Tankers: Calling the rebound

After a year of extremes, how, where and when a recovery materialises are the questions that preoccupy owners, writes Tim Smith, director, oil and tanker markets, Maritime Strategies International.

Q1 2021 saw the oil tanker market hit rock bottom with earnings very similar to mid-2018. MSI believes, for spot earnings, Q1 21 will represent the low point of the market downturn, with improving levels seen across the rest of 2021 and potentially much better rates in the second half of the year. For the period market we see limited further loss of altitude in a market which has already been severely downgraded.

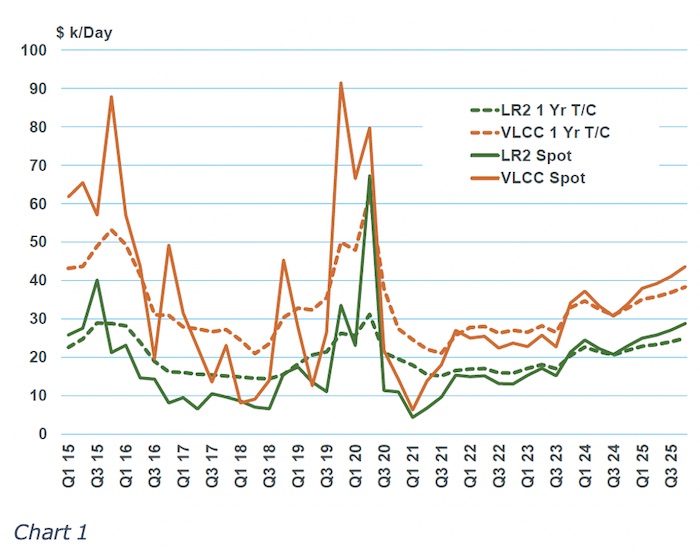

The tanker market could see conditions improve above and beyond the MSI Base Case as well. MSI has begun publishing extended quarterly tanker spot forecasts on the MSI HORIZON platform. These spot projections do start to see significant upside movement before the T/C rates, as shown in Chart 1, but they are coming from a very weak position early in 2021.

As the market transitions from a low environment at the start of the forecast to a more solid footing and (eventually) strong conditions, we see the spot earnings exceed T/C rates.

Hurry Up and Wait

What could make this recovery happen faster? In terms of fleet dynamics, the most likely impact would be from temporary factors. Following the OPEC+ announcement in March, it isn’t likely that we will see an extreme oil surplus in the market in the near-term, and certainly not on the scale seen in 2020.

High oil prices are not conducive to floating storage, and so at present this source of tightening is unlikely. With the ongoing uncertainty around COVID-19 and the events of the last 12 months, we don’t rule it out though.

Geopolitical friction remains another potential driver of fleet restrictions. By its nature though this type of event is not going to be a sustainable source of upside.

Nonetheless the tanker market is arguably the most exposed shipping sector to geopolitical volatility, and this usually works in its favour. The recent blockage of the Suez canal has had a positive impact on spot rates, but its duration was short lived.

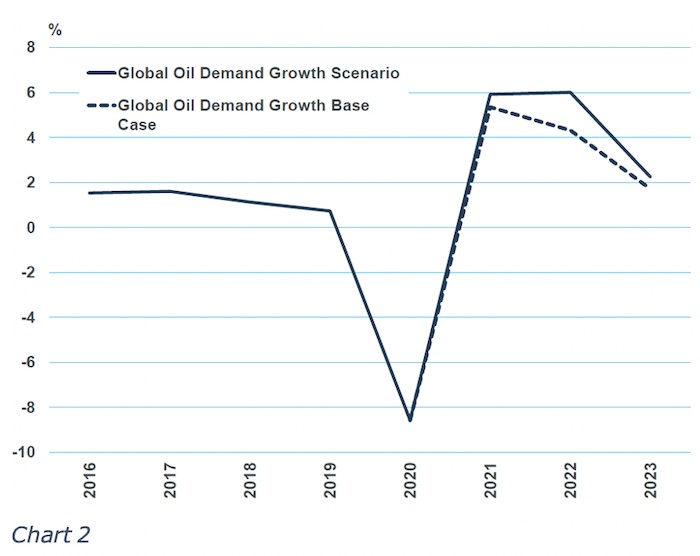

What about more sustainable sources of recovery on the demand side? Although our Base Case incorporates a positive view on oil demand recovery, we could see it rebound even faster. Given the sluggish start to 2021 that is unlikely to happen this year but 2022 offers more potential for out-performance. Such a scenario would require a lot to go right in the world’s ongoing battle against COVID-19.

Accelerating and widespread vaccination, sustained and strong protection against new variants, rapid recovery in air travel, and an explosion of pent-up travel demand unleashed with e.g. vaccination passports or similar, a mass return to working from ‘work’ etc would be among the waypoints required.

At present it is perhaps understandably easier to see how things could go wrong given the mass of bad news we have been subject to for over a year now. However, were we to see an upside materialise, 2022 could see much higher growth. This is shown in Chart 2. This jolt in oil demand implies 2022 would significantly exceed 2019 levels.

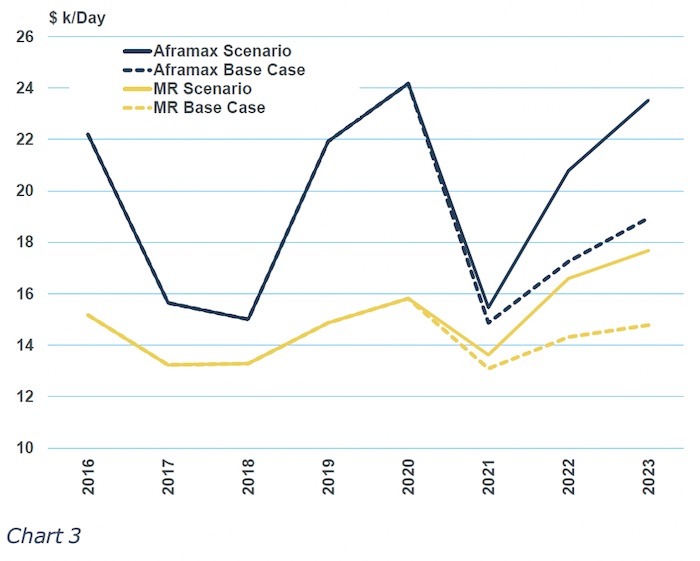

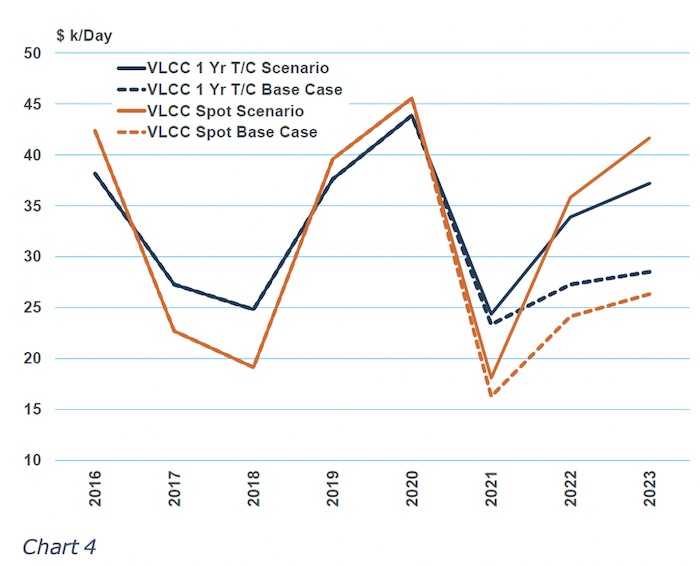

Effectively earnings return to conditions, on average, similar to 2019/20. This is shown for an MR and an Aframax in Chart 3. In the spot market, as shown for a VLCC in Chart 4, the gains are even more pronounced.

This scenario shows that the outlook could quickly turn more positive. With respect to transport demand the COVID-19 pandemic shock has by its nature been discriminatory, sharp and policy-driven. Transport and mobility have been some of the hardest hit areas. A reversal could be just as abrupt in a positive sense.

Whilst a rebound in underlying oil demand is all-important at present, other demand-side factors could enhance a recovery, beyond the extra trade volumes which the scenario above would generate.

The rapid change in the refining landscape could also herald more buoyant markets. This could come not just from import demand but changing trade patterns. Regional refinery contraction and expansion changes the balances of required crude and supplied products, driving global trade in both oil’s raw and refined forms.

For the world’s largest crude exporting region, the Middle East, more crude will be used in its expanding domestic refining facilities—reducing export potential, but significantly increasing products output.

Conversely, in the US, reduced refining capacity will potentially free up even more shale crude for export. This will add a further dimension to the ongoing contest between OPEC and US shale crude, which is likely to resume in earnest when we see a strong and sustained recovery in oil demand following the pandemic.

Regulatory Driver?

Aside from cargo-driven factors, one other area could provide more abrupt upside potential. In November last year the IMO agreed to introduce the Energy Efficiency Existing Ship Index (EEXI) for in- service vessels, amending MARPOL Annex VI.

This should come into force in Q4 22, though this is to be confirmed when the regulation is formally adopted in June this year.

The EEXI will be calculated for every ship and indicates the energy efficiency of the ship compared to a baseline, in terms of the grams of CO2 emitted per capacity tonne mile.

Vessels will be mandated to meet an EEXI which is based on a reduction factor relative to the Energy Efficiency Design Index (EEDI) baseline. EEXI is determined by the reference technical specifications of the vessel and therefore cannot be altered through operational means such as slow-steaming.

However, the technical adjustments made to a vessel such as propulsion and engine optimisation and power limitation could reduce a vessel’s reference speed.

The regulation could therefore reduce the average speed of the fleet, supporting market fundamentals as effective tonnage supply reduces, or in the medium term give a further shot in the arm to scrapping totals if vessels are not able to comply with the benchmark standards.