LNG vessel demand forecast to double this decade, hogging available newbuild slots

Booming Asian demand is set to double the ton-miles picture for LNG shipping in the 2020s, new analysis from Oslo-based Rystad Energy suggests.

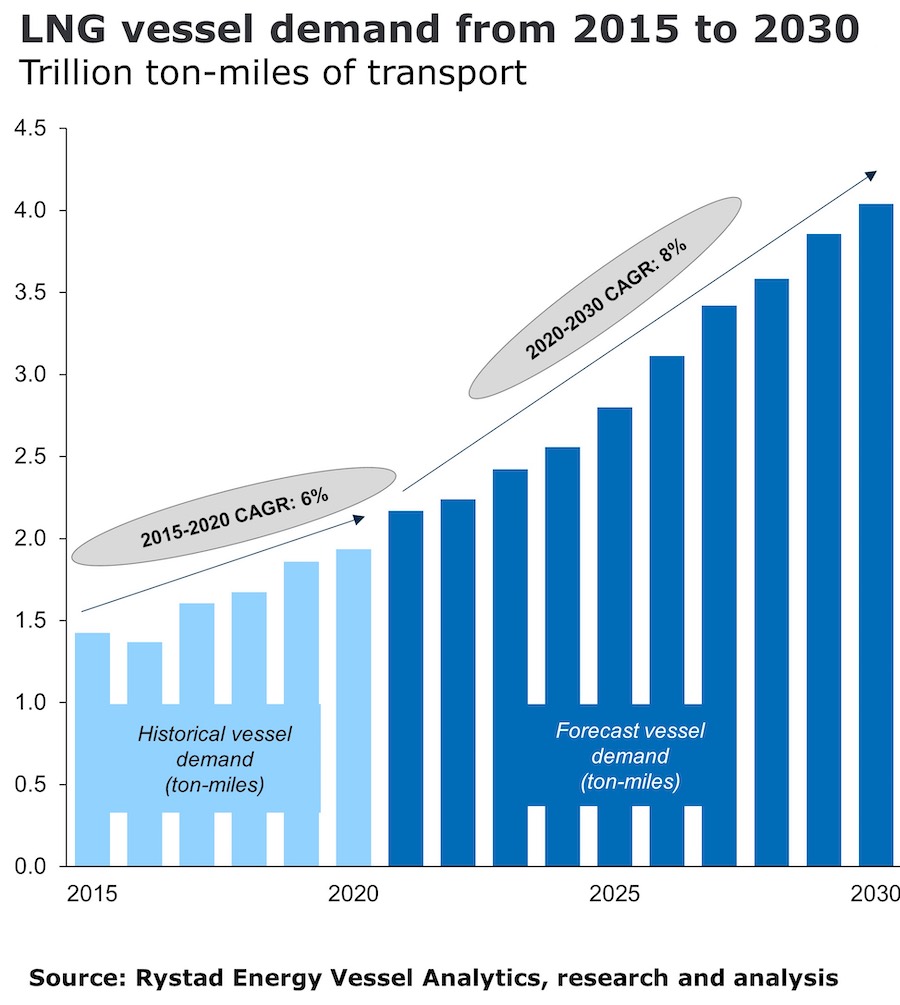

Rystad is predicting LNG vessel demand will increase from approximately 2trn ton-miles in 2020 to 4trn ton-miles in 2030. This equates to a yearly growth rate of 8%, a considerable acceleration compared to the growth rate of 6% seen from 2015 to 2020.

“Larger volumes and longer sailing distances have caused this increase in demand for LNG carriers in the current decade,” Rystad stated in a new report looking at LNG shipping emissions.

Asia is key to this growth with the continent on track to constitute 75% of the global LNG market by the end of the decade.

The stunning growth in demand will require many more gas carriers to be built, something that will have knock-on effects to other shipping sectors as shipyards tend to prioritise slots to more profitable gas carrier construction.

Based on the average distance sailed by LNG carriers in recent years, Rystad reckons the current LNG carrier fleet and yard orderbook capacity will not be sufficient to meet the surge in ton-mile demand.

Rystad Energy’s team expects to see a record high 64 newbuild vessels delivered by shipyards in 2021. That is also the number needed on an annual basis to ensure sufficient capacity to meet the rising demand for ton-miles towards 2030. Yet, such a high pace of new deliveries over several consecutive years will be a major challenge due to capacity limitations, as qualified shipyards can presently build around 57 units per year.