Baltimore salvage ops prove more challenging than expected

Ahead of what will be years of legal wrangling, the owner and manager of the world’s most discussed ship, the Dali, have sought to limit potential pay-outs from last week’s Baltimore bridge allision.

Singapore-based Grace Ocean and shipmanager Synergy Marine filed a limitation of liability court petition yesterday seeking to cap their liability to just $43.6m, in a case that overall is expected to see pay-outs in the billions of dollars.

The petition claims that the vessel itself is valued at up to $90m and that it is owed more than $1.1m in income from freight. The estimate also deducts two major expenses: at least $28m in repair costs and at least $19.5m in salvage costs.

“The Casualty was not due to any fault, neglect, or want of care on the part of Petitioners, the Vessel, or any persons or entities for whose acts Petitioners may be responsible,” the filing claims, adding: “Alternatively, if any such faults caused or contributed to the Casualty, or to any loss or damage arising out of the Casualty, which is denied, such faults were occasioned and occurred without Petitioners’ privity or knowledge.”

The Singapore-flagged Dali, on charter to Maersk, struck and destroyed Baltimore’s largest bridge at 1:30 am last Tuesday with six people dying. The head of Lloyd’s of London warned last week that the Dali could prove to be the largest marine pay-out in insurance history.

The ship has been aground for the past week with a section of the structure weighing on its bow. As much as 4,000 tons of steel from the bridge’s frame are hanging on the bow of the ship, pinning the hull to the river bed below.

The authorities have managed to create a temporary alternate channel with a depth of 3.35 m on the northeast side of the main channel which a tugboat was able to use successfully yesterday.

A second, temporary alternate channel on the southwest side of the main channel with an anticipated draft restriction of up to 4.87 m is expected to be launched soon.

Two crane barges, a 650-ton crane and a 330-ton crane, are actively working on scene. Bridge wreckage is being lifted and transferred to a barge in daylight hours.

Moving the Dali however will prove to be a very tricky process.

Rear Admiral Shannon Gilreath, commander of Coast Guard 5th District, conceded yesterday that dive surveys of the water around the vessel reveal that the mangled state of the bridge below the water makes any metal cutting decisions difficult.

Bridge girders are tangled below the waterline, Gilreath explained, making it difficult to determine where to cut debris so it can be lifted away from the scene.

“It’s turning out to be more challenging than we originally thought it might be,” Gilreath told reporters.

“Below the waterline, along the bottom, is very challenging because these girders are tangled together, intertwined, making it very difficult to figure out where you need to eventually cut,” he said.

Maryland governor Wes Moore commented at a press conference yesterday, “You cannot overstate the complexity of this operation.”

US president Joe Biden is due to visit the scene on Friday.

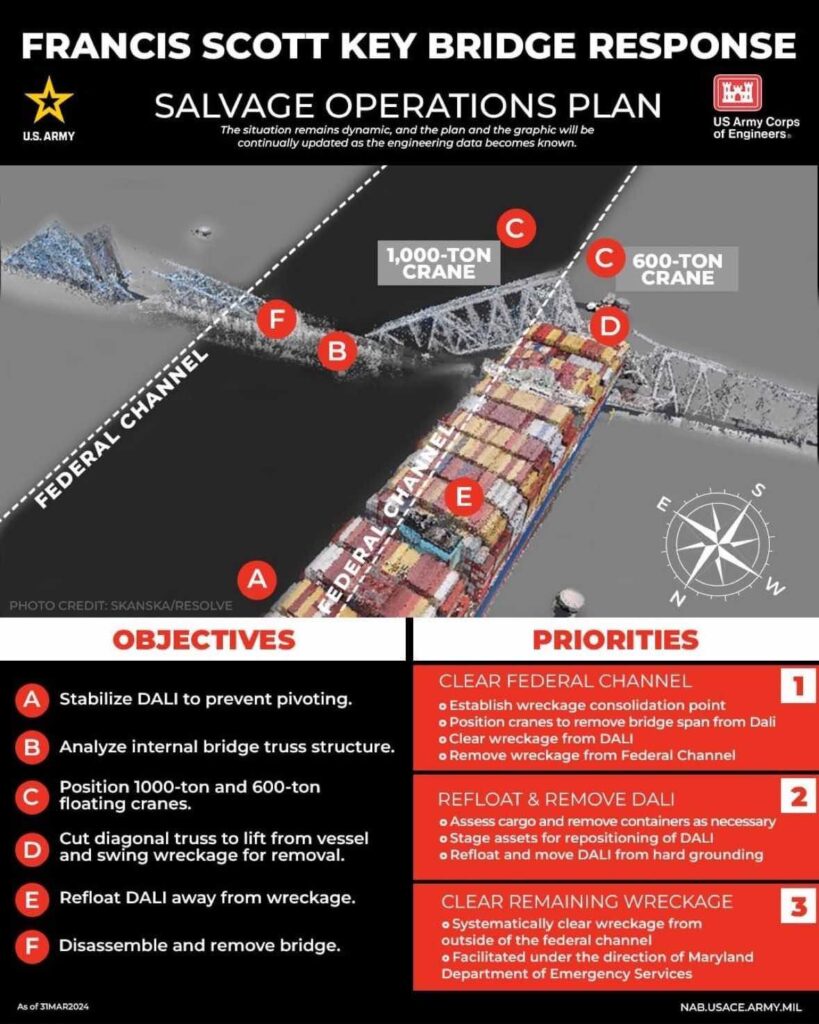

Carried below are the official salvage plans, which also show how the potentially hard-to-remove Dali is located largely outside the main shipping channel.

This is a unique event. No salvage company or port authority has ever had to deal with an accident of such magnitude and complexity, therefore estimates will run wildly wrong. One should only hope and pray that the salvage process goes uneventfully, even if slower than expected.

Clear the Chanel

No.5 ?

‘ No salvage company’ Try Holland.

Costa Concordia?

The Baltimore mayor should stop briefing on issues that involve complex engineering. He is not qualified to speak on this. Leave it to the experts.

Gobby Septic being Septic.

I wonder why the responsible authorities for hoisting the bridge parts ever chevked for a crane barge lije tge are using at sea for example Heerema at the Netherlands presently their Crane self propelled vessel Sleipner at Rotterdam or another offshore selfpropelled vessel ?

I was about to say something similar, that Dutch salvors have a vast experience, but theMAGA mindset etc. has infested the USA .

A certainty that the owner/manager/P&I club application to limit liability to US law post incident value of the DALI (USD 43.6 million) will be strenuously resisted by lawyers for claimants who will seek to prove prior ‘privity and knowledge’ of owners/managers of the causative fault. Based on the history of such applications in US courts and their evident repugnance of the US limitation defence (the US has not ratified the IMO Limitation Convention ’76 as amended), it seems likely the application will be denied. If so, it will not be a good day for the International Group of P&I Clubs (IG) and their reinsurers.

“(the US has not ratified the IMO Limitation Convention ’76 as amended)”

The USA has a long history of isolationism and shooting itself in the goolies.

Yes, the US seems to be infamous for making the most noise at the IMO and other UN bodies when conventions are being drafted. They then decline to sign and ratify. Examples include the UN Law of the Sea Convention (UNCLOS), the Civil Liability (Oil Pollution) Convention and the failed Rotterdam Rules which were intended to get everyone, including the US, on the same page with respect to carriage of goods by sea law. Bizarre stuff that all make the US a high risk exposure jurisdiction for shipowners and P&I Clubs.