The consensus for an effective carbon price for shipping

Channoil Consulting in collaboration with Gibson Shipbrokers have produced a paper offering views and analysis of the route to 2050, crunching the numbers of fuel prices.

The world is under increasing pressure to decarbonise. Historically, the shipping sector has been somewhat exempt from external pressure to improve emissions, but this is changing fast. We have investigated the context of decarbonisation in the maritime sector, take a reality check on the fuelling options and likely short-term solutions, and examine fuel economics for the likely short-term options.

The fuels that are readily available for the maritime sector today are the conventional fuels of VLSFO, or HFO using abatement scrubbing systems, Marine Gasoil, bio-derived fuels using FAME or HVO, and lastly LNG.

We have focussed our assessment on the near term. Prices for most fossil fuels are currently depressed due to lack of demand: VLSFO and Marine Gasoil are at historically low multiples against Brent crude oil. LNG is oversupplied and priced accordingly. The biofuel grades price higher due to the high costs of production, these costs being supported by demand driven by various mandates on their use.

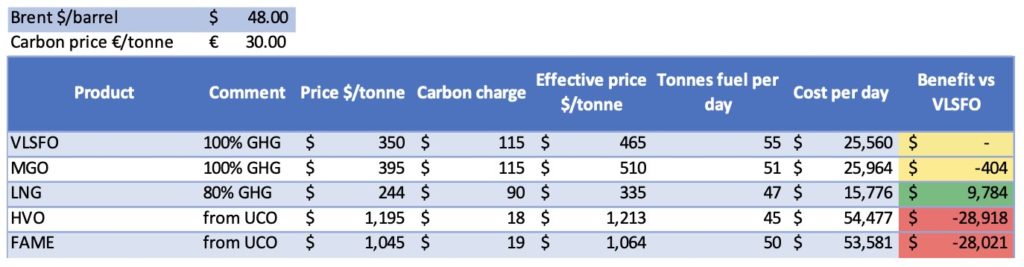

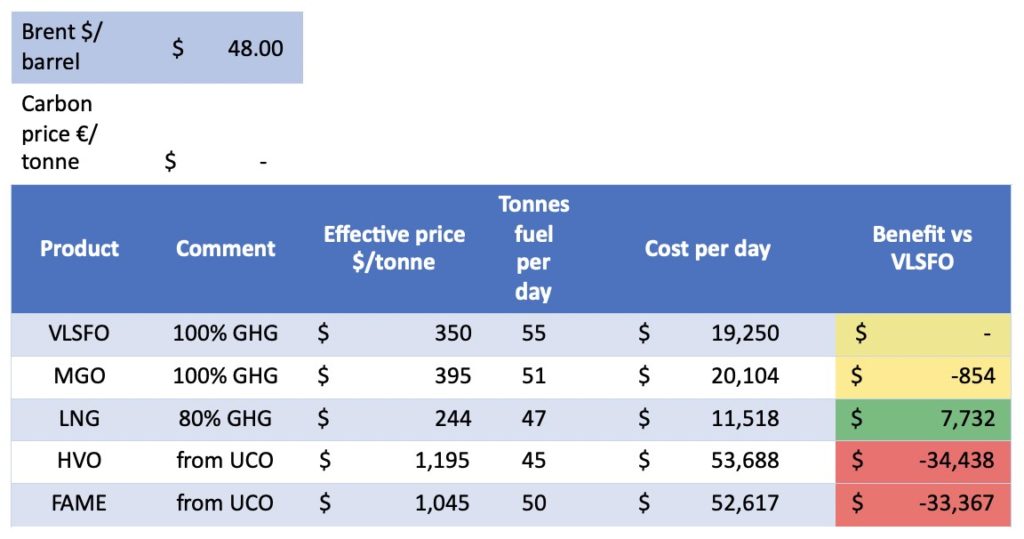

Using current prices for these grades and the appropriate fuel consumption, based on fuel energy content, allows us to draw a comparison between the various fuel grades as shown below.

As of today, there is no carbon levy on the maritime sector. And in today’s price environment, LNG is a hands-down winner. It gives a saving of around $7,700 per day versus VLSFO, based on a VLCC’s typical daily consumption, so this could amount to a total saving on fuel of $2,800,000 per year.

A VLCC making a fuel saving of $5,000/day could very well be able to justify the additional $14m investment and generate an IRR of 10% over a 15-year period.

Unsurprisingly, HVO and FAME are completely uncompetitive against other grades in the absence of a carbon trading scheme.

Using an indicative current value of the EU ETS CO2 price of €30, there is little change to this picture. Indeed, LNG benefits from its lower GHG intensity, but HVO and FAME continue to be outcompeted both by LNG and by conventional fossil fuels.

It is also worth noting that the trends for both the carbon costs and VLSFO/MGO prices are to increase, the former as and when the price of crude oil recovers, the latter as decarbonisation agendas build momentum, whilst the trend for the relative LNG price is to stay low, as there is oversupply for the next 10 years. So, the fuel cost benefit for dual LNG fuel ships could increase further.

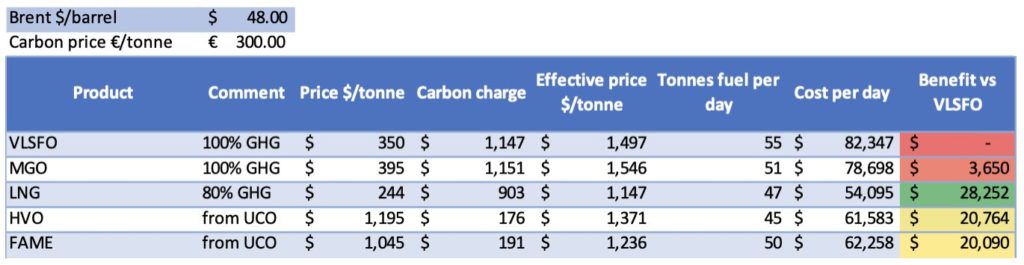

Trafigura has recently proposed an industry levy of $250-$300 per tonne of CO2 emitted, on high GHG fuels as a means of accelerating the decarbonisation transition in Marine. This is the level required to make the biodiesel HVO and FAME grades competitive against fossil fuels, as shown below:

But the high carbon price, while bringing HVO and FAME more on a par with fossil fuels, would also provide a huge incentive to LNG.

We have focussed our analysis of current fuel alternatives. When considering lower carbon options, the likes of blue or green ammonia, hydrogen or methanol are simply not a realistic option at present. This then leaves LNG and biodiesels as alternatives to fossil fuels.

Even without a carbon scheme, LNG looks very attractive and we would expect the current trend towards investment in LNG bunkering infrastructure to continue. The daily benefits are likely to support dual fuel vessel investment plans.

As and when the maritime sector is brought into the EU ETS, it would take a huge increase in the current carbon price for ship owners to deviate from their current fuel mix. A higher carbon levy could provide an attractive additional boost for LNG.

However, the ETS covers many consumption sectors, including heavy industry and commerce, all of which can be served by green energy options that require a lower carbon price than that needed to make HVO or FAME compete against fossil fuels.

The consensus for an effective carbon price for the maritime sector appears to fall somewhere in the $100 to $150 per tonne CO2e range. We think it unlikely that a carbon price in the EU ETS would move high enough to support the introduction of HVO or FAME at any significant level for Marine use. This sector would require its own separate approach, as advocated by Trafigura. What this analysis further shows us clearly, is that HVO and FAME are among the most expensive green fuels, which should in the long term restrict their use to sectors where there is no feasible alternative. Shipping is not one of these sectors in the long run.

Finally, investors in an LNG bunkering facility or a dual fuel vessel are likely to be considering a 20-year time horizon. An important consideration will be how these assets can be recycled for use with future fuels such as ammonia and hydrogen once they become available at scale and at a cost-effective price.

See you all at MEPC 76

Its still 1.5tostayalive and a comprehensive universal carbon tax is the logical next step

Nice one, i surport this idea of including heavy industry and commerce… Not only shipping industry.

So if current reports indicating that LNG is not carbon neutral are correct, what is the carbon taxation required to make novel “green” fuels economically favorable?