This is why the world needs more harsh environment semi-submersible rigs

There just aren’t enough new rigs to meet long-term drilling requirements in the North Sea and Canada, argues David Carter Shinn from Bassoe Offshore.

Harsh environment semisub dayrates hit their lowest point in recent history about two years ago, but they’ve been creeping up ever since.

While better planning, prudent project cost management, and general organizational and technical efficiencies have allowed oil companies to save big money exploring and developing North Sea fields, most of the savings has come from being able to contract cheap offshore drilling rigs.

Rigs were cheap not only because of a high availability rate, but also because oil companies sanctioned shorter drilling projects – rig owners normally don’t lock their rigs in at low rates for long-term contracts.

Out of 24 semisub contract fixtures in 2018, only one (the Deepsea Nordkapp’s two-year contract with Aker BP at $325,000 per day) has a duration of two years or more. Average new-contract durations in 2018 are running at just over 200 days.

Now, the need for new investments and longer drilling projects is expected to pressure oil companies into contracting rigs for multi-year programs. And these programs will require new, efficient rigs, with energy-saving features to lower carbon emissions.

The problem is that, as things stand today, there won’t be enough of these rigs around.

This impending lack of new rig supply is what’s driving owners like Awilco to build new, specialised semisubs for midwater operations in the North Sea. Other rig owners are likely to follow with newbuild orders over the next six months, but will enough of them be built?

Norway has nearly closed the door on old rigs, the UK to follow

Bassoe Analytics shows that virtually all working semisubs in Norway are committed through 2019. There are gaps here and there, but contract extensions and new awards are likely to keep these rigs working well into the next decade.

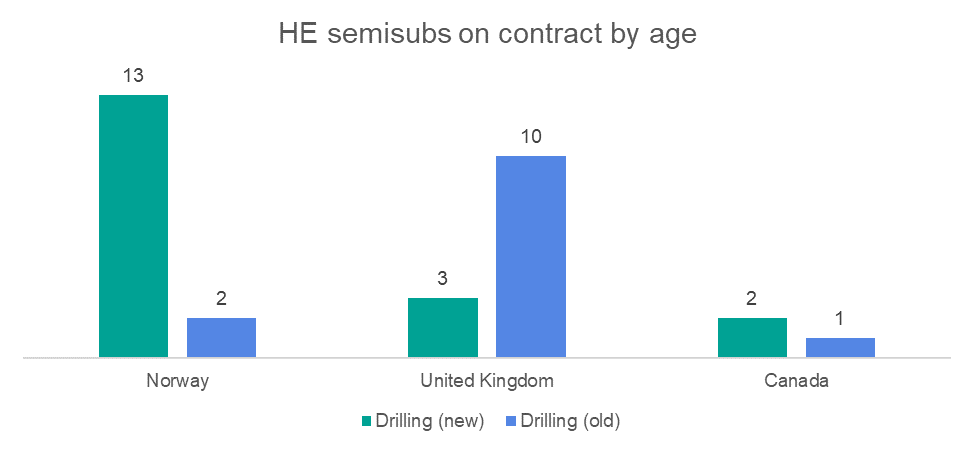

If you look at the age of the 15 rigs working in the country, only two were built before 2000.

The Transocean Arctic and the Deepsea Bergen, built in the 1980s, are committed at least up until 2020, but, apart from these, the rest of the earlier generation rigs are cold stacked and unlikely to return to service in Norway other than for plug and abandonment or workover projects.

Modern rigs are clearly preferred today, and that trend will continue. Equinor, already with some of the highest environmental and efficiency standards, says that their policies will only become more stringent as they remain steadfast in using the most sustainable and effective rigs in the fleet.

The United Kingdom has 13 semisubs on contract, and ten of them were built before 2000. There’s a limit for how long this situation can last.

Over the next few years, we expect the market in the UK to develop in much of the same way that Norway has. Older rigs, as they roll off contract and near their special survey due dates, will one by one become relegated to low-tech work or sent to scrapyards.

New-rig availability is low, reactivation and upgrades of older rigs unlikely

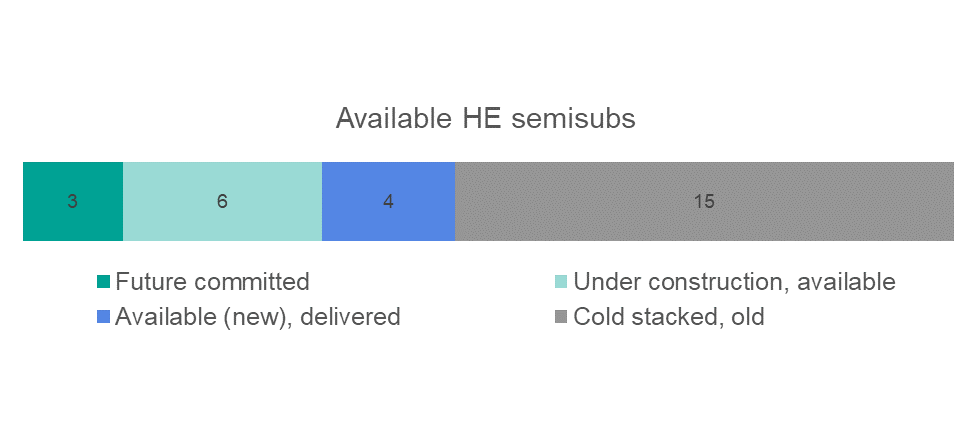

Looking at the fleet of new available rigs, there isn’t much to offer. Three rigs have future commitments (including newbuilds West Mira and Deepsea Nordkapp). That leaves ten new or under construction semisubs to fill the coming gap in supply of rigs as older ones are phased out.

And as eight of the ten available new rigs are Norway-compliant (and able to command higher dayrates), the momentum in dayrates for harsh environment rigs will build.

You could argue that the future rig supply gap could entice owners to attempt to reactivate and upgrade their old rigs. The Stena Don, for example, will undergo extensive upgrade work at Damen Verolme this year, but it was delivered in 2001 and is a far more logical upgrade candidate than those built in the 1980s (which account for most of the supply of old rigs).

At the same time, Ocean Rig announced earlier this year their intention to raise equity to reactivate the Eirik Raude (built in 2002) for over $100 million. This deal failed, and it was likely investors’ reluctance to put high-risk money into an old rig that killed it.

So how many new harsh environment rigs does the world need?

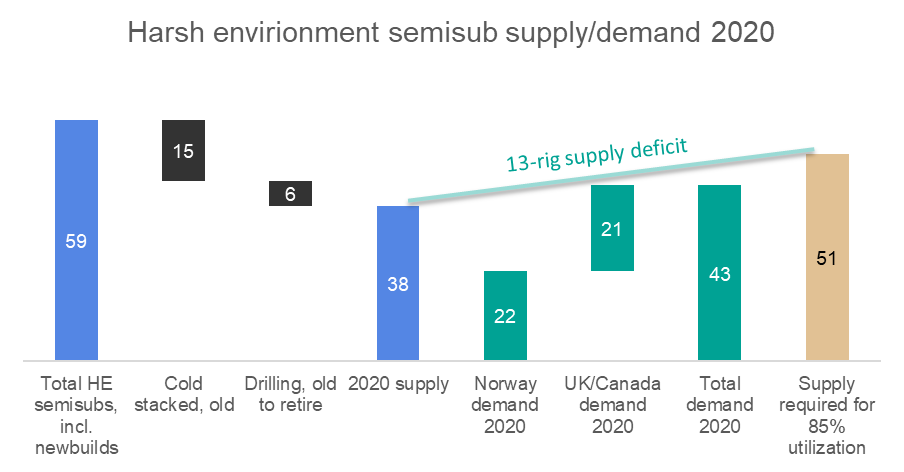

If demand for new and efficient rigs in harsh environment areas rises and if oil companies’ preferences for new rigs continues – both of which we believe to be true – the market will need more rigs.

After contract awards to the Deepsea Nordkapp and West Mira, there are still six newbuild rigs which could potentially work in Norway, the United Kingdom, and Canada.

But at least another six rigs will become non-competitive by 2020 in addition to the 15 which are already considered to be out of the competitive drilling market. So the market will absorb the current newbuilds without affecting real supply.

While supply stagnates, we estimate that Norway, the UK, and Canada will hit 43 rigs, up by ten from around 33 (plus two committed) rigs today and leading to a shortfall of five rigs. To maintain 85% utilization, we would need a further eight rigs on top of that.

So up to 13 newbuilds could enter the market over the next three years (in addition to the six existing and uncontracted newbuilds) and we’d still have 85% utilisation.

Oil companies, who’ve proudly touted their offshore drilling cost-cutting efforts in the North Sea, may be about to discover that costs are going up again. Without more harsh environment semisubs, oil companies will experience a major cost disruption if utilisation reaches above-normal levels.

In the meantime, as more longer-term contract requirements materialise and newer rigs continue to be preferred for efficiency reasons, dayrates will more toward $400,000 for longer programs.