Weekly Broker: Celsius heats up the market

The positive sentiment in the sale and purchase market continues to grow this week on the back of positive chartering signs in the larger size segments for both bulkers and tankers. The capesize market kept firming up while the VLCC market seems to have finally found some stability after volatilities seen in the past couple of months. The owner seen wheeling and dealing the most in the past week has been Denmark’s Celsius Shipping.

“On the dry bulk side, a very interesting week was due, with a good flow of transactions coming to light the past couple of days. It seems as though it was long overdue for a more vivid SnP market to take shape in the larger size segment. Despite this, it’s too early to call if this was just a momentary spike or if we are to expect more activity to take place over the coming months, on the back of the improved freight market, is yet to be seen. For the time being, it looks as though we will continue to see the main focus hold firm on the small and medium size ranges,” Allied Shipbroking said.

Splash has already reported two en bloc deals. Greek owner Pavimar acquired a pair of panamax bulkers from Triton Navigation and Russian company White Lake bought two sister handysize bulkers Summit and Alpine from CarVal Investors.

Multiple shipbroking houses including Allied Shipbroking, Intermodal, Lorentzen & Stemoco and Andreas J. Zachariassen all reported that Belgian owner Bocimar sold its 2003-built 171,000 dwt capesize bulker Mineral China to South Korean interests. The vessel has been chartered back to the company for three years at a rate of $15,000 per day.

Allied Shipbroking, Lorentzen & Stemoco and Andreas J. Zachariassen all reported the sale of the 1997-built 47,000 dwt handymax bulker Heng Chang. The Japanese-built vessel was sold by Chinese company Ocean Longevity to Vietnamese interest for $4.3m.

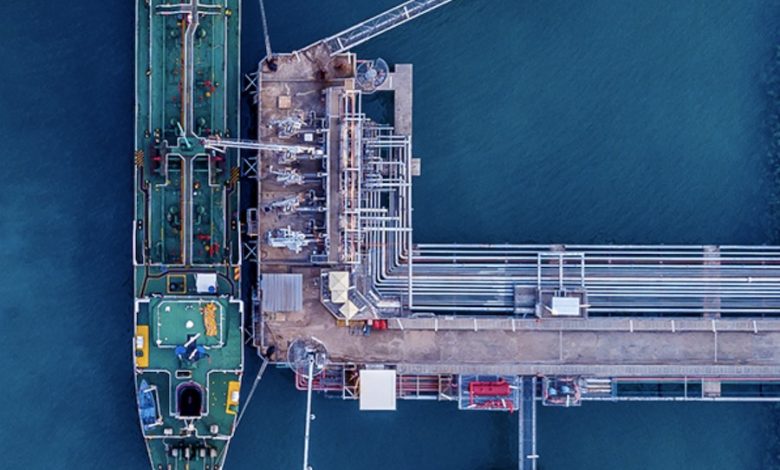

On the VLCC chartering market this week, Fearnleys said in its report that earnings are still barely covering opex, however activity in the West and predominantly in the USG area has attracted a handful eastern ballasters for the next fixing window to come in early July. The market steady for now, but Fearnleys said owners seem more optimistic as the summer months are coming. In the meantime, the suezmax chartering market has been all about absorbing the overhang of tonnage.

“On the tanker side, things slowed down considerably this week. At this point, the only active size segment is the MR, which actually leads the overall secondhand market for some time now. All-in-all, given that we haven’t noticed any clear direction in this specific market, we can expect a high level of asymmetry to take place, at least in terms of volume of transactions, in the short run,” Allied Shipbroking said.

Intermodal reported that Danish owner Jeppe Jensen’s Celsius Shipping has sold two 2004-built 37,200 dwt MR tankers, Celsius Penang and Celsius Perth. The two South Korean-built vessels have been sold to Indonesian interests for $8m each.

In the meantime, multiple shipbroking houses reported that the 2009-built 47,000 dwt MR tanker Glenda Megan was sold to Danish interests and Intermodal identified the buyer as busy Celsius. The vessel fetched a price of $17m.

Both Banchero Costa and Clarkson listed the sale deal of the 2000-built, 160,000 dwt suezmax tanker Eurospirit. The vessel was sold by Greek owner Eurotankers to Qatari interests for $13.9m.

In the containership sale and purchase market, Braemar ACM Shipbroking reported the sale of the 2006-built, 1,100 teu boxship BC Hamburg. The Chinese-built vessel was sold to German buyers for a price below $5m, with a long term charter to MSC.

Celsius has had a hot week with Alphaliner reporting it had purchased the 4,132 teu JPO Capricornus from German owner Oltmann for $8.6m and the acquisition has been combined with a long term charter extension of the vessel to Maersk.

“Although little was concluded, a number of vessels in the 1,700 teu sector invited offers and it will be interesting to see what levels these achieve,” Braemar ACM Shipbroking said.