Smaller Chinese owners react to merger speculation

China’s smaller owners, already not enamoured with the strength and overarching power of the nation’s top two lines, have reacted with mixed emotions to news that Cosco and China Shipping are to merge.

Such is the strength of the nation’s top state-owned shipowners that some smaller owners have in the past suggested setting up an alternative Chinese shipowners association to have a greater voice.

“My understanding is the two groups are joining their forces to compete on the international market. I don’t think that is going to change the scene for smaller shipowners much, but I also don’t think that is a good news. They are already in a dominant position in China and they don’t really care about making a sustainable market economy. The C3 alliance they established has already brought anger and panic to the small owners operating on Japanese routes, and they just don’t care. Smaller owners just have no say on this market,” said the general manager of a Qingdao-based shipowner, who requested anonymity.

The C3 alliance was established by three state-owned shipping companies Cosco, China Shipping and Sinotrans in May 2014 to jointly operate container services on Japan routes. The trio deployed a vast amount of tonnage on a tradelane that has always been wafer thin profit wise, infuriating many other private lines on the route.

Other owners contacted by Splash were more sanguine about the merger.

“The merger between such giant shipping companies in China should have no effect on us. We are small owners, it is hard to say what impact it will have on us,” said a spokesperson from Ningbo Silver Star Marine Shipping.

One Tianjin owner even said the merger was a good thing for the nation’s shipping industry.

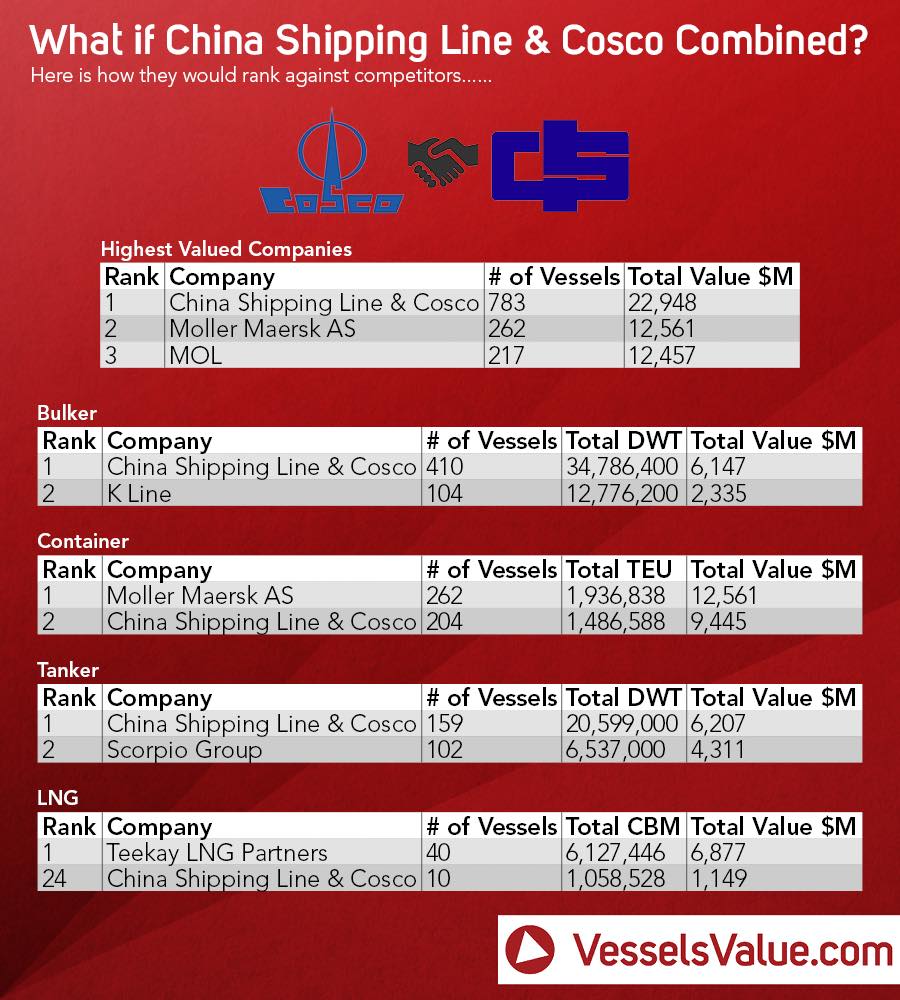

“The merger between China shipping and Cosco should be good for the development of the industry, it is good for the nation’s fleet optimization plans, and will allow a Chinese shipping company to take more market share worldwide,” the owner, who requested anonymity, said.

A five-man team is now going through restructuring options for Cosco and China Shipping with a view to reporting back to Beijing how best to proceed in three months time in what is the greatest shake-up in Chinese shipping in a generation.