Surging demand sees new lay-up destinations emerge

With demand for lay-up services growing, traditional parking lots for unused ships are becoming congested forcing shipowners to seek alternative sites to send their assets into hibernation.

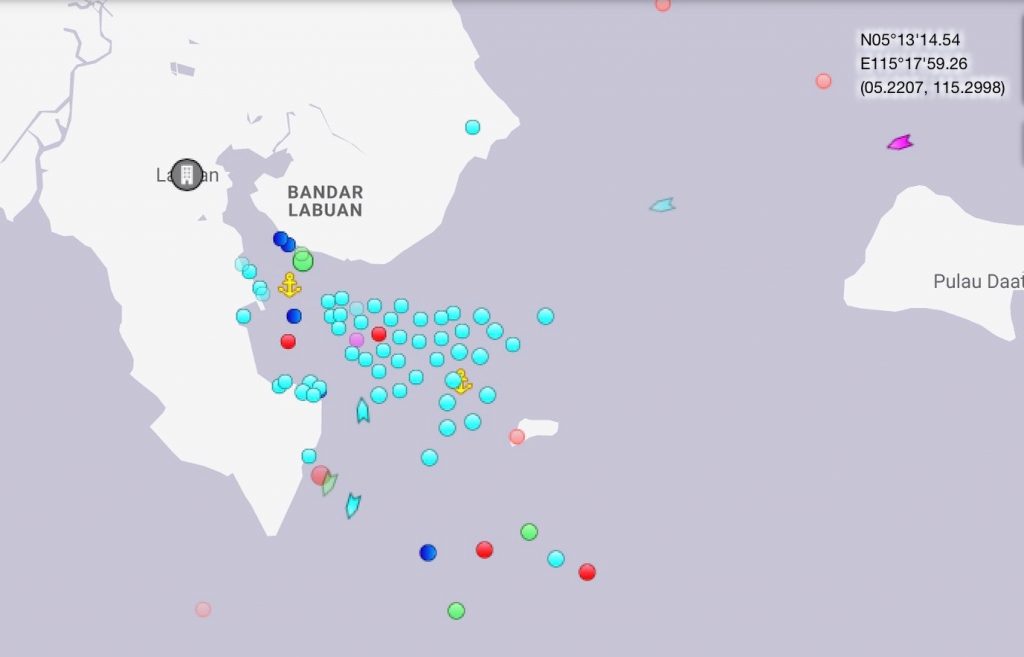

Labuan in Malaysia, just north of Brunei, one of Asia’s premier lay-up destinations has become very busy in recent weeks (see MarineTraffic image taken today below), with available space becoming even tighter due to recent ship-to-ship operations. Costs in Labuan have also increased as authorities have just introduced new measures to use tugs to bring vessels into the anchorage area.

Alternative lay-up sites are emerging across the world from places as far afield as Panama, the Philippines and Norway.

A spokesperson for Relinic International Marine & Trading Corp in the Philippines told Splash today his company was seeing ships now being laid up in Manila and Negros Occidental through to the second quarter of 2021.

Carl Schou, CEO and president of Wilhelmsen Ship Management, commented: “Traditional lay-up locations like Labuan are quickly filling up. We are also on the look out for new locations. Just recently, we have sucessfully laid up five vessels in two new locations in Norway. “

A survey published on this site last month saw nearly two-thirds of reader anticipate that through to the end of 2021 shipping would experience record numbers of ships laid-up. In a report published in May from Lloyd’s Register (LR), the classification society reported the volume of lay-ups already in place had not been seen since the global financial crisis of 2008 and 2009.

The container sector still has 375 ships listed as inactive – albeit not in lay-up, per se – according to the latest data from Alphaliner, while Dynmar has estimated that the the idle car carrier fleet will hit 220-250 vessels at its peak in the coming month or so. Many passenger and cruiseships remain out of service too.

Data sent to Splash by Clarkson Research Services today shows that for containers, idle capacity peaked at 11.9% in May but as of July 10 had trended down to 7.9%. It was around 4% a year ago.

There are now 196 offshore drilling rigs ready stacked compared to 153 in March. Cold stack has been steady at 125, Clarkson data shows.

But, where do the crews go? Well, an industry that relies on the hiring of quasi-slave labor does not need to respond.