Tanker demand boost from the sulphur cap

BIMCO’s chief shipping analyst Peter Sand remains cautious despite the recent sensational highs.

Stakeholders have long been talking about a demand boost from the new IMO 2020 sulphur cap as refineries increase their crude oil demand and their exports of the new compliant fuels, benefitting both crude oil tankers, but in particular oil product tankers.

We are, however, still waiting to see to what extent this may benefit the tanker shipping industry. Data from the EIA shows that although US refineries’ crude oil throughput has risen from its low point in mid-October, it remains below levels in the corresponding weeks of 2017 and 2018. This same trend can be seen in weekly US oil product exports. Both these numbers will need to rise if the US is to deliver part of the 2020 boost, the exact timing and extent of which remains uncertain.

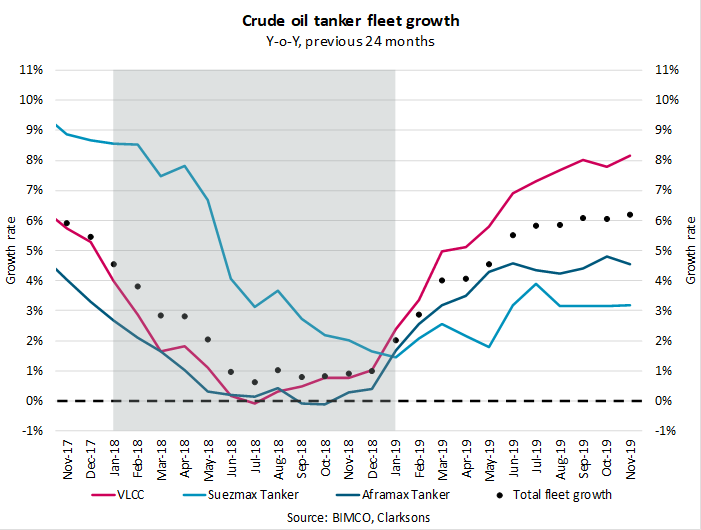

Added to this uncertainty is the high fleet growth experienced in both the tanker markets: 4.8% growth in the oil product tanker fleet and 6.3% in the crude oil tanker fleet. The high growth rates are the result of increased ordering ahead of the much talked about 2020 boost, but have caused market fundamentals to deteriorate. These ships will still be sailing when any boost from the sulphur cap has become just a memory, and except for the recent peak in freight rates, the market has shown no need for this extra capacity in recent years.

The new ships include 65 VLCCs delivered in the first 11 months, already the highest deliveries on record since 1974, bringing the year to date VLCC fleet growth to 8% as only four have been demolished. This fleet growth has not been matched by similar demand growth, leading to further pressure on freight rates when the seasonal boost fades away and any short term game from the sulphur cap passes.

Rates spiked in mid-October as the strong Q4 seasonality mixed with a variety of geopolitical factors including sanctions on Iran, Venezuela and certain shipping entities as well as tensions in the Middle East. Freight rates have since fallen as fundamentals have begun to catch up with the market, but remain elevated.

Freight rates will remain at these elevated levels for the remainder of the year and into the start of 2020. Traditionally the strong seasonality then ebbs away over the course of Q1, but the IMO 2020 sulphur cap, will bring a boost to tanker shipping, and may therefore keep freight rates elevated for longer than in a usual year.

There is good news to be found in BIMCO’s projected growth for 2020, with the crude oil fleet expected to grow by 1.6% and the oil product fleet by 1.8%. While it is good news that the fleet growth is slowing, the effects of high fleet growth this year will be felt in the market in years to come.

This article first appeared in the latest issue of Maritime CEO magazine, the quarterly title aimed at the top names in shipowning. To subscribe, contact grant@asiashippingmedia.com.