VLCC price-to-net asset value discounts are now at steepest levels seen in decades

Brave investors might look to listed VLCC vehicles as shipping punt as new data emerges on just how undervalued much of the stock is today.

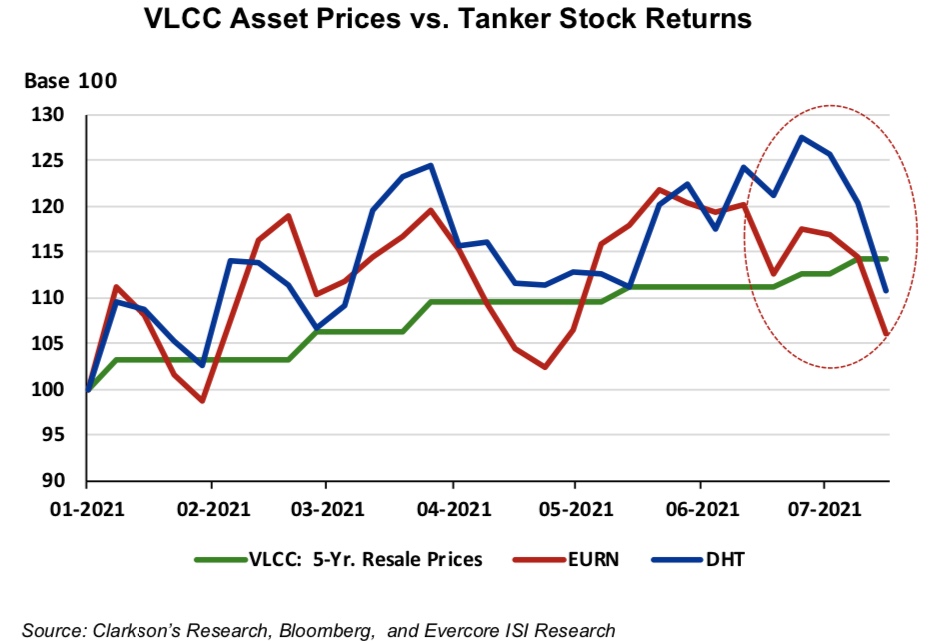

Research from Evercore ISI shows that price-to-net asset value discounts for Euronav and DHT, which serve as proxies for the VLCC sector, are now at steepest levels seen in decades.

“Typically, equity prices have a positive correlation to ship prices as the fallback valuation metric remains price-to-net asset value (P/NAV), for better or for worse,” Evercore ISI explained in a note to clients.

Asset values can be a predictive factor in calling market inflection points – pullout needed VLCC story

The analysts have noted not only a renewal of sale and purchase activity for tanker assets, but also an uplift in values that far exceeds any improvement – or lack thereof – in underlying spot rates. Tanker equities, by contrast, have reacted to these rising asset values by taking a nosedive.

“We completely acknowledge that investors will need to see the whites of the eyes of an actual improvement in rates to buy into our newfound favorable thesis on the equities, but asset values can be a predictive factor in calling market inflection points. It will certainly take nerves of steel to buy these violent dips in tanker (or any shipping) shares today, but with the market bouncing along the bottom, oil demand and supply on the mend, and asset values providing a solid floor to current valuations, the risk/reward tradeoff is skewing meaningfully to the latter,” Evercore ISI stated.