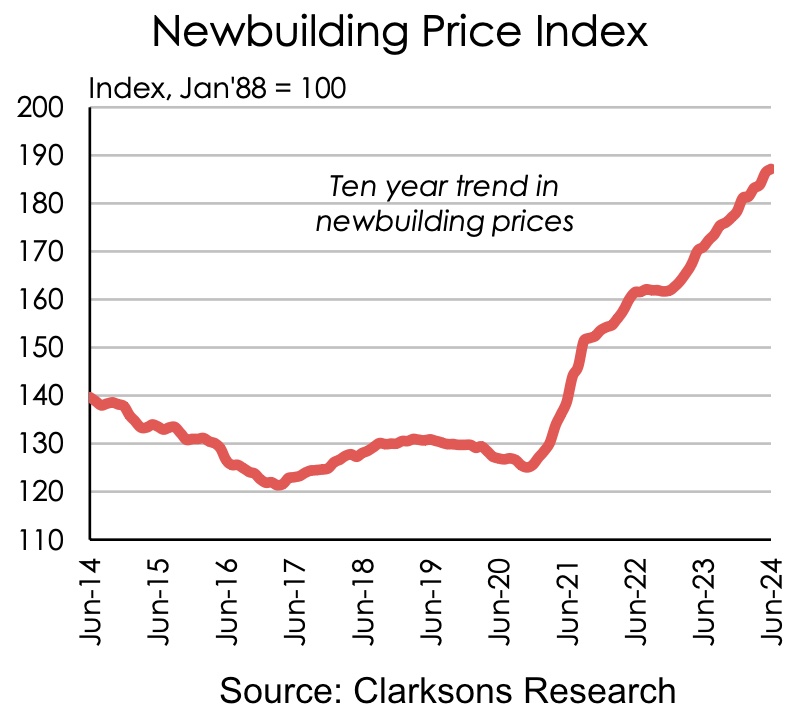

Newbuild prices set to eclipse the highs recorded in 2008

Newbuild prices are on track to surpass the dizzy peaks achieved in 2008.

The newbuild price index conducted by Clarksons Research has risen 5% since the start of the year, and now stands just 2% below its 2008 peak in nominal terms.

One again, LNG and container orders have made the most headlines in 2024, although unlike in earlier years of the 2020s tanker and dry bulk orders have accelerated too.

Year to date MB Shipbrokers has recorded containership orders for about 603,000 teu, and assuming the majority of the current pipeline of projects materialise, the Danish broker reckons that figure will reach about 1m teu within the coming months.

Shipyards are making the most of the current newbuilding boom with new data suggesting the number of active yards has leapt by 17.7% in the space of the last two years.

In June 2022, there were 153 active shipyards, according to Greece’s Xclusiv Shipbrokers. This number climbed to 180 this month, with China accounting for most of the growth. Yard activation comes at a time when shipbuilders are basking in very long order books, with prices at highs not recorded for close to a generation. Splash has reported recently on container delivery slots being marketed for 2029 and LNG slots being negotiated for as far out as 2030.

Shipyards’ global orderbook currently stands at more than 133m compensated gross tonnes (cgt), an increase of 56m cgt compared to the orderbook’s most recent low in late 2020, according to shipping organisation BIMCO. LNG and containerships have accounted for respectively 35% and 30% of the increase.

The number of LNG newbuilding orders has more than doubled from the same period last year where 34 orders were placed, compared to 78 in the first five months of 2024, an increase of 129%, according to recent analysis from VesselsValue.

After a decade of declining output, shipyard production has begun to edge up in recent years with deliveries in Q1 reaching a seven-year quarterly high of 10.1m cgt, according to data from Clarksons Research. Clarksons is projecting a 15% increase in shipyard output for full year 2024 to 40.6m cgt.

Analysts at Danish Ship Finance are bullish on the outlook for the shipbuilding industry, but only in the short term, with global utilisation rates forecast to peak in 2024 before potentially softening in the following two years.

“Continuously firm contracting activity and limited yard availability are pushing newbuilding prices ever closer to an all-time high,” Danish Ship Finance noted in a report issued in May.