Weekly Bunker: Credit crunch approaching

Earlier this week 4 cargoes totalling 80,000 of VLSFO in Singapore changed hands in a single day, with Hin Leong buying 3 from Lukoil and 1 from Shell.

These were bought at $489, on a day when delivered bunkers in Singapore were indicated at $538 (+$49 premium).

As the rapid switch from HSFO to VLSFO continues, we expect to see this premium drop as competition kicks in between suppliers.

HSFO prices continue to slump as shipowners begin to calculate how much they need to last them to the final days of December and not a day more.

Structure is a good indication of market demand, and throughout 2020 we see HSFO in contango (weak demand) but VLSFO and MGO in backwardation (strong demand). No surprises there.

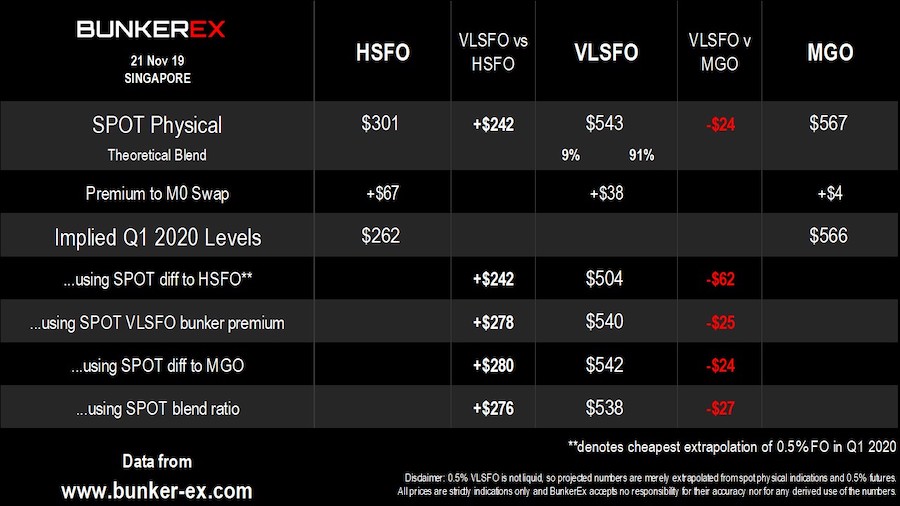

HSFO-VLSFO differentials are now $242 and converging nicely with Q1 2020 implied values, where we expect it to sit in the $250-300 range.

Considering this, we should start to see a ‘credit crunch’ on bunker financing soon. Buying 1000mt of bunkers now costs an owner an extra $242k. Across 10 stems, that is $2.4m of added financing that needs to be drawn from somewhere – so expect to see trader’s margins increase as they are the main credit and finance providers to the bunker industry.

Elsewhere, oil prices rose again as US stocks in Cushing fell dropped and fresh doubts about US-China trade talks continued.