Fuel price spread at lows rarely experienced during the global sulphur cap era

The price spread between high and low sulphur fuel oil (HSFO and VLSFO) are at lows rarely seen since the advent of the global sulphur cap at the start of the year 2020.

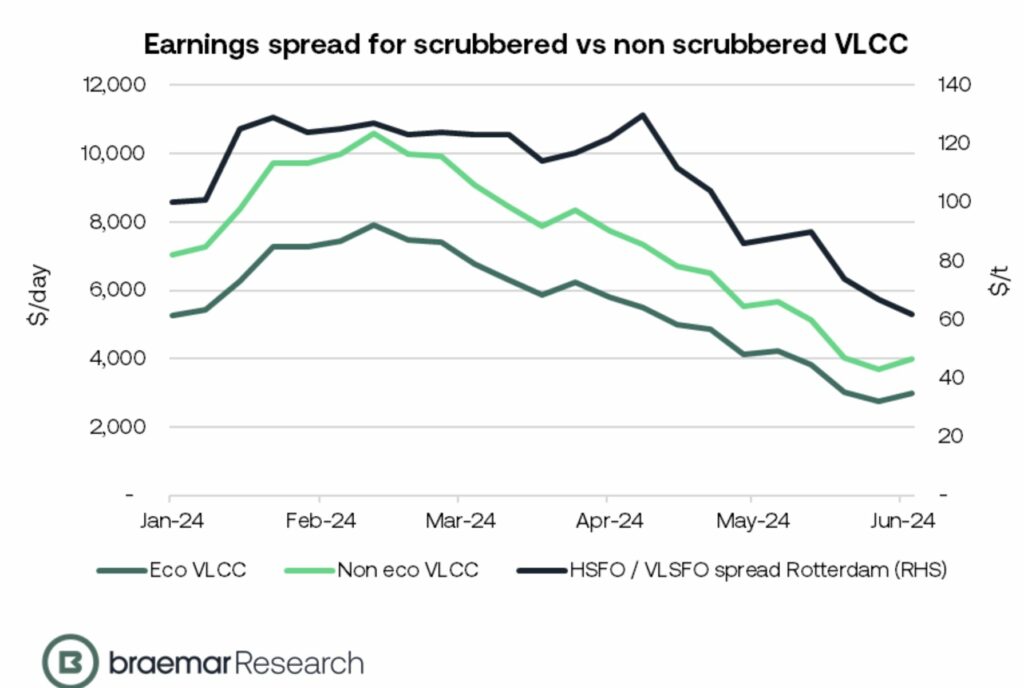

The price spread between shipping’s top fuels – known as the Hi5 – stands at around $67 today, eroding the premium earnings that scrubber-fitted ships have enjoyed for most of the global sulphur cap era.

Research from broker Braemar suggests earning premiums for an eco scrubber-fitted VLCC are under $3,00 a day, down from $8,000 a day in February.

HSFO margins have increased by nearly $10 per barrel in the past two months, which Braemar said in a new report reflects a scarcity of sour crude.

Fuel oil stocks in Singapore and Europe have also been steadily declining since the start of the year. Disruption in the Red Sea caused by Houthi attacks on vessels have forced vessels to take longer routes between the east and west, driving bunkering demand to a 19-month high, according to the International Energy Agency.

Sales of HSFO were higher than VLSFO in the port of Rotterdam for the first quarter of 2024, the first time this has occurred since the global sulphur cap came into force, something that was in no small part down to the longer voyages much of shipping is doing to avoid the Red Sea.

A new report from Integr8 Fuels has pointed out that geopolitical events often have a knock-on effect on fuel quality, sometimes relating to blending economics, and occasionally, also relating to the impact on barge infrastructure because of rapidly changing demand.

“Since October 2023, many more vessels have been rerouting around Africa rather than travelling via the Red Sea, resulting in a significant increase in volume of HSFO demand, with a ripple effect stretching as far as Barcelona,” the Intergr8 report noted. During the same period, tIntergr8 reported that there has been a 30% increase in VLSFO sulphur off specification incidents in ports along the African coast and nearby Spain, which upon closer inspection, show a root cause of affected barges also carrying HSFO.

The increase in HSFO demand is also putting pressure on supply models, according to Intergr8 with more than 100m dwt of ships around the world now kitted out with scrubbers.

Finally, Braemar is warning that as the northern hemisphere approaches summer, the demand for fuel oil for utilities may put further strain on fuel oil supply and bunker prices.