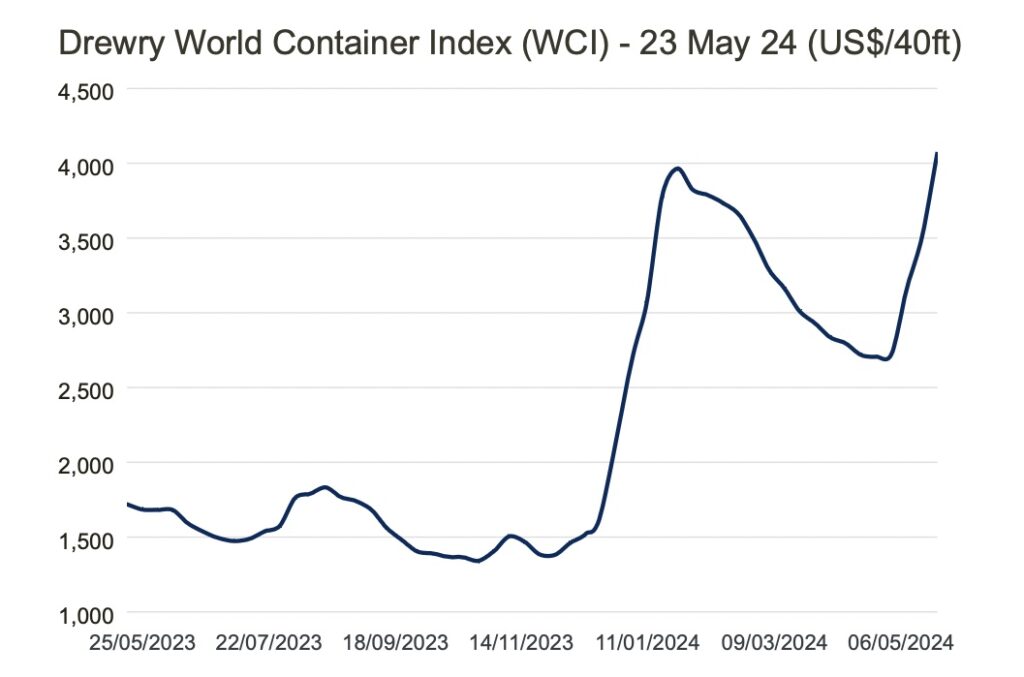

Box spot rates ‘entering pandemic-level territory’

Drewry’s composite World Container Index increased 16% to $4,072 per feu this week, sustaining remarkable increases recorded throughout May and pushing box shipping back towards the all-time highs of the covid era earlier this decade.

A constrained supply picture due to Red Sea rerouting and healthy demand trends in several geographies have prompted an early start to peak season volumes leading to rates on the main east-west trades leaping this month to levels not seen since September 2022. The latest boom has been across nearly all routes with the strength spreading to Latin America, Africa and intra-Asia.

“We are entering pandemic-level territory,” commented Lars Jensen, founder of container advisory Vespucci Maritime, in a post on LinkedIn yesterday, noting that it was only during the covid era that liner shipping experienced similar extreme increases over a three-week period.

“The current market dynamic is somewhat similar to the 2021/2022 period which started with a sudden jump in demand, leading to a constrained fleet, then leading to box shortages, leading to congestion and then to record-level spot rates,” analysts at Jefferies, an investment bank, recounted in a recent note to clients, adding: “This year has begun with a sudden change in trader patterns, leading to a constrained fleet, which is now leading to box shortages. Congestion remains moderate at the moment though that may change as shippers/retailers scramble to book availability; meanwhile spot rates are already at all-time highs excluding the record 2021/2022 period.”

The Shanghai Containerized Freight Index (SCFI) published today – another key spot index – climbed 7.25% this week to 2,703.43 points, its highest point since September 2022.

“Unseasonal increases in demand for ocean freight out of Asia – due to the possible start of a restocking cycle in Europe, and a pull forward of peak season demand by North American importers out of concern over labour or Red Sea disruptions later in the year – are putting additional strain on a container market already stretched thin by Red Sea diversions,” noted Judah Levine, head of research at Freightos, a box booking platform.

“The barrage of general rate increases (GRIs) by major liners in April and the 1st and 15th of May have also contributed to the spot freight rate surge,” observed a new report from UK consultancy Maritime Strategies International (MSI). Another factor leading to the surge picked up by MSI has been bad weather at Chinese ports this month.

Analysts at Alphaliner are forecasting liners will report Q2 profits that surpass the healthy figures already outlined in Q1.

Liner veteran John McCown, who runs Blue Alpha Capital, has suggested liners as a whole made a combined net income of $5.4bn in Q1 this year, a sharp rebound sequentially from the $0.7bn net loss in Q4 last year.