Summer’s dog days see dry bulk market still playing the waiting game

Champagne corks are popping but adjust for the impact of China’s port delays and the outlook shows greater fragility writes Will Fray from Maritime Strategies International.

The dry bulk freight market has gone from strength to strength since the publication of MSI’s Q2 report, with spot earnings increasing to over $30 k/Day for all benchmark vessels on average in July. This is the first time this has happened since August 2008, notwithstanding changes to the benchmark vessel and route compositions since then.

Given rising sentiment and surging freight markets, it would be natural to assume that trade in dry bulk commodities this year had exceeded previous estimates. The reality, however, contrasts with expectations; in its Q3 Dry Bulk Market Update*, MSI’s estimate for trade growth in 2021 has been cut from 6% yoy to 4%.

The largest downgrade has been made to iron ore trade, now forecasted to rise by just 1.4% yoy, from over 6% previously. Coal trade growth has also been cut, to 3.6% yoy from 5.4%, and minor bulks trade has also seen a marginal downgrade, mainly due to a downwards adjustment for bauxite.

Bucking the trend has been more positive grains trade, however a 6 MnT uplift (driven by strong shipments from the US to China) is heavily offset by the 80 MnT cut to iron ore, 21 MnT cut for coal and 12 MnT cut for minor bulks.

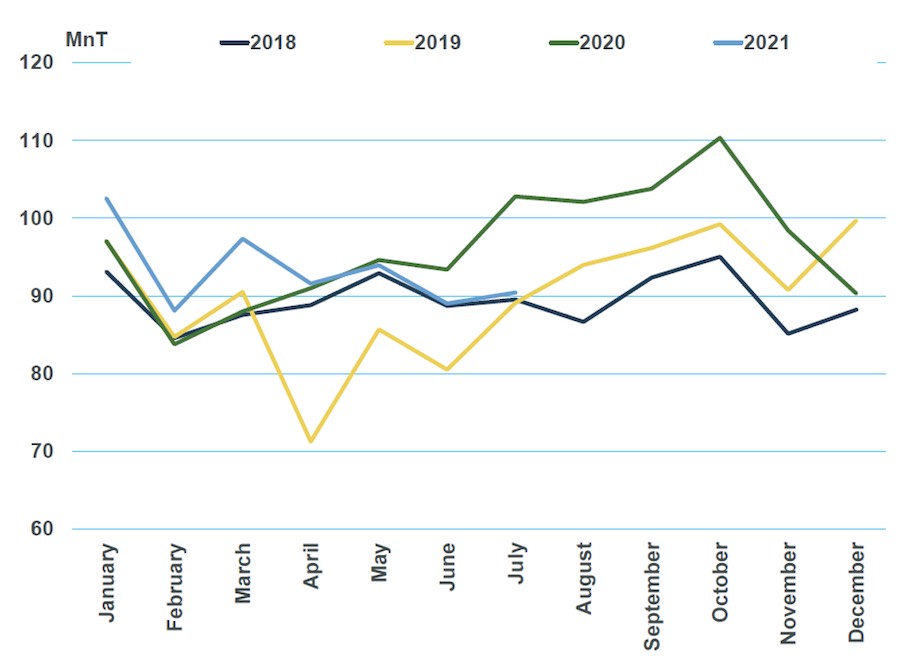

The change to MSI’s view for China’s imports this year stems from several factors. Perhaps the most powerful signal is the recent historical trend: Chart 1 plots China’s monthly iron ore imports by year – 2021’s trend is now on a downwards trajectory, although we note that the second half of the year is usually stronger than the first.

Lower cargo growth in 2021 means our estimate for tonne-mile demand growth has declined from 6.3% yoy in our view published three months ago to 4.6% yoy in this update. Notably, our headline Dwt demand outlook is barely changed at a robust 6.4% yoy as we have again increased our assessments of days in port for 2021.

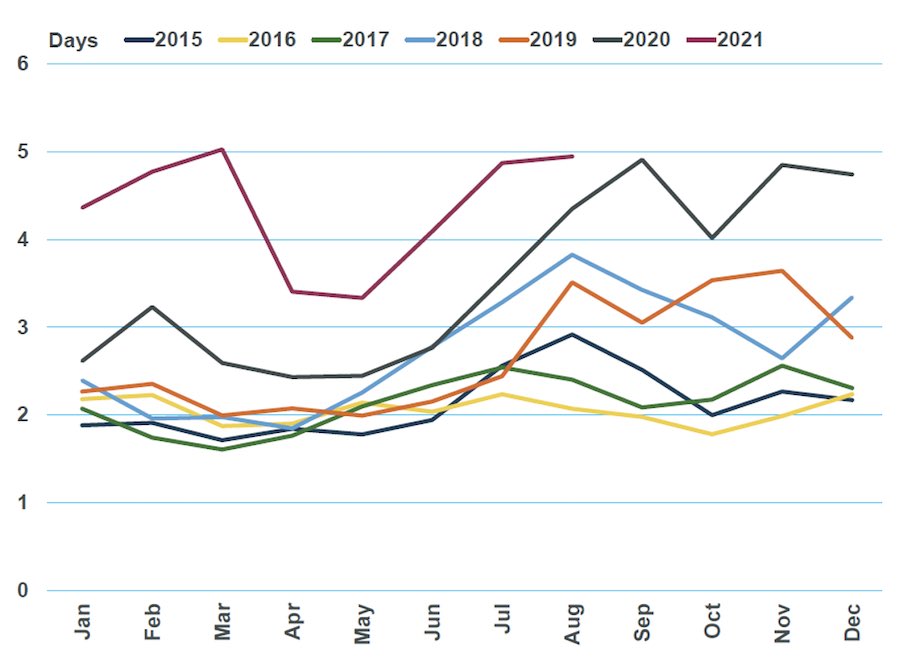

Chart 2 plots the average days spent waiting to discharge in China for the Panamax, Handymax and Handysize bulker segments according to data from Oceanbolt. Since this time last year, time spent waiting has been far higher than any period since 2015.

Note that with China accounting for such a high concentration of cargo, increasing time in port there has leveraged the impact of cargo volumes on the requirement for ships.

To understand the impact of higher port days, we ran a scenario through our market model on MSI HORIZON with port days in 2021 at the 2015-2019 historical average.

The outcome is startling – in this scenario the dry bulk fleet employment rate would be 81%, similar to the weak markets of 2015 and 2016. Handysize 1 Yr T/C rates would be only $7.8 k/Day in 2021, compared with $18 k/Day in our Base Case.

To MSI this is critical to understanding the drivers of the current freight market strength, and to build an informed sense of its likely direction. To put it more clearly, port congestion is a major reason behind high freight earnings.

The outlook for port delays, therefore, remains a critical factor in assessing the outlook for the dry bulk earnings. This is a position that MSI has held front and centre of our analysis for much of this year and has been reinforced by the latest market developments.