Shipbuilders struggle to get out of the red despite multi-billion dollar orders

The shipbuilding industry’s eternal capability to lose money even when raking in billions of dollars of orders forms a key plank of broker BRS’s annual review.

The 170-page report, one of the shipping market’s must-reads every year, covers all the main segments of the industry.

On the shipyard business, BRS stated: “Shipbuilding is not an industry that makes money,” going on to point out how Korean majors such as Daewoo Shipbuilding & Marine Engineering and Samsung Heavy Industries have regularly been in the red in recent years.

“There is an urban legend in the shipbuilding industry that shipbuilders make a profit when prices rise. Unfortunately, sometimes, building costs increase quicker,” BRS stated, adding: “The shipbuilding industry is characterized by inadequate pricing where sale price is seldom above building costs.”

The industry has been trying to develop various strategies to counter low prices and one of the main findings has been to reduce global shipbuilding capacity via yard closures and consolidations, BRS stated.

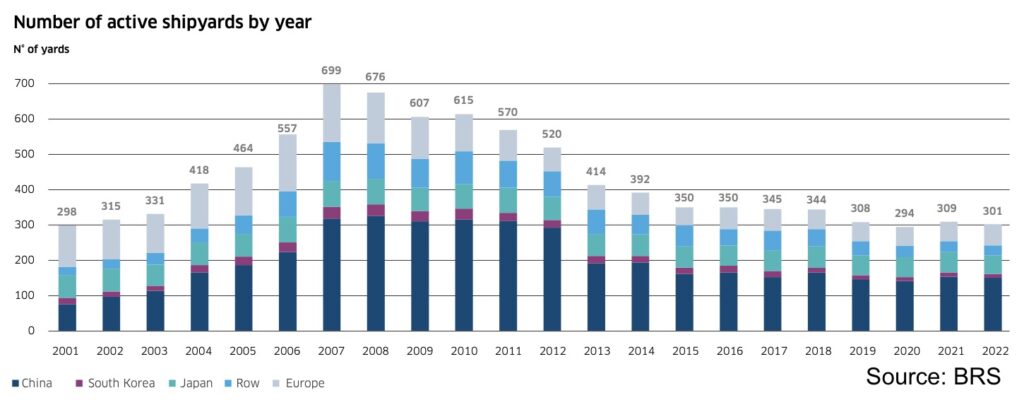

Consolidation has been an ongoing process, as the number of shipyards dropped steeply from about 700 in 2007 to about 300 by 2022. This saw the active global shipbuilding capacity contract so that about 1,200 to 1,300 vessels can currently be built and delivered annually compared with the capacity for the construction and delivery of 2,000 vessels per annum in the years 2005 to 2010.

Due to the significant consolidation that took place amongst shipbuilders in the intervening years, 75% of world shipbuilding capacity is now in the hands of nine shipbuilding groups. Furthermore, 68%, 92% and 71% of the capacity in China, Korea and Japan, respectively, is in the hands of only three shipbuilding groups.

BRS is forecasting global orders this year will total around 85m dwt, similar to last year’s figure of 88.9m dwt with prices remaining “firm”. BRS sees the split this year as 10m dwt for container carriers, 20m dwt for tankers, 40m dwt for bulkers with other types including LNG making up the remaining 15m dwt.

Newbuild prices are on the way back up. Prices for new ships plateaued briefly for a couple of months towards the end of last year, but have been pushing back up since December.

According to data from Clarksons Research, newbuild prices have increased by 2% in the year to date following rises of 5% in 2022 and 22% in 2021.

According to brokers Braemar, 2021-22 marked the most active period for the global shipbuilding industry since the 2006-08 and 2013-15 booms. As such, major yards’ forward cover now extends well into 2025-26.