Shipping navigates the fallout from Russia’s invasion of Ukraine

Global shipping reacted sharply to yesterday’s full-scale invasion of Ukraine by Russia with an armada of international merchant ships exiting the area to safer waters, and tanker rates recording historic leaps in earnings.

Russian forces are closing in on the capital Kiev today while Ukrainian ports such as Odessa, Kherson and Mariupol have been under heavy bombardment.

Analysts at shipping platform Sea/ tracked a swift exit of many international ships from the region yesterday, a departure made more urgent following a missile strike on a Turkish bulk carrier.

“While some have fled and made it down to the Bosporus others are still underway and some look to be waiting it out just before the border,” a spokesperson for Sea/ told Splash today.

Currently there are 23 ships sitting idle in the northeast corner of Romania where the border starts with Ukraine, having left Ukrainian anchorages in last 24 hours or simply not able to enter at all. On top of that, 43 vessels are now seen to be diverting or leaving Ukrainian anchorages over the last two days, up from 30 yesterday.

Russia’s pincer attacks look like they are attempting to create a land bridge from Russia to Crimea north of the Sea of Azov, an area Russia closed off to merchant shipping yesterday. Ukrainian ports have ceased operations and liner operators have informed clients that services to Ukraine have been put on hold.

“As the situation develops there remains a high degree of uncertainty regarding the freedom of navigation throughout the wider Black Sea,” security consultants Dryad Global warned yesterday, adding: “As such the primary risk to all vessels and commercial operations operating beyond the key risk area remains one of commercial uncertainty rather than risk to safety of crew. Vessels and commercial operators are reminded to avoid all operations and transit within the EEZ of Russia and Ukraine at this time. No attempt should be made to access the Sea of Azov.”

The US Department of Transport has indicated that one of the risks vessels may experience is GPS interference, AIS spoofing, and/or other communications jamming when navigating in the Black Sea and the Sea of Azov.

Lars Jensen, CEO of liner consultancy Vespucci Maritime, stated via LinkedIn that the Ukrainian port closure will worsen the congestion problems in ports and terminals in the east Mediterranean and the Black Sea.

“We already have congestion problems and the new Ukrainian containers will be added into the mix with a high likelihood that they will remain standing in the ports – or nearby depots – for an extended period of time,” Jensen warned, adding that shippers using the overland services by rail or truck between Asia and Europe will likely face service disruptions too.

Reacting to the attacks, US president Joe Biden unveiled a swathe of further sanctions and other economic measures on Russian entities yesterday including new debt restrictions on Sovcomflot, the nation’s top shipping line. Splash reported yesterday that five box ships operated by FESCO have also been hit with sanctions. The White House also said sanctions coming in would impact Russia’s shipbuilding sector.

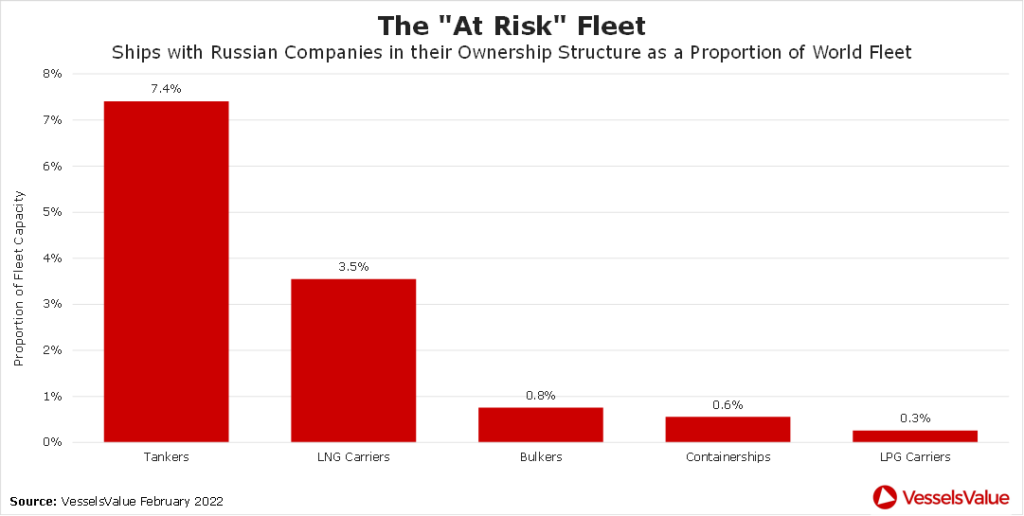

Vivek Srivastava, senior trade analyst at VesselsValue, has looked at the impact of further sanctions on the Russian merchant fleet. Potentially, 7.4% of the world’s tanker fleet would be at risk, as would 3.5% of the world’s LNG carrier fleet.

“With cripplingly weak utilisation and freight rates afflicting both of those sectors for the past several months, in marked contrast to booming dry bulk carrier and containership sectors, sanctions on Russian shipping companies could remove some excess supply of ships from the openly competitive market without causing as large an upward movement in freight rates,” stated Srivastava in a new report yesterday.

Tanker rates soared massively yesterday, with the aframax TD17 route from the Baltic to the UK/Continent stunning by leaping by $108,155 in one day to $121,741. Splash understands this is the first time in history any ship segment has leapt by more than $100,000 in a day.

In terms of dry bulk, research from brokers Arrow suggested the most exposed vessel class is the small handysize sector of which around 16% of trade either loads or discharges in Russia or Ukraine, 10% being just Black Sea. A third of this trade is coal, but the rest is mainly split across grains, steel and fertilisers. Panamaxes are exposed primarily from the Baltic coal trade, but some Black Sea grains too.

The International Chamber of Shipping (ICS) has warned of supply chain disruption should the free movement of Ukrainian and Russian seafarers be impeded.

The Seafarer Workforce Report, published in 2021 by BIMCO and ICS, reports that 1.89m seafarers are currently operating over 74,000 vessels in the global merchant fleet.

Of this total workforce, 198,123 (10.5%) of seafarers are Russian, while Ukraine accounts for 76,442 (4%). Ukrainian airports are closed and all crew movements have stopped.

For all the news on how the invasion of Ukraine is affecting global shipping, check out Splash’s dedicated coverage here.