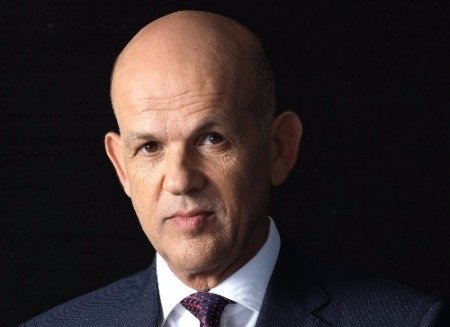

ZIM: Glickman makes his mark in first year at the helm

It’s been just over a year since Eli Glickman, 56, replaced long serving Rafi Danieli as CEO and president at the world’s 10th largest containerline, ZIM. In his first year Glickman has stamped his authority on the line and pushed in new directions that were previously unimaginable, most notably the announcement this month of a strategic partnership with 2M partners Maersk and MSC for shipments from Asia to the US East Coast.

The Israeli boxline had thus far avoided container alliances. The new strategic cooperation, which starts in September and is set to run for an initial four years, will see the removal of two strings on the tradelane, equivalent to a 5.2% reduction in total Asia – US East Coast weekly nominal capacity from 161,700 teu as at July 2018 to 153,300 teu in September, according to Alphaliner data.

Glickman is a very hands-on CEO, keen to meet customers and employees from around the world and to position ZIM as a carrier that cares. Speaking from Chicago where Glickman has been meeting clients, Glickman explains the rationale for the line signing up with 2M.

“Maersk and MSC came to this strategic partnership because they saw the value we could add,” Glickman says.

The ZIM strategy over the last few years, Glickman says, has been to position itself as a “global niche carrier”. With 417,000 slots equivalent to a 1.9% market share, ZIM is never going to go head to head with the biggest names in the industry over volumes, rather choosing the areas where it believes it can perform well.

“We compete globally in markets where we can feel compete with the bigger carriers,” Glickman says. It’s very strong on Asia-US East Coast with an 8% market share. “We are not small in this trade, we compete very hard here,” Glickman says. Likewise it is strong on intra-Asia, and Asia to the Pacific Northwest and Asia to the Mediterranean. However, Glickman knows where to pick his battles.

“We cannot compete with the big companies on Asia to North Europe where they use 21,000 and 22,000 teu ships so we withdrew from there,” Glickman says.

Another important aspect of Glickman’s first year in charge has been his pursuit to make ZIM a digital leader among containerlines. Glickman, who headed up utility Israel Electric before being appointed ZIM boss, recounts how on taking the new job last year he found shipping to be 20 or 30 years behind other industries in terms of digitalization.

“Israel is considered to be a start up nation so we are going to use this be a start up of the container shipping industry,” Glickman says.

A chief digital officer was appointed in January and a number of big projects, including blockchain, have got underway this year.

“For sure we are going to be the leader in the digital generation in this market. We are not just speaking we are doing,” Glickman stresses.

While this tech push is a priority, Glickman is adamant that digital does not mean ZIM loses its face-to-face relationships with clients.

“Digital does not mean losing the personal touch, that is actually our strength,” he says.

On the markets, Glickman believes the maths simply do not add up for container shipping at the moment and something has got to give soon.

“The market is looking for a new equilibrium point,” Glickman says. “Freight rates are vnot strong, especially when compared to the current high bunker and charter rates. Something is not working. I am sure we will see changes in the near future. We cannot live like this forever.”

With that, the ZIM boss has to go – there’s more clients to meet in Chicago before heading to meet other customers in New York.