Ukraine invasion has permanently changed the map of the oil market

China’s Asian neighbours are soaking up surplus crude volumes and creating new routes in the process, writes Tim Smith, Director, Maritime Strategies International.

Crude trade volumes in 2022 are seeing conflicting dynamics. The historical ‘engine’ of growth, China, is contracting. We expect China’s import volume growth to be negative for the second consecutive year, dropping by 0.7%.

Given the country’s weak demand and well publicised, and intensive, fight against COVID-19, this will come as little surprise. More at risk is our view that imports will see a big increase in 2023.

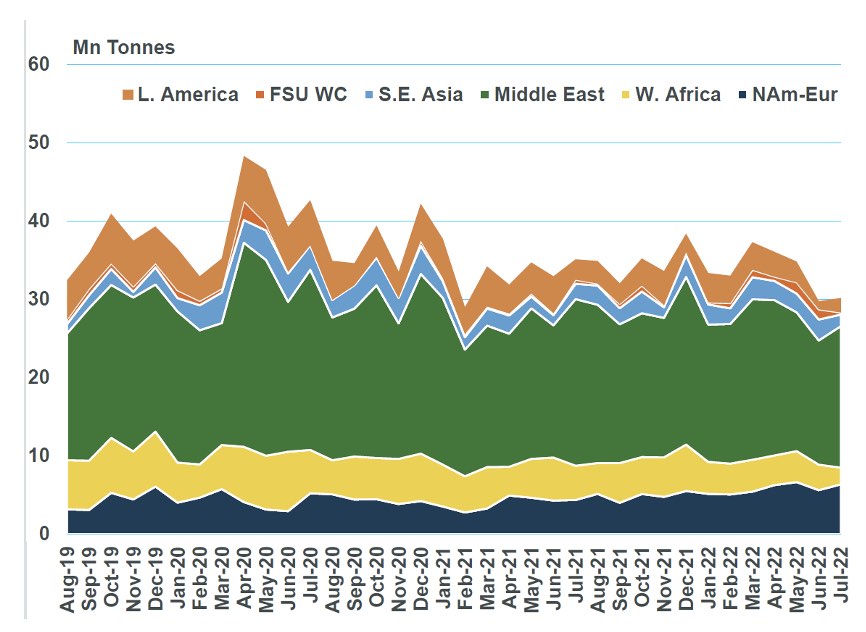

Chart 1 shows crude flows into China through July from key regions, with a significant decline evident across Q2. Q3 has seen some pick-up but volumes remain low in a historical context.

However, whilst China has been in the doldrums, other regions have been soaking up crude. We have made significant upward revision to European and South Asia crude imports in 2022 helping offset the impact of China and continuing to drive crude tanker demand higher. The major Asian economies of Japan, South Korea and India are all seeing substantial increases in imports this year, supporting our view on net crude trade growth of 4.5% in 2022.

This ‘volume’ factor is key in explaining the revival in tanker markets – it is not all about changing route dynamics. Adjusting for overland flows, seaborne crude trade volumes are also revised up, with the 2022 growth rate increased from 3.9% to 5.1%.

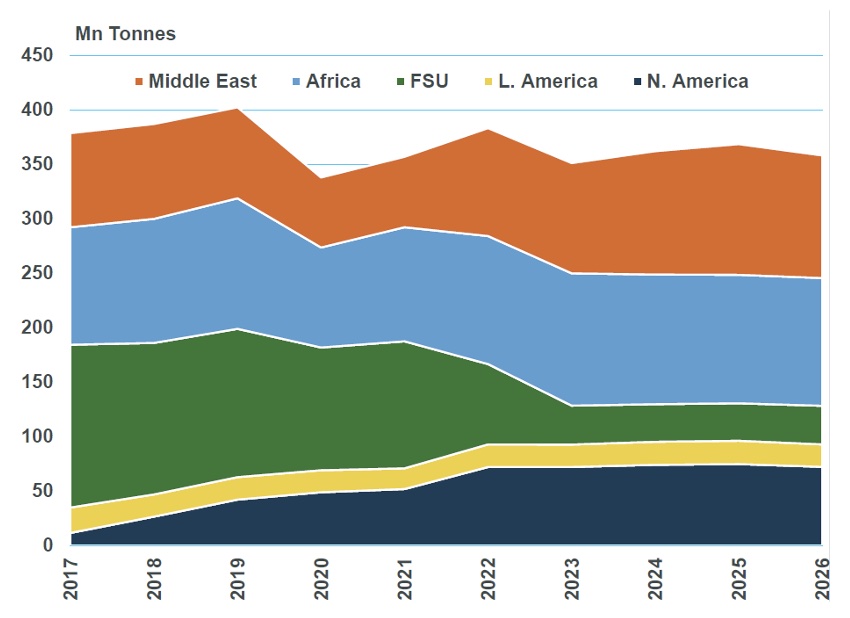

As Chart 2 shows, Europe and North America are also playing a major role in the positive growth of crude trade in 2022 with European import growth particularly notable. However, we don’t expect this to last.

Much like our forecasts for overall consumption, 2023 is expected to see crude trade growth drivers switch dramatically.

Europe’s ban on seaborne Russian crude is expected to pressure import volumes next year; even though we have revised up overall levels (from a higher base in 2022), we still project a net decline in the region’s crude imports.

In terms of Europe’s sourcing of crude, we expect to see a major switch in the latter part of 2022 – the EU’s ban on seaborne crude comes into effect on December 5th. Our projections for flows combine an overall decline with more weight now added to African imports which have been growing strongly, alongside Middle East and US crude imports.

FSU imports still contribute to the region’s intake as other countries comprising the region, e.g. Kazakhstan, are not affected by the ban. Nonetheless, outlets for these countries’ crude are subject to related disruption with the CPC pipeline that moves crude into the eastern Mediterranean being subject to Russian interference.

Stronger Chinese crude import demand in 2023 is predicated on both COVID-19 policy easing and limited macroeconomic downside – neither are guaranteed – supporting VLCCs. Seaborne crude cargo is expected to reach pre-pandemic levels by 2024 and during 2024/25 trade growth reverts more closely to pre-pandemic ‘norms’ with volumes driven by China/Asia.

At the same time, Americas import demand declines as domestic production rises and demand growth slows. However, with Russia’s invasion of Ukraine, we should only refer to any ‘normal’ in a limited context. The oil market map has been changed permanently. Oil tankers are likely to continue to benefit from this restructuring and with markets all but shut off in Europe and North America, Russian crude must, if is to continue to be produced and exported, head primarily to Asia supporting tonne miles.