Secondhand crude tanker values hit highest levels recorded in 15 years

Prices of secondhand crude tankers have reached their highest level in 15 years, backed by a reconfigured global oil trade after Russia’s invasion of Ukraine, according to shipowning body BIMCO.

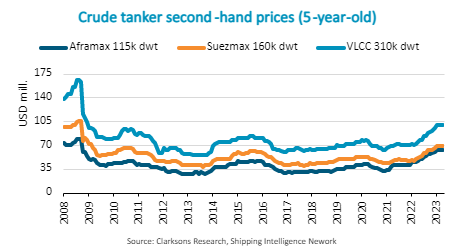

As the hot market scrambles for available tonnage with secondhand units approaching newbuild prices, BIMCO’s chief shipping analyst, Niels Rasmussen, has seen five-year-old ships increase in value by an average of 67% since December 2020 and up 34% over the past twelve months.

The combined value of a five-year-old aframax, suezmax, and VLCC has risen to $231m versus the most recent low in December 2020, when Clarksons Research estimated the trio at $138.5m, Rasmussen noted.

The EU’s ban on Russian oil imports reshaped both Russia’s exports and EU’s imports. According to BIMCO, Russia’s oil exports now contribute 83% more tonne miles to the dirty tanker trade than they did a year ago, while EU imports add 13% more tonne miles, and 42% more than at the beginning of 2022.

“This has been a key factor in driving up the values of five-year-old aframax, suezmax, and VLCC crude tankers, which now stand at respectively 96%, 85%, and 83% of newbuilding prices,” said Rasmussen, adding: “Despite the high secondhand to newbuilding price ratios, and with the newbuilding orderbook only 2.6% the size of the trading fleet, newbuilding contracting remains very low.” As the first quarter of 2023 ended, the total tanker orderbook saw its numbers drop almost by half, year-over-year, data from Greece’s Xclusiv Shipbrokers shows.

BIMCO projects a bright outlook for the crude tanker segment as EU sanctions against Russia will most likely remain in place and as the IEA expects global oil consumption to exceed 2019 levels next year for the first time since the covid pandemic hit.

The Baltic Exchange’s latest weekly assessment of secondhand prices, published last Friday, puts VLCCs at $97.8m, suezmaxes at $67.5m, aframaxes at $62m, and MRs on $42.4m. Since the start of the year, these asset classes have surged respectively by 4.5%, 5.5%, 5.1% and 2.5%.

Having risen steadily since the start of 2022, prices for secondhand MRs are currently at the highest levels since October 2008, according to VesselsValue. The volume of MR sales has firmed, rising by 39% year-on-year, with 79 sales reported so far this year. The average age of vessels sold in 2023 to date is 14 years.