One of the most famous names in Norwegian maritime is making a return to the tanker trades, confident the sector is set for an extended boom period.

Speaking at Marine Money’s New York conference, Tor Olav Trøim told delegates why he felt now was the right time to get back into the tanker business after a 15-year absence.

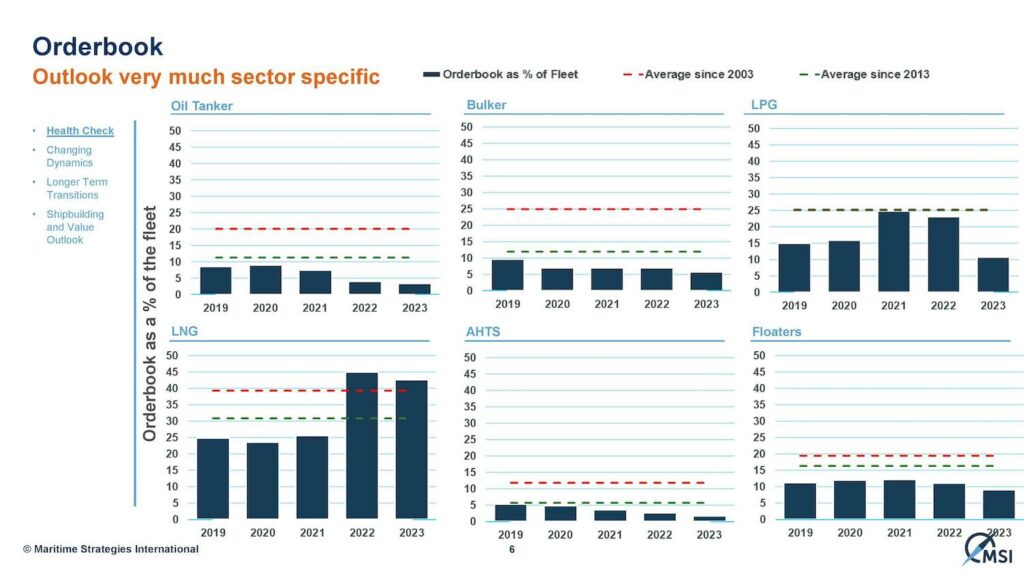

Trøim, who ran Frontline Management with John Fredriksen through to 2008, has focused on drilling, LNG and dry bulk in the intervening years since parting ways from the Fredriksen empire in 2014. However, presented with the statistics on the incredibly low tanker orderbook today, the Norwegian tycoon decided now is the time to make a tanker return, revealing he is contracting for two VLCCs, confident that today’s tanker run could eclipse the one seen between 2003 and 2008.

“In ’05, ’06, I think I said it’s enough and since then I have not looked at another tanker investment,” Trøim told delegates attending the event at the Pierre Hotel in Manhattan.

Trøim then recounted he was presented with the details of today’s tanker fleet stats, in particular the incredibly low orderbook, and this made him decide to get his feet “a little wet” he told delegates, revealing orders via his private investment vehicle Magni Partners for two VLCCs for delivery in 2026. Trøim did not reveal the yard he has selected.

Like the series of newcastlemax bulk carriers he contracted for his dry bulk concern, Himalaya Shipping, the tanker newbuilds will be LNG dual-fuelled.

“After 15 years of bearishness, I’m getting bullish,” he said, adding: “I look at supply and the orderbook for tankers and bulkers are at 30- to 40-year lows. There’s something interesting happening.”

The low state of the tanker orderbook was covered extensively at the conference yesterday, including via a presentation given by Dr Adam Kent, managing director of UK consultants Maritime Strategies International (see slide below).

VLCC rates have been soaring this month. Global VLCC utilisation has picked up by over 5% in June, according to data from Vortexa.

“VLCCs have been the biggest surprise recently as high activity levels and a misplaced fleet pushed spot rates to unexpected highs. Robust fixture volumes for late-June and early-July loadings boosted rates from $30,000/day (non-eco) at the start of June to $83,000/day this week,” a recent report from Jefferies noted.

HUGE Tor Olav fan and agree with his view. Surprised, though, that not getting pre-2026 exposure too… maybe working on it?

The IEA has recently posted a report predicting that oil demand growth may peak soon after those ships deliver:

https://www.iea.org/news/growth-in-global-oil-demand-is-set-to-slow-significantly-by-2028

The uncertain timing of the energy transition is making tanker market predictions harder than ever.