Growing Chinese port congestion fires capes to 12-year highs

Capesize spot rates are rocketing once again, having risen by more than $5,000 on a Friday and a further $6,736 on Monday, taking them back above the $50,000 mark and to levels not seen since 2009.

Brokers Lorentzen & Stemoco described the current cape freight environment as a “perfect storm” in an update to clients today.

“The C5 between West Australia to China skyrocketed, transcribing into the C10 transpacific round voyage going ballistic … that then reverberated into the Atlantic,” analysts at Lorentzen & Stemoco explained.

A number of factors came into play, all pointing in an upward direction. The typhoon Chanthu, centered in the East China Sea, disrupted vessel scheduling and thus hiked up vessel capacity utiliszation. Moreover, iron ore prices in China for 62% Fe fines dived to $123.84 per ton on a CFR basis, likely causing anxiety among the mining companies in West Australia and Brazil eager to fix vessels in fear of commodity prices dropping further. The futures prices trading on the Dalian Commodity Exchange yesterday were changing hands at $113.66 per ton for January delivery.

We are quickly moving towards a market regime favouring very high-risk lovers

The other factor increasingly coming into play is Chinese port congestion, thanks largely to Beijing’s zero-tolerance Covid-19 policy. In addition to official restrictions, some ports are enforcing even stricter rules. Cleaves Securities cited the major iron ore port of Qingdao as an example in a new report published yesterday. Qingdao port authorities view vessels having called Indian ports – or ports nearby – within the last 28 days as high level risk and may delay the berthing plan accordingly.

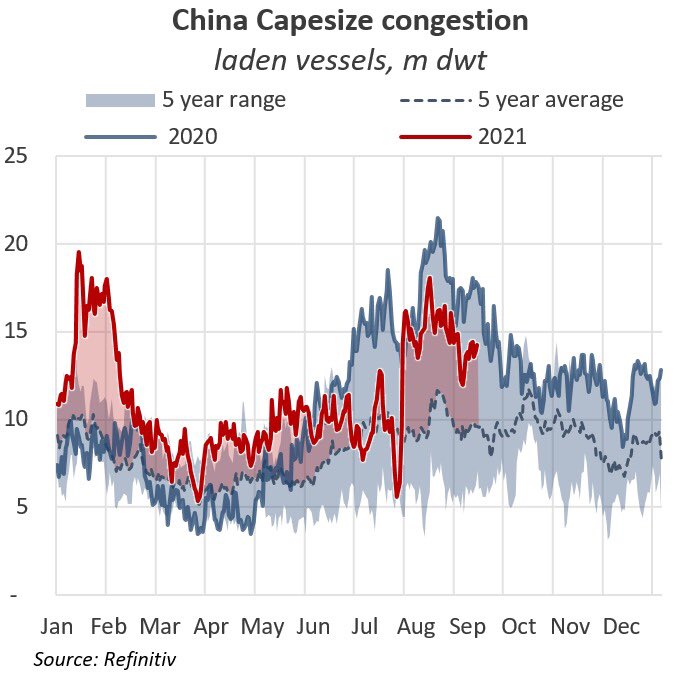

Nick Ristic, a dry bulk analyst at Braemar ACM, observed cape queues in China today are 49% higher than the five year average (see chart below).

The concern for cape owners, however, is China’s restrictive policy on commodities and especially on the steel market, something a new report from Breakwave Advisors suggested should be taken seriously and at least moderate some of the current excitement.

A recent report from BIMCO also touched upon Beijing’s commodities clampdown.

“After strong growth in the first half of the year, the Chinese government seems keen to clamp down on the steel and other heavy industries in order to limit emissions. One big question is how strictly these measures will be enforced and whether they will start to constrain economic growth,” the BIMCO report noted.

The two largest dry bulk goods imported by China in terms of volume, iron ore and coal, have both fallen year-on-year during the first seven months of the year.

“Given the current level of uncertainty and lack of robust long-term fundamentals in support of the current freight boom, we are quickly moving towards a market regime favouring very high-risk lovers,” George Lazaridis, Allied Shipbroking’s head of research and valuations wrote in a new report published this week.