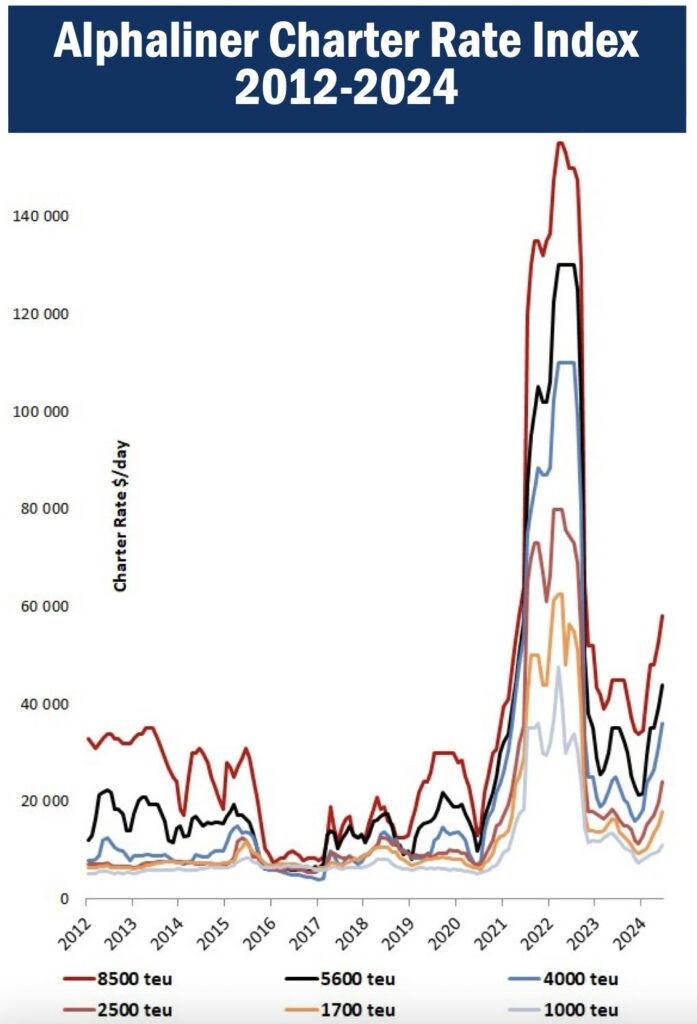

Boxships being chartered for in excess of $100,000 a day

The buoyant container shipping market has seen charter rates return to six-digit territory for the first time since 2022.

Alphaliner is reporting CMA CGM has fixed a 7,000 teu newbuilding for three months at a rate of $105,000.

Analysts at Clarksons Research note that owners are considering very short charter periods with heavily inflated rates in order to capitalise on current market conditions where spot rates are at highs never experienced outside the covid era.

Discussing the CMA CGM fixture, Alphaliner noted in its latest weekly report: “This robust price highlights the scarcity of large ships, especially prompt units, forcing charterers to either pay high premiums for immediate tonnage availability or consider forward positions as far as 2025 for longer and more affordable period charters.”

Container shipping’s current earning bonanza started thanks to the Houthi attacks in the Red Sea leading to a massive rerouting of the global fleet around the west coast of Africa on trips between Asia and Europe.

“A deficit in numbers of the largest container vessels to fully staff the mainline East – West services is causing a scarcity in cargo capacity and schedule disruptions,” noted the compilers of the New ConTex chartering index in a recent report. Schedules not being met in turn leads to port congestion as vessels currently have to wait a few days before berthing in some of the major hubs such as Singapore, Dubai or Rotterdam.”

Adding to the lack in capacity is an increase in cargo volumes as shippers try to move their goods early in order to avoid an end of year squeeze.

“There is a firm belief that this positive trend will continue for some time. As a result, charter rates are improving further,” broker Braemar noted in a Monday container markets briefing.

“The container market remains very tight with healthy demand, constrained vessel capacity, out-of-position boxes and congestion in Asia leading to a more frantic pace of bookings on the part of shippers and retailers,” Jefferies, an investment bank, noted recently.

The Shanghai Containerized Freight Index (SCFI), out last Friday, was up by another 140 points to 3184.87, its highest level since August 2022, while Drewry’s composite World Container Index, published last Thursday, jumped 12% to $4,716 per feu, up 181% compared to the same week last year. The Drewry index stands at 232% more than the average 2019, pre-pandemic rates of $1,420.

As stated above, the original source for this year’s leap in container earnings has been the Houthi attacks on more than 100 merchant ships in support of Hamas’s ongoing war with Israel leading to the vast majority of containerships to avoid the Suez Canal.

A proposed ceasefire plan between Hamas and Israel – which was endorsed by the United Nations Security Council on Monday night – saw the share prices of many stock-listed liners fall yesterday.

Cautioning that any cease-fire will not instantly see shipping shift back to the Red Sea, Lars Jensen, who heads up liner consultancy Vespucci Maritime, wrote on LinkedIn today that a temporary ceasefire would be unlikely to be sufficient for operations teams of global liners to redirect their vessels back towards the Suez Canal.

“From a carrier viewpoint the major risk would be going back to Suez routing only to have to do a U-turn and go back around Africa if the ceasefire does not hold or the Houthis have another agenda,” Jensen wrote, adding: “This would be extremely disruptive to the cargo flow and the capacity availability, hence the carriers might be quite risk-averse.”