Transpacific box volumes pick up just as labour strife hits

More containers are on the waters of the Pacific heading for the west coast of North America than at any time this year, just as labour strife makes their smooth arrival uncertain.

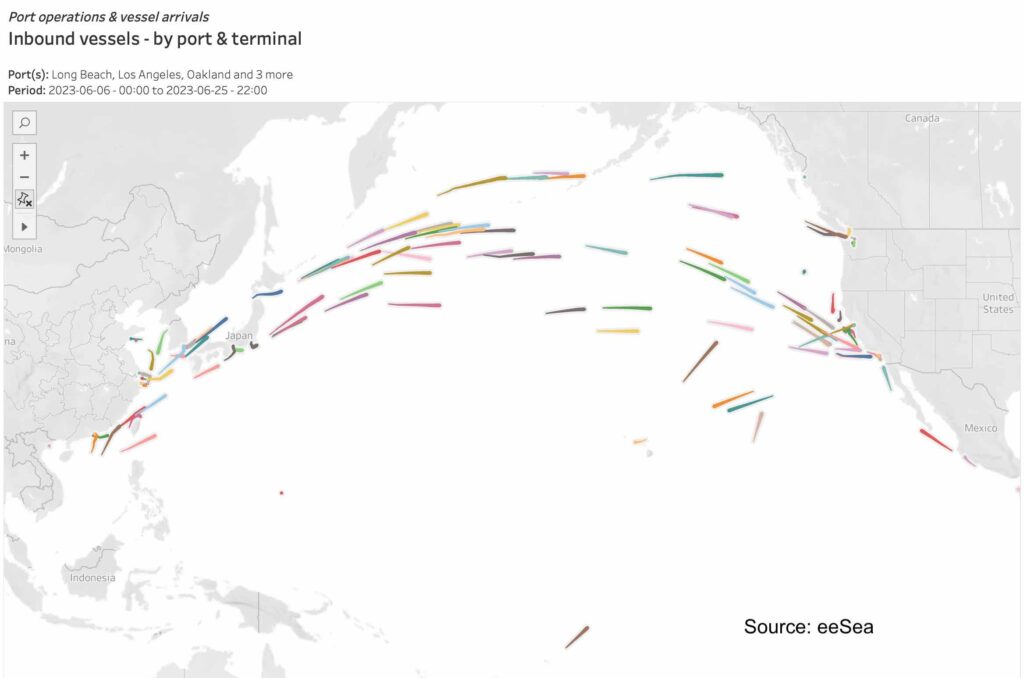

Outbound transpacific cargo movements spiked to their highest level in six months in May, according to the Japan Maritime Centre, marking the first time since October 2022 that monthly outbound volumes on the route have exceeded 1.5m teu. All boxships heading across the Pacific due to arrive in the coming 18 days are tracked by Denmark’s eeSea below.

The armada of ships heading for the US and Canada come at a time where US west coast ports are suffering sporadic labour walk-outs at terminals up and down the coastline, while later this week union members will vote on pushing ahead with a 72-hour strike at the Canadian ports of Vancouver and Port Rupert.

With supply chain specialists increasingly returning to vessel tracking sites – like covid days – to assess whether ship queues are forming, Adil Ashiq, who heads up MarineTraffic’s operations in North America, commented on LinkedIn, “I can surely see a lot of vessels currently on their way from Asia to the USWC. The caterpillar effect will show and if things do not resolve in the coming days, then we may see some excitement in our supply chain once again.”

While there has not been a noticeable build-up in ships waiting for berth space at terminals yet, congestion signs are building inland.

Railroad Union Pacific has put a temporary pause this week for shipments from its inland terminals into three terminals at the ports of Los Angeles and Long Beach noting the build-up of freight at container yards at the terminals.

In Oakland, where labour walk-outs had been the highest over the weekend, the situation worsened yesterday with the port closing operations after a crane operator died while working.

Judah Levine, head of research at box booking platform Freightos, warned shippers yesterday that the ongoing stand-off between employers and employees at the docks was showing signs of spot freight rates increasing this week.

The last major industrial actions by the International Longshore and Warehouse Union (ILWU) were taken in early 2015 after negotiations for a new agreement stalled with up to 30 ships forced to queue outside Los Angeles and Long Beach in the ensuing weeks.

Once disruptions eased it took a month and a half for that number to drop to zero but reportedly took another six months until operations had completely returned to normal.

In the event that the situation worsens in the coming days and weeks, Levine predicted: “The recovery from a significant slowdown could be shorter than in 2015 due to new covid-era strategies like off-site overflow yards and improvements in truck scheduling that could help unclog terminals themselves and speed the rate at which waiting ships can be unloaded and cleared.”

Data from Seaexplorer, a unit of Kuehne+Nagel, concerning anchored vessels and blocked capacity at Los Angeles and Long Beach ports show that an average of five vessels were outside the port complex since the beginning of the disruption on June 2.

The stalled pay negotiations between the ILWU and employers at the Pacific Maritime Association have dragged on for more than 13 months, with increasing calls from retailers and manufacturers for the Biden administration in Washington DC to get involved.

“Pay structures should be put into place whereby workers are paid for the work which they physically do, but not for the business which they drive away,” commented Andy Lane, a container shipping consultant at Singapore-based CTI Consultancy.

Fingers crossed – the whole industry in LAX / LGB