Surging US oil exports set to reinvigorate ailing tanker sector

Tanker owners looking for solace in what has been a dire year have been buoyed by yesterday’s latest monthly oil market report from the International Energy Agency (IEA).

The IEA says that global oil supply is rising fast and that a reprieve from the price rally could be on the horizon, contradicting recent narrative coming out from OPEC.

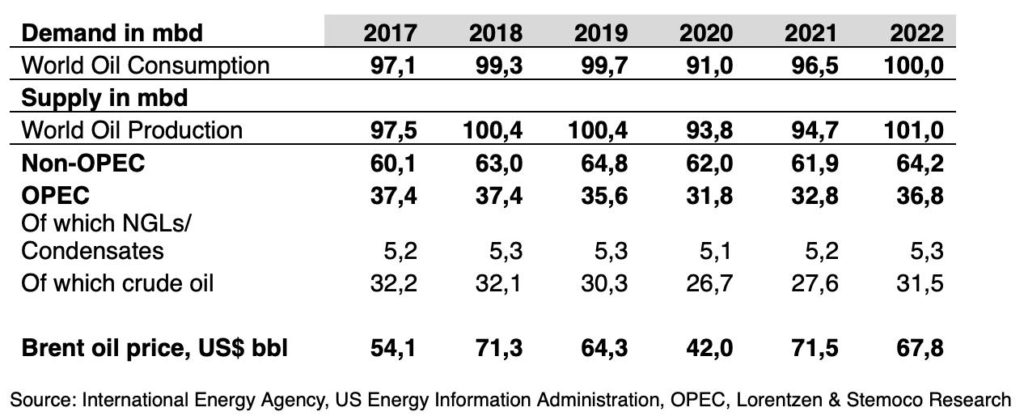

The IEA does little to its global demand forecasts, seen rising 5.5m barrels per day this year and 3.4m bd next year.

But the IEA has raised its forecasts of US oil production, now being upped by 0.3m barrels per day in the fourth quarter of this year and by 0.2m barrels per day on average next year, something that is expected to have a significant effect on the tanker ton-mile picture in 2022.

The IEA believes that the US will account for 60% – or 1.9m barrels per day – of non-OPEC+ supply gains next year.

“That is a huge fast-tracking of events with the US poised to surpass the all-time-high threshold of 13.1 mbd already within a year,” analysts at Lorentzen & Stemoco stated in a markets update this morning.

The Norwegian brokerage maintained today that the oil market balance is about to tilt from a deficit to a surplus and bring about a complete turnaround for the tanker market.

“Downward pressure on spot crude oil prices, already underway, will flatten out the oil price structure from steep backwardation into contango, as long-dated prices will remain relatively sticky on anxiety over dwindling OPEC+ spare production capacity. That, in turn, will lead to refineries boosting their refining margins and able to act on a newfound upward price structure encouraging inventory build-up. More production will come from US shale oil producers, both majors and independents, triggering a response from OPEC+ producers competing head-on for Asian market share,” the Oslo-based firm predicted.

Lorentzen & Stemoco is predicting global production increasing by 6.3m barrels per day. Since much of that production will come from the US Gulf Coast into Asia, ton-mile demand will grow relatively more, probably by double-digit figures, the analysts predicted, setting in motion a tanker market ready for an “explosive upturn” nearing soon.

OPEC, meanwhile, has said it expects high energy prices to hit consumption and slow the pace of demand recovery.

On US output, OPEC sees US shale output rising 610,000 barrels per day in 2022, up by 200,000 barrels from last month’s forecast.

UAE energy minister Suhail al-Mazrouei said on Monday that all indications point to an oil supply surplus in Q1 2022 and he expected OPEC+ would likely stick to current production policy when it next meets in early December.

Not everyone seems to agree with OPEC’s bearish forecast. Both Goldman Sachs and JP Morgan see demand reaching the 100m barrels per day mark within the end of the year or by Q1 2022 at the latest.