Ships with CII’s lowest rating suffer significant drop in value

Brokers and owners are starting to observe the impact of energy efficiency regulation on the S&P market, particularly regarding the risks now associated with vessels which are operating in band E of the January 1 introduced Carbon Intensity Indicator (CII). The effects are most prominent in the tanker market, followed by dry bulk.

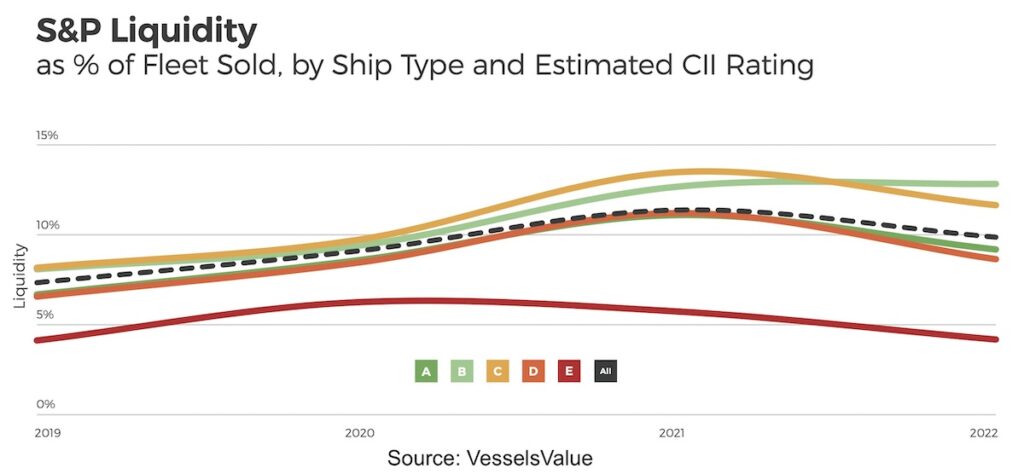

“CII is becoming increasingly influential in the sale and purchase market. At the moment, this is primarily manifesting in the liquidity of vessels,” online pricing portal VesselsValue stated in a new report, noting how vessels operating in band E have substantially lower liquidity as they will carry capital requirements, or will see their earnings potential reduce in the near future.

The liquidity gap between band E vessels and other higher ratings has widened substantially.

The CII measures how efficiently a vessel above 5,000 gt transports goods or passengers and is given in grams of CO2 emitted per cargo-carrying capacity and nautical mile, something owners can effect by changing vessel speeds.

The first reporting of the CII based on 2023 data is due no later than 31 March 2024. Vessels will receive a rating of A through E. A vessel rated D for three consecutive years or rated as E, will need to develop a plan of corrective actions.

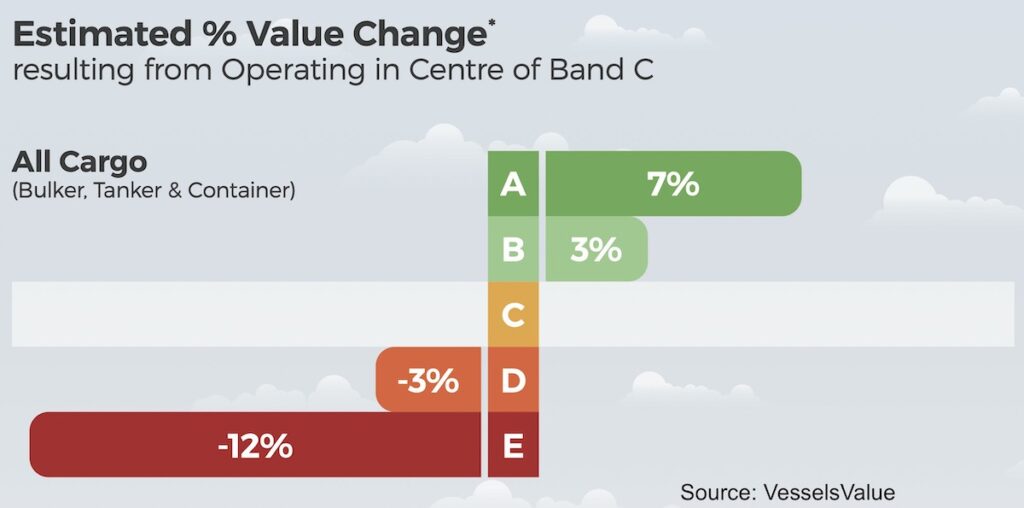

According to analysis by VesselsValue, on average across sectors, for band A vessels to operate in band C, the required 9% increase in speed would result in a 7% increase in vessel value. While for band E vessels to operate in band C, the average speed reduction of 12% would result in a discount of 12% (see chart below).

The effects are most prominent in the tanker market, with band A vessels potentially able to generate an average value premium of 9%, and band E vessels suffering an average discount of 15%, according to VesselsValue.

The complexity of CII is also keeping commercial pool managers very much on their toes.

“Managers will need to take into consideration the impact that their commercial trading strategy as a whole will have on individual vessels’ CII. This will be a challenge as the best financially yielding trading strategy may not automatically yield the best CII,” commented John Michael Radziwill, who is in charge of Monaco-based C Transport Maritime (CTM), a dry bulk pool founded in 2004.

Pankaj Khanna, who took over the running of Athens-headquartered tanker pool Heidmar in 2020, told Splash: “Going forward, the trading of ships is going to determine the CII rating of vessels and access to the right commercial people, with the right tools, training, mindset and knowledge is going to be critical to ensure a good CII rating.”

“can effect by”

Can affect by?

Can influence by?

Very informative, a lot remains to be adapted for apt compliance Etc

Need to be aware of them all principles

to practice and perfect.

Well wishes

Ajit

The graph is irrelevant as 2023 is the first CII reporting year and the correction factors/voyage adjustments were only recently published. A graph based on the age of ships at the time of purchase would likely line up the same.