Signs growth of the 1,000-strong ‘opaque’ fleet is slowing

For grey, shadow or dark, read opaque. Shipping is having to come up with new terms to define an increasing chunk of the tanker fleet, which has chosen to trade on the sidelines of international norms, creating huge concern about potential safety lapses.

Data analytics firm Vortexa now assesses that exactly 1,000 unique tankers have operated in the so-called opaque market since January 2021, of which 745 of them were still active in the first quarter this year.

Analysts from different companies have different methods of classifying the growing grey fleet. Vortexa’s opaque definition includes product and crude tankers handling Russian cargoes regardless of the price cap mechanism as well as tankers involved in the Iranian and/ or Venezuelan trades. The Vortexa analysis excludes tankers operating internally and ships with sanctions waivers.

Over at brokers BRS, meanwhile, the latest analysis shows the grey fleet is still expanding, but at a slower pace than earlier this year.

The latest update from BRS shows there are 758 tankers in the so-called grey fleet, up from 731 a month ago.

“This suggests that the grey fleet growth rate is slowing down,” commented Andrew Wilson, BRS’s head of research, a point of view shared by many S&P brokers who have noticed a slowdown in vintage tanker sales recently.

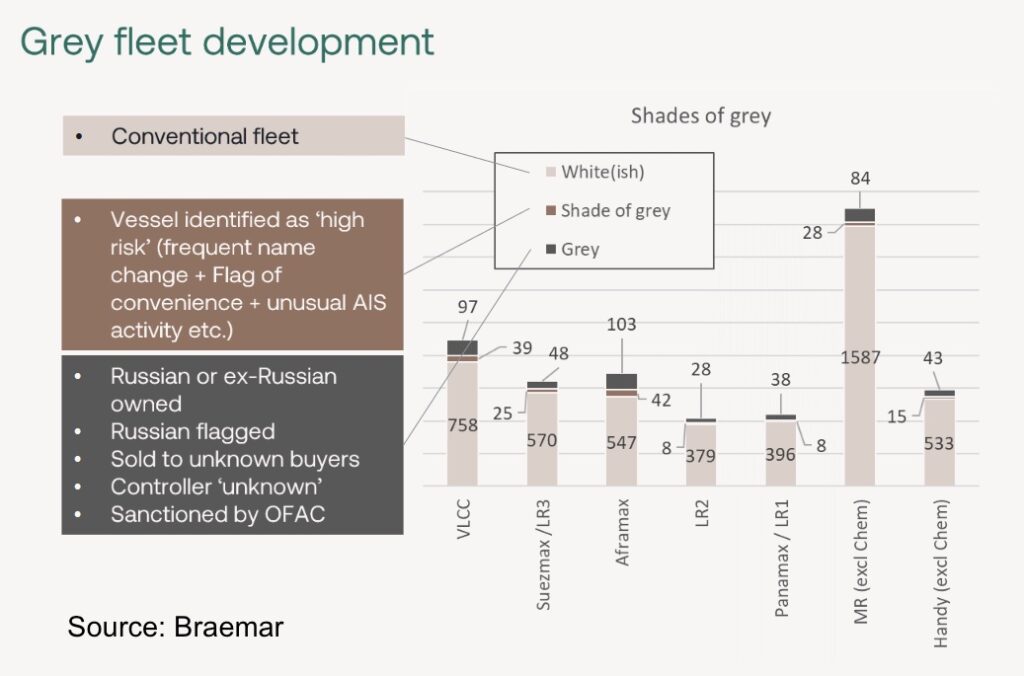

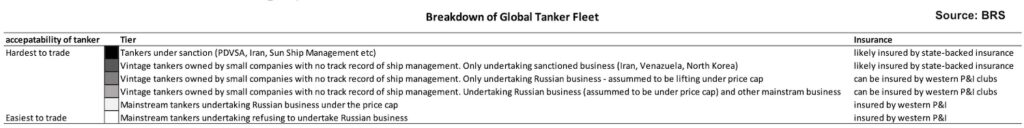

With so many nuances, BRS has argued that the dark fleet ought to be now referred to as the grey fleet in which there are several shades, as outlined in the breakdown below.

The shadow fleet has more than tripled in size since the start of the war between Russia and Ukraine, with TankerTrackers.com suggesting recently that one in five VLCCs are “up to no good”.

TankerTrackers.com, one of the world’s leading authorities on the illicit seaborne movement of oil, has its own visually-proven numbers on the dark fleet, which as of today tallies 544 ships.

Major class societies, managers, and insurers have shunned former clients in Moscow, Tehran and Caracas, with substandard tonnage subsequently running into trouble at many destinations around the world, exacerbated by increased use of ship-to-ship transfer operations, all of which is proving a tremendous strain on the world’s shipping insurers.

An uninsured 1997-built aframax exploded last week, killing three crew, with oil washing up on nearby shores.

The unladen Gabon-flagged Pablo, owned by a single ship shell company in the Marshall Islands, exploded in Malaysian waters, likely a result of hot works on the cargo deck, with three of the 28 crew perishing and almost the entire top deck ripped off the hull.

It remains unclear who will pay to move the wreck, and clean up the spill with the ship having no clear insurance according to multiple shipping databases. The ship has changed hands three times and reflagged four times in the space of just three years with current ownership very opaque. The aframax has a history of transporting Iranian oil, which face sanctions from the US.

“The growth of the so-called grey fleet particularly since the introduction of the Russian oil price cap scheme should be a concern for everyone,” commented Mike Salthouse, a sanctions expert and head of external affairs at NorthStandard, a P&I club.

“The simple fact is that a growing number of vessels that are transporting oil are insured, flagged, and classed with institutions and countries that do not provide anything like the same technical and regulatory oversight as we have come to expect whilst those providing the insurance cover lack the experience and quite possibly the financial capacity to deal with a major incident,” Salthouse said.

Carried below is research from brokers Braemar on the scale of the grey fleet as of April 26.