Shipyards look to plug the gap as two-horse newbuilding race runs its course

Shipyards banking on a decarbonisation-driven order boom must contend with present day realities, writes Stuart Nicoll from Maritime Strategies International.

The global orderbook for all vessel types continues to rise during 2022, as the quantity of new orders outstrip deliveries. This is despite a trend decline in newbuilding contracting volumes over the last year.

Ordering continues to be dominated by two ship types: containerships and LNG carriers. With an aggregate contribution of close to two thirds of orders this year in Gross Tonnes, it is clearly a two-horse race.

No other ship type got a look in over the period: for bulkers, activity was the lowest for more than five years, while oil tanker activity remains spectacularly low, as the recent bull run for crude tanker earnings had yet to affect newbuilding activity in the period up to the middle of the year.

Accordingly, if the current boom in newbuilding prices is to be sustained then the baton of newbuilding contracting activity must pass to other shipping sectors. The question then becomes, who can come to the fore if the leading contenders pull up, particularly as there are various handicaps hindering the replacement runners and riders.

The dry bulk market remains volatile and increasingly uncertain in the face of potential impending global economic woes. Moreover, bulker newbuilding demand, if it materialises, is most likely to head to under-utilised Chinese and Japanese shipyards, rather than the currently rammed berths in Korea.

The PCTC market is hitting the stratosphere and ordering looks set to follow, but even orders for 20 or more 8,500 CEU ships (as has been rumoured) will not offset the flood of containerships leaving yards in 2024. The PCTC sector will barely move the dial at a local let alone a global level.

That leaves only oil tankers as the potential gap filler. Tanker contracting has certainly been substantial in the past, but it is a moot point if the sector can still deliver the quantity required to sustain today’s boom. On the plus side, the sector looks set fair, as the old cliché about a crisis being good for tankers finally holds true and substantial cash generation spread to include VLCCs.

Despite the current positivity, our Base Case remains that tanker newbuilding contracting will be just 4.1 Mn GT in 2022 and 8.9 Mn GT in 2023, compared to an average of 13 Mn GT in the last five years.

A period of booming earnings may mean there is upside risk to this forecast, but the reality remains that oil tankers do not have the financial power that COVID-19 and subsequent crises handed the containership industry. And despite the crisis in gas supplies and potential EEXI/CII Armageddon for old LNG carriers, it is hard to believe that ordering for this sector can be further sustained.

So, our essential conclusion is that replacing the containership and LNG carrier orderbook, to be delivered in 2023-25, with tankers (and/or bulkers) to keep the yards full in 2025/26 will be very difficult. We project total contracting for all ship types to decline to 38 Mn GT in 2023 and 44 Mn GT in 2024, compared to an average of 69 Mn GT in 2019-21.

On the yard cost side, although inflationary pressures and weakening demand are beginning to impact negatively on many parts of the world economy, trends within the shipbuilding industry are acting to reduce some of the cost pressures that have built up dramatically during the last couple of years.

Steel price trends are inconsistent but in China there is clear evidence of a sharp fall, in all classes of steel, including plate for shipbuilding. In Japan, prices are reported to have fallen 10% since the middle of the year, though they remain at the historically high level of $900/T.

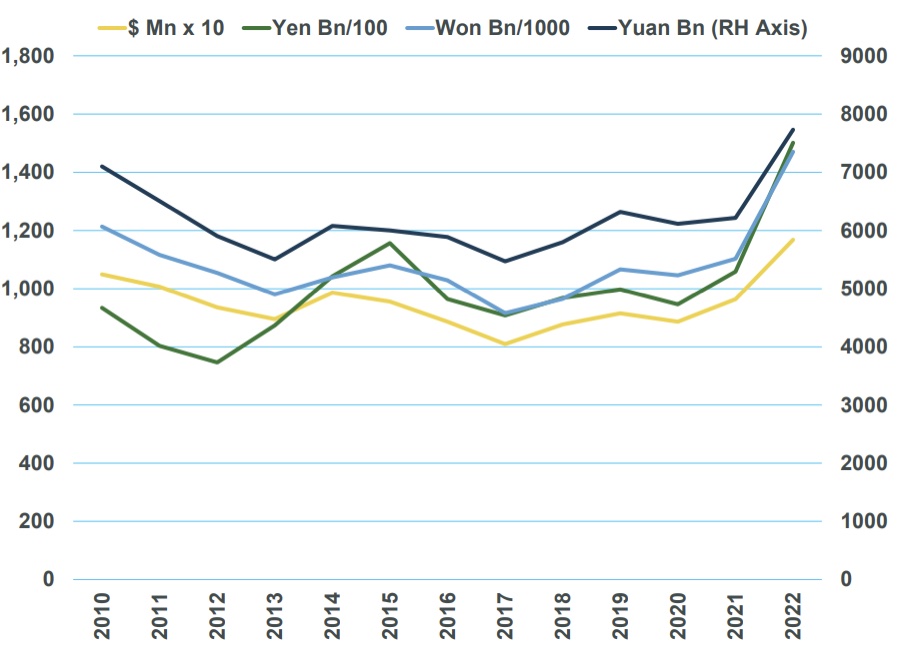

Another major factor that should be easing the pressure on yards is the evolution of the Asian currencies against the dollar. These have seen spectacular declines over the last year, especially in Japan and Korea.

To put the impact of these declines in context, Chart 1 shows the development of VLCC prices in both local currency and dollar terms over the same period. This chart implies that the income generated by recent orders will be greatly boosted by the weakening of currencies, though the actual impact will depend very much on the payment terms that apply.

There is a strong sense in many quarters that shipbuilding could experience a boom period of the kind last seen 15 years ago. In our view, this is likely to be the case, but it is all about timing. The decarbonisation newbuilding boom is upon us, but it cannot be entirely decoupled from present day market realities. The immediate environment suggests that before that emerges a period of relative weakness must be traversed, as newbuilding prices decline in 2023 and remain weaker through to 2025.