Too much oil and not enough ships

Erik Broekhuizen from Poten & Partners charts how tankers got into such a sweet spot.

Unlike many of the other main shipping segments, such as containers and dry cargo, which are going through very challenging times, crude oil and product tankers seem to be humming along nicely, despite (or because of?) continuously falling oil prices and reports of slowing growth in China. Is the tanker market living on borrowed time with a correction just around the corner or can we expect the market outperformance to continue? As is usually the case, it depends.

If we go back a few years, we can see how the seeds for the current bull tanker market were sewn. After the global financial crisis of 2008-2009, tanker rates and prices collapsed and newbuilding contracting slowed to a trickle. As a result, newbuilding deliveries during the period 2013-2015 (for vessels ordered after 2009) totaled 491 across all tanker segments, almost 40% less than the 802 vessels that hit the water during the three-year period from 2010-2012 (mostly vessels ordered prior to the financial crisis). Demand for tankers actually started to grow again during this period, partly due to a worldwide recovery in economic activity and partly due to the growth in average distances over which oil and oil products are being moved. Crude trades, for example, are benefiting from more long-haul movement of oil from producers in the Atlantic Basin (like Venezuela, Angola and Nigeria) to consumers in the Pacific. Product tankers are moving more refined products globally over longer distances as a result of the completion of large export refineries in the Middle East and Asia. Combined, these developments have boosted tanker demand.

In recent years, oil production has provided an additional boost to tanker demand as it continued to grow at a faster pace than oil demand. Initially, the main contributor was the United States, where the rapid growth in shale oil production added significant supply to world oil markets. Shale oil production in the US rose from less than 500,000 barrels per day in the first half of 2008 to a recent peak of 4.64m barrels per day in May 2015, a 10-fold increase. The shale revolution impacted the oil and tanker markets in various ways, the two most important being (a) a significant reduction in US crude oil imports, freeing up Atlantic Basin crudes for Asia and (b) a significant decline in the price of oil since the middle of 2014, as production increased faster than world oil demand. In the second half of 2014 and throughout 2015, oil supply continuously exceeded oil demand by a significant margin, leading to significant stock building. In addition to the increases from the US shale, OPEC producers decided to challenge non-OPEC for market share and also increase production.

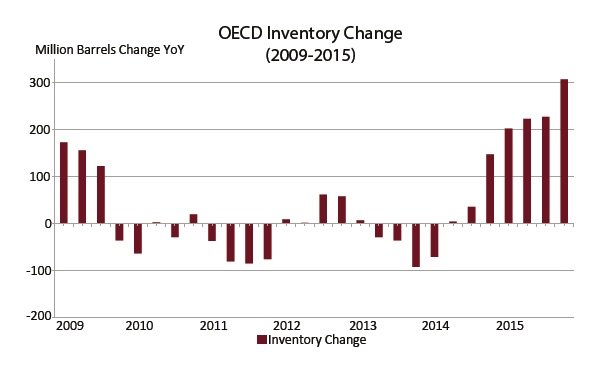

The chart from the Energy Information Agency below illustrates the point. It shows the quarterly changes in OECD inventories (year-on-year) for the period 2009 – 2015. The last time we have a significant inventory build was in 2009, but the increases we have seen in the last 18 months have been higher and longer in duration.

The International Energy Agency (IEA) estimated that worldwide crude oil stocks increased by an average of 1.2m barrels per day in the second half of 2014 and by 1.8m barrels per day in 2015. This means that over the last 18 months, worldwide inventories have grown by an astounding 875m barrels. Most of this crude was transported by sea, providing material support for the tanker market.

The abundance of oil in world markets has sent the price of crude spiralling down to levels not seen since 2012. As a result, shale oil production in the US has started to decline already. Significant cuts in capital expenditures by the international oil industry will also have an impact on production in the years to come. At some point, this will have an impact on tanker rates, especially since the healthy market over the last 18 to 24 months has led to a significant increase in newbuilding orders. These new vessels may be delivered around the same time as tanker demand starts to falter. And so the tanker cycle starts again.