Tanker asset values remain in the ascendant

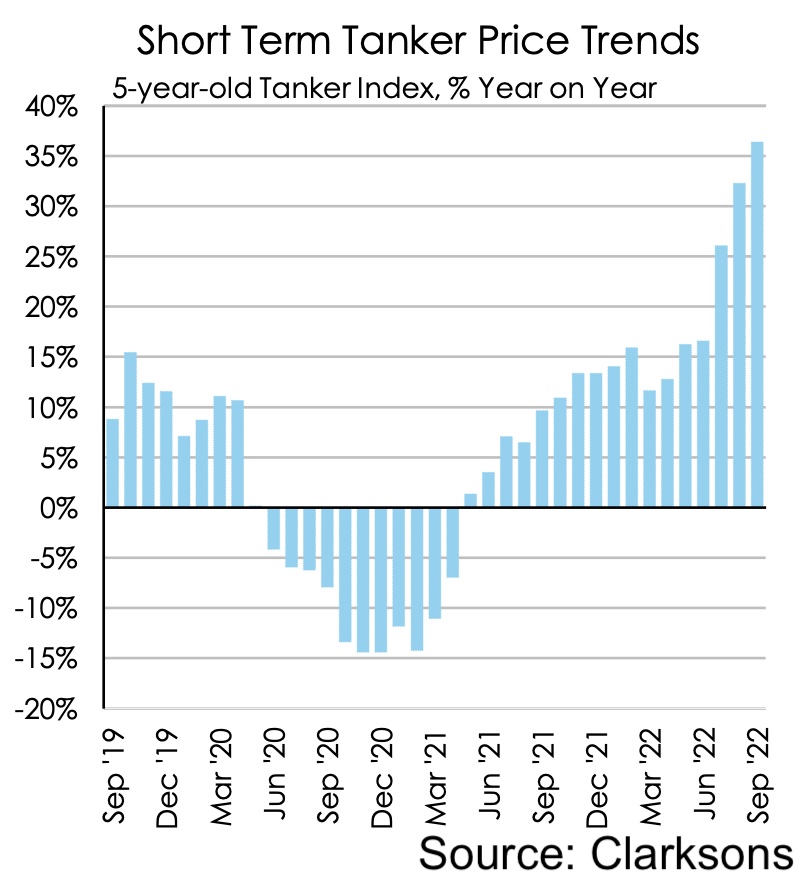

Secondhand tanker prices, which have been on a tear for months, are hitting highs not seen for more than a decade. Analysts remain divided on just how much further the asset appreciation can continue.

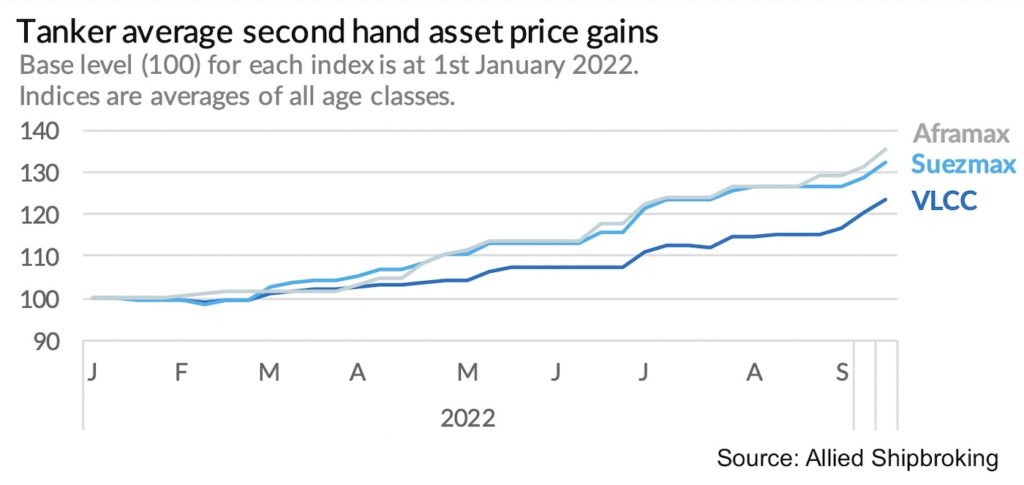

Crude tanker prices have gained in average around 30% from their start of the year levels. The most recent rate hikes have taken place at a typically seasonal low point in the market, a new report from Allied Shipbroking pointed out, suggesting tankers are still in the early part of their rally.

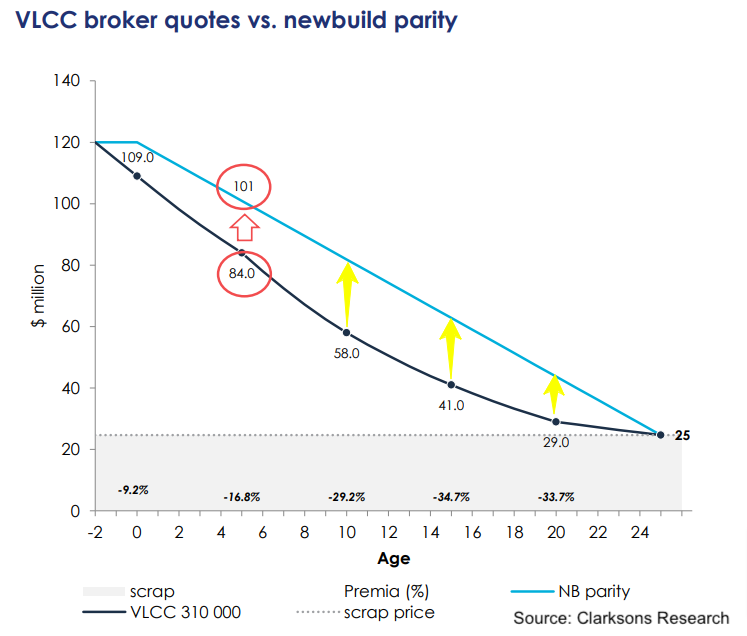

A presentation given by Clarksons earlier this month argued that the tanker newbuild parity line is still far away. Drawing a straight line from a newbuild at $120m down to current scrap value shows that the implied value of a five-year-old VLCC should be $101m. The point, Clarksons executives argued, is that when a shipping market is balanced, shipowners get 10-12% unlevered return and secondhand values move more in a straight line, something seen in the dry bulk and container markets for the past year, in which secondhand vessel values could trade above the straight line.

A new report from Xclusiv Shipbrokers suggested a peak in secondhand tanker prices is still some way away given the lag between time charter rates and asset values.

Looking at the 10-year-old vessel prices, Xclusiv conceded they are above levels of spring 2020. However, one-year time charters for VLCCs, suezxmaxes, and aframaxes remain far below the levels in spring 2020, having only started to have an upward trend during the last three months.

“Considering all the positive news for the wet market, it is very probable that the freight rates can continue to move higher as the prevailing fundamentals imply a healthy market for the months ahead, and this will possibly drive the secondhand prices to even higher levels than today,” Xclusiv forecast.

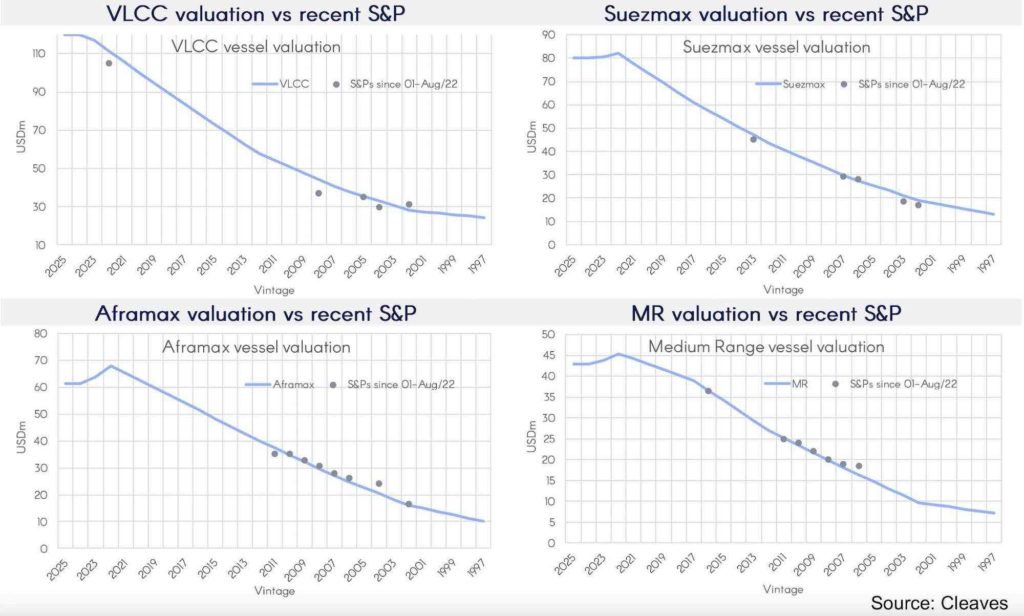

Researchers at Cleaves, meanwhile, believe VLCC asset prices have some room for growth through to 2025, but other tanker types are closing in on their peak pricing (see chart at bottom of article).

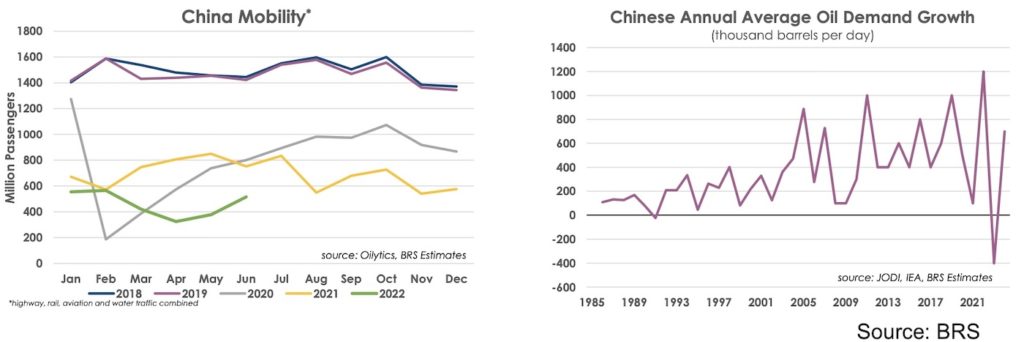

All the bullish sentiment on tankers has been during a period where China, the world’s second-largest economy, has been scaling back its seaborne energy imports as its economy still faces major covid lockdowns and its heavy industries are fighting off a slump in local consumption levels. However, Chinese crude oil imports are now making a strong comeback during the first few weeks of September.

While Russia was China’s biggest crude provider in July, Saudi Arabia has reclaimed the top position in August, supplying over 2m barrels per day according to Lorentzen & Co calculations converting monthly metric tons into barrels per day.

China remains the largest downside risk to demand in 2023, a new report from BRS argues.

BRS currently anticipates a steady reopening of China next year, although this may not gather pace until later in Q2 when the winter covid peak should have passed. BRS currently projects Chinese oil demand to grow by 700,000 barrels per day next year, which should put it back at a record 15.7m barrels per day.