Owners face severe yard bottleneck

Shipowners face a severe shipyard bottleneck if they want to source prompt delivery slots from yards in Asia, a situation that is set to worsen in the coming months.

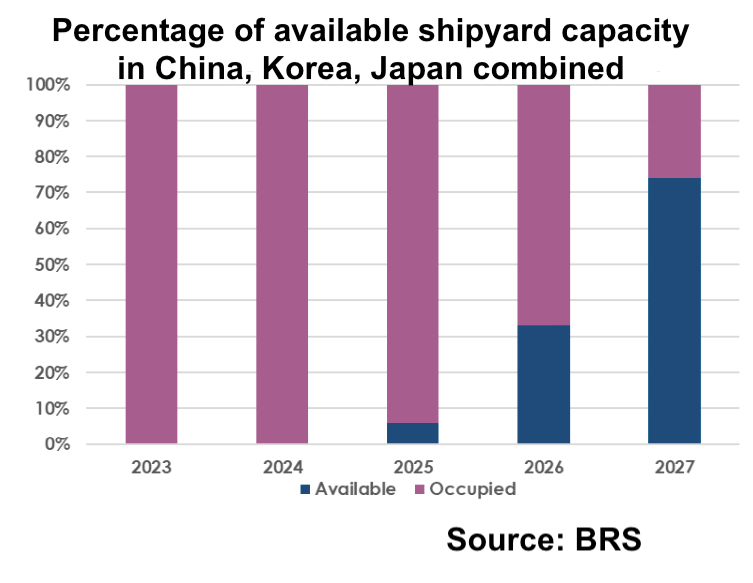

Analysis from multiple broking and banking sources show that available delivery slots have all but dried up for 2025, and are rapidly disappearing for 2026 too.

Maersk Broker is reporting there are now no newbuild slots available at yards for 2025 and most of the early part of 2026.

“Accordingly we do not see shipyards being very flexible on price nor indeed payment terms in the short to medium term,” Maersk Broker noted in a recent report.

Moreover, containership owners and the big names in LNG, who have driven the ordering boom of the past couple of years, show little in the way of a diminished appetite. Splash reported yesterday, for instance, on Taiwanese liner Evergreen issuing a tender for twenty-four 16,000 teu methanol dual fuel ships with another tender for a large series of 3,000 teu vessels expected to follow shortly afterwards.

Tanker and dry bulk owners keen to order are faced with long waits, and high prices, amid an era where shipyards capacity has decreased dramatically in the 15 years following the global financial crisis.

Mark Williams, who heads up UK consultancy Shipping Strategy, has urged yards to massively increase capacity to ensure shipping meets its green goals as stipulated by the International Maritime Organization (IMO).

“If the global fleet is to meet the IMO emission ambitions for 2050, then the entire global fleet needs replacing or refitting,” Williams told Splash Extra in a recent article looking at global shipyard capacity. More than 3,500 ships a year need to be built or refitted, every year, until 2050, according to analysis by Shipping Strategy. At its peak in 2010, the global shipbuilding industry was able to churn out 2,700 vessels a year

“Retired and mothballed shipbuilding capacity will have to be brought back onstream by the end of this decade,” Williams said, going on to predict a newbuilding boom that could last for decades.

According to Danish Ship Finance, which issued a lengthy shipping markets report on Tuesday, today’s average newbuilding price is among the highest 15% seen since 2000.

Yard capacity is predicted by Danish Ship Finance to increase by 1.5m cgt from 2022 to 2023, with the reopening of 12 yards in China.

There’s a huge assumption in those graphs – the “3% CAGR” (3% compound annual growth rate).

Given that replacement fuels will be much more expensive, and given that the 3% CAGR of the past was assisted by a long term drop in real freight rates as ships got bigger, cheaper to build and cheaper to operate, I really doubt if this assumption should be made.