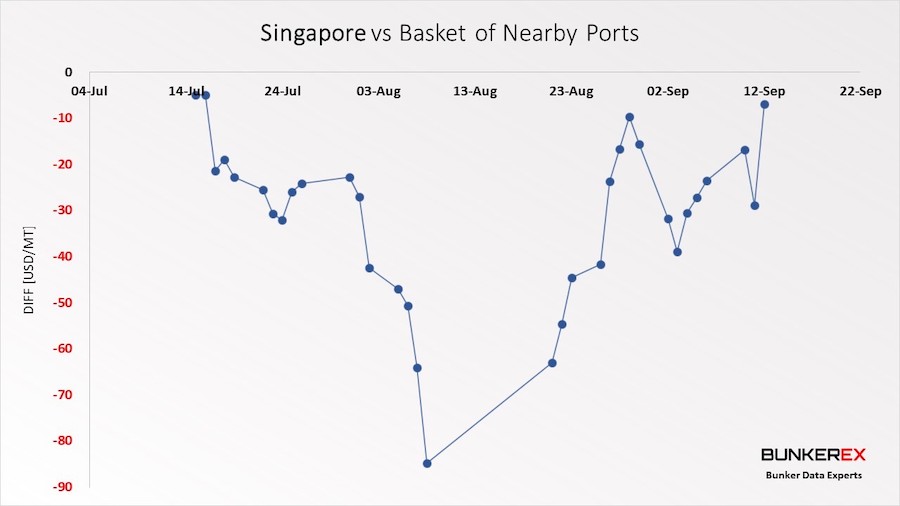

Physical premiums in Singapore continue to be extremely strong leaving many owners searching for alternate options. The graph below illustrates the trend of HSFO in Singapore versus a basket of nearby major ports.

Perhaps it was the jubilation of their National Day because since August 9, Singapore has been steadily rising and is now at relative 60-day highs.

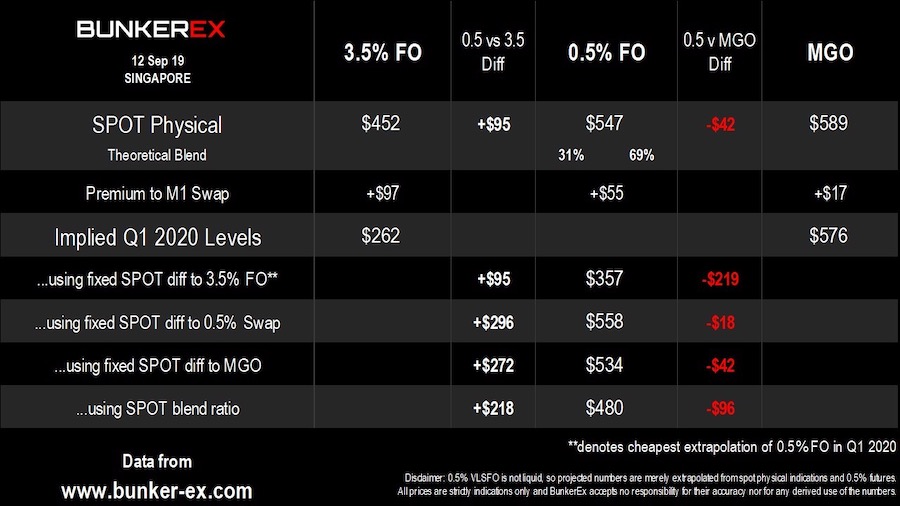

Looking forward, this makes VLSFO ($547 today and $42 under MGO) look deceptively cheap versus HSFO (+$95).

We don’t anticipate HSFO physical premiums in Singapore to stay this strong come Q1 2020. Assuming HSFO drops down to +$30, this gives a ‘physical’ GoFo of $314.

Much of the talk at the annual Asia Pacific Petroleum Conference (APPEC) has been about the 0.5% FO contract gaining liquidity and if the premiums stay steady, we can expect a big bump in the HSFO-VLSFO difference in January next year (currently $270) before reducing as the year drags on (the Cal-20 hi5 jumped to $245 this week as HSFO got sold off).

All of this is good news for vessels fitted with a scrubber as the ‘scrubber premium’ for TC rates grows.

In other news, flat price reacted to the prospect of Iranian crude once again hitting the market and weaker demand by dropping to $60 from highs in the week of $63.55 (Nov-19 Brent). As ever though, OPEC is expected to try and support prices with more production cuts.

Lastly, advocates of using wind as a clean way to power ships will be happy to hear that the vinyl is set to outsell CDs for the first time since 1986 – it seems older technologies can make a comeback.