Tanker rates are surging into six-digit territory. How the sector’s fortunes fare once new European Union bans kick in on Russian crude from December 5 has analysts divided.

The many hurdles Russia will face to get its top export to market from next month face a new layer of inspection.

Concerned at the potential for accidents from an ageing dark fleet of tankers, the Turkish Ministry of Transportation and Infrastructure last week issued a directive that every ship passing through the Turkish Straits after December 1, in loaded condition carrying oil, will need to provide a letter of confirmation that the ship has valid P&I insurance with sufficient coverage for that ship, voyage and cargo.

The directive pointed out that “in the event of an accident involving such ships, there will be potentially catastrophic consequences for our country, people and our national values.”

By December 5, tanker owners that fly any European Union flag or carry P&I insurance from an EU club can no longer have crude oil onboard that originated in Russia, unless Russia has sold the crude to the buyer at or under an agreed price cap.

There are alternatives to the International Group of P&I Insurers. For example, the state-controlled Russian National Reinsurance Company (RNRC) is currently the main reinsurer of the Russian national fleet, which are covered by the Ingosstrakh Insurance Company after they were dropped by the Western insurers. However, according to Poten & Partners the Russian national fleet is not sufficient to move all of Russia’s exports.

In its latest weekly report Poten mused whether Ingosstrakh will also be providing coverage for the dark fleet which will be needed to move the remainder of Russian crude and products. If so, Poten questioned what would happen if there is an oil spill, and a western country submits a claim. Poten is predicting that most owners will likely steer clear of Russian oil after the ban goes into effect.

Beyond Turkey, attention is turning to Copenhagen and what the Scandinavian country will do to ensure ships transiting the Danish Straits are safe and correctly insured.

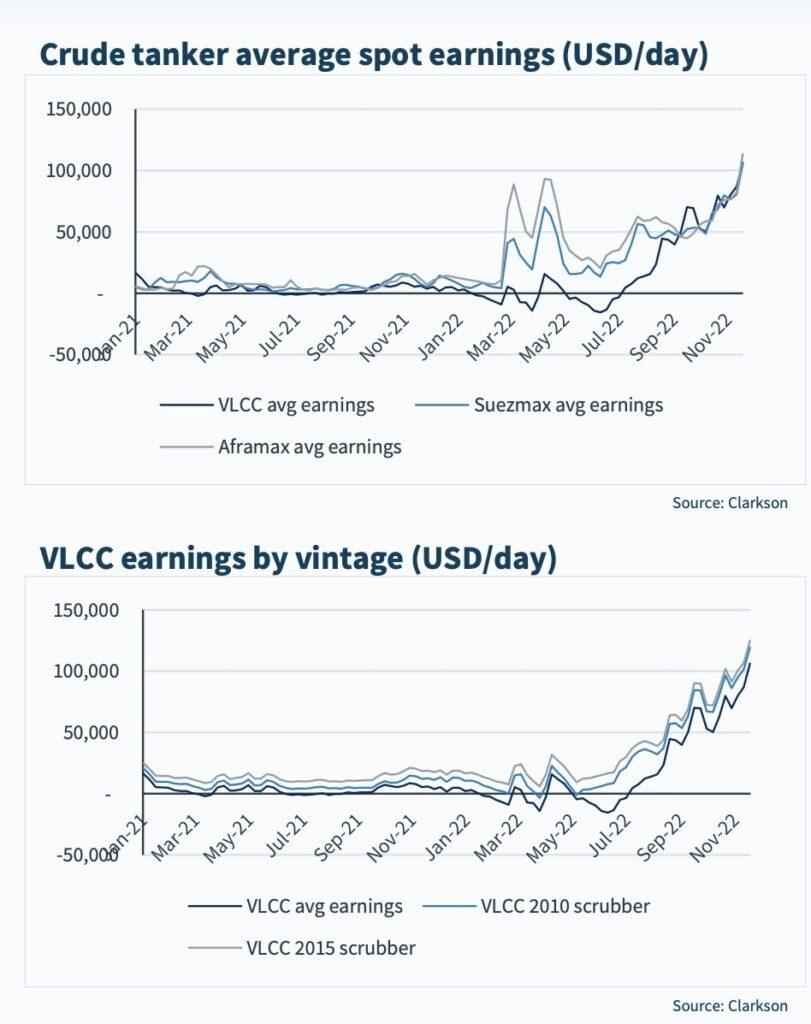

Crude tanker markets strengthened significantly last week, with average VLCC earnings rising 22% to $106,137 a day, the highest level since April 2020, according to Clarksons Research. Average suezmax and aframax earnings also both broke the $100,000 a day mark. The products tanker sector also firmed notably, with average product tanker earnings up 24% to $48,571 a day.

“The market does not fully understand how fundamentally tight virtually all tanker classes and regions now are, well ahead of the usual winter peaks,” a recent report from Pareto noted, while Jefferies analyst Omar Nokta has gone uber-bullish, predicting VLCC rates could spike to anywhere from $150,000 to $200,000 a day this winter.

Sanctions on Russian oil are expected to contribute at least 25% of the growth in tonne-miles in 2023, according to new analysis from ABG Sundal Collier.

“If you look at the current conditions of the tanker market, it’s hard to imagine that any owner would be left with a sad face, but changes are coming that will test the waters and the stability of the bullish market,” stated Dubai-headquartered brokers OceanEXL in a new report, published yesterday.

OceanEXL argued that once the EU sanctions kick in next month many owners will ditch Russian cargoes.

“[T]he bearish impact of that is increased tonnage supply, which might add some instability, but the bullish side is that non-Russia EU imports will mean longer tonne-mile,” OceanEXL observed.