Volume of blank sailings deemed insufficient to stem box rate decline

Carriers are taking services out of the transpacific, and this year’s first boxship scrap candidates have emerged as container shipping recalibrates to a slowing global economy.

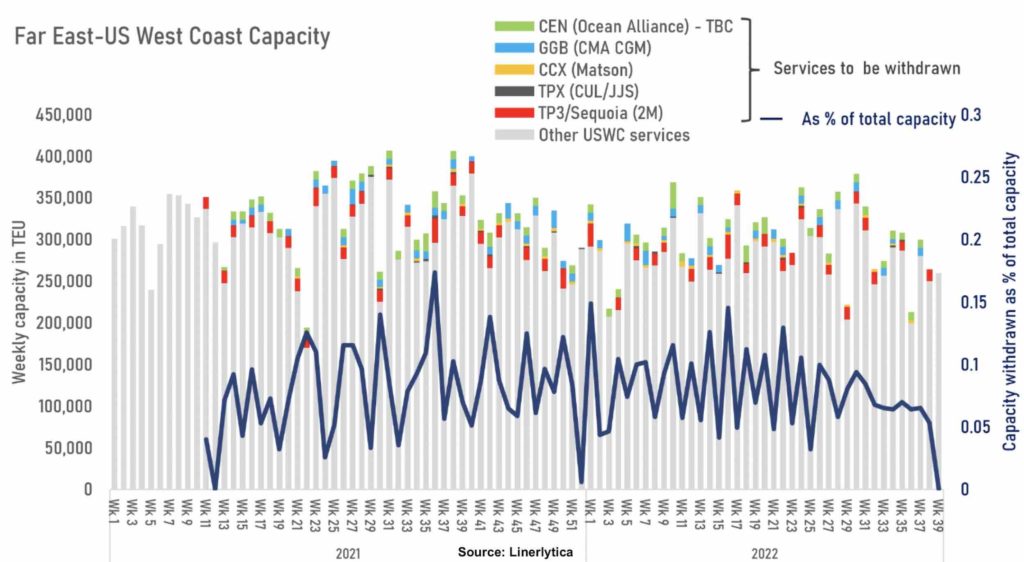

On the Asia to the US west coast tradelane, Linerlytica reports three services have been withdrawn with two more suspensions planned (see chart below for details).

The services to be removed represent just 7% of the total capacity on this tradelane, and remain insufficient to counter the recent sharp reduction in demand, Linerlytica suggested in its latest weekly report, going on to estimate that demand to the US west coast dropped 20% in September compared to the same month last year, with capacity utilisation 5% lower despite running on 16% less capacity.

Plenty of data emerging shows that this year’s peak season has proven to be far weaker than previous years.

“What has happened to peak season? It just doesn’t seem to have materialised, does it?” Peter Sand, the well-known analyst at Xeneta was quoted in a Splash report from late last month. The weeks ahead look similarly aneamic.

According to Sea-Intelligence, the five-week period covering October 2022 will see carriers offer a total nominal capacity of 1.56m teu, almost exactly the same as was on the table in the same period last year.

“[T]he many blank sailings seen so far are likely insufficient to stem the rate decline in October – for that to happen, we would need to see substantially more blank sailings,” Sea-Intelligence stated in its most recent weekly report.

While rates remain elevated compared to pre-pandemic, there are signs that container shipping players have become spooked at the rapid decline in multiple indices of late.

The first two containerships – aged 32 years and 38 years respectively – to be sold for scrap this year have just been reported.

“As more ships sit spot we will likely see transactions increase in the coming weeks and for those with older tonnage high demo prices are an opportunity to make use of a residual that is historically attractive,” Braemar stated in its most recent container shipping market report.