range seen recently.

Notably the conditions of this scenario have not been extreme.

Rather we acknowledge that the risks to certain elements of our forecast are weighted on the downside and as such, prolonged depression in the market (which MSI has been predicting for some time) shouldn’t be ruled out, despite what appears to be a positive consensus on medium-term fundamentals.