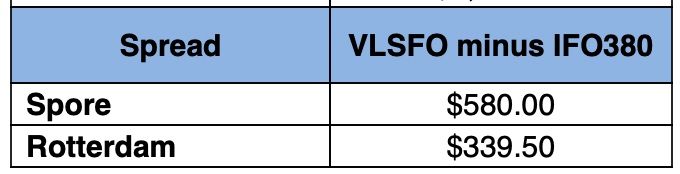

For the first time in nearly two months, crude oil prices have fallen below $100 a barrel this week, yet in Singapore the price gap between high and low sulphur fuel oil – known as the Hi5 – remains at record highs, nudging towards $600 per tonne with ships in the region increasingly swerving away to other bunkering destinations.

The pricing gap between Singapore and Rotterdam, the world’s two largest bunkering hubs, is stark.

“VLSFO supply has been acutely tight for weeks in Singapore’s bunker market, with high price premiums quoted for prompt delivery dates,” a new report from bunker platform Engine states, adding: “Sources in Singapore’s bunker market point to a lack of incoming VLSFO cargo flows as a reason for the grade being tight.”

The situation is expected to remain tight throughout July with reports emerging of ships avoiding Singapore for bunker operations, something that could increase on quality concerns. Global testing firm Intertek Lintec on Tuesday issued an alert regarding flash points below the ISO 8217 minimum requirement of 60°C found in VLSFO bunker samples from vessels that have taken fuel in Singapore, the latest in a series of damaging bunker quality incidents hitting the republic this year.

“It is the nature of the product and the inter-relationships with high priced transport fuels that is driving VLSFO prices so high, especially in Singapore. The position in the east is stronger than in the west, with exceptionally low diesel and gasoline exports out of India and China resulting in highly restricted supplies east of Suez,” a recent report from Integr8 Fuels pointed out.

This year’s growing price gap between shipping’s main two fuels is seeing a renewed interest in scrubbers.

Looking at the VLCC segment, Norwegian broker Fearnleys observed in its most recent weekly report: “The disparity between the scrubbered and unscrubbered vessels is stark.”

With a price differential close to double, a VLCC owner able to burn high sulphur fuel oil can look to earn around $27,000 a day for a Middle East to China run, according to Fearnleys. However, for the non-eco, non-scrubber vessels, on the same voyage, TCE returns are still struggling to break even.

Many will be eyeing the next dry dock as an opportunity to fit a scrubber and level the playing field

“Many will be eyeing the next dry dock as an opportunity to fit a scrubber and level the playing field,” Fearnleys predicted, something rival broker Clarksons also forecast in its latest weekly report, noting that thanks to the high fuel price differential, the share of global tonnage with a scrubber is set to grow to 24% by start 2023.

Prices for crude oil have dropped noticeably this week with growing fears about recession in many western countries. Not all shipping analysts are convinced that a plummeting oil price will be eagerly greeted by the shipping industry at large.

“Shippers and shipping companies will normally agree that lower crude and bunker prices are to be preferred, however, right now most will probably be happy for crude to stay around $100 per barrel as much lower prices will be a reflection of adverse global economic developments that help no one,” BIMCO’s chief shipping analyst, Niels Rasmussen, commented today.