Box rate difference between smaller and large shippers approaching $20,000 per feu

The crippling container shipping costs hitting smaller shippers has been analysed by Danish consultancy Sea-Intelligence, clearly illustrating why so many exporters are skirting with bankruptcy thanks to this year’s record freight rates.

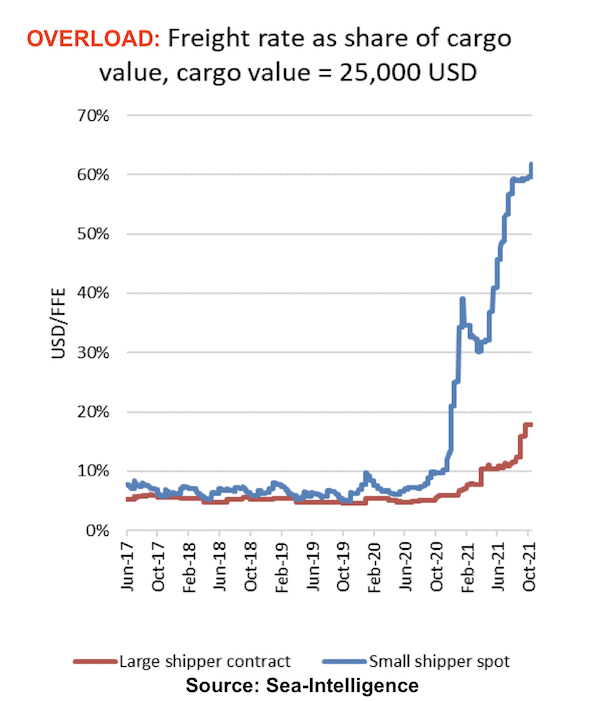

The price differential between smaller shippers using spot cargo and larger shippers on contract continues to escalate. The gap was $10,000 per feu four months ago but is now approaching $20,000.

Taking merchandise inside an feu worth $25,000 as an example, Sea-Intelligence data carried in its latest weekly report shows the share freight costs account for as a ratio of the cargo value. A large shipper with fixed liner contracts typically will be paying freight costs with up to 18% of the box’s cargo value, up from 5% pre-pandemic.

However, the small shipper, suffering the vagaries of the soaring spot market, has seen freight costs explode from 7% to 62%.

The current freight crisis shifts competitiveness between shippers

Calculating the impact on overall profitability, under the assumption that both shippers have a profit margin of 20% exclusive of freight costs, Sea-Intelligence shows that for this comparatively lower value merchandise, the larger contract shippers essentially see their profits reduced to zero, but the small shippers see their profits flipped to losses, which in magnitude exceed previous profits to an extreme degree. In Sea-Intelligence’s model, published yesterday, a spot shipper will see a net loss of $10,000, on a shipment with a value of $25,000 in today’s sky-high spot rate freight rate environment.

“[T]he current freight crisis shifts competitiveness between shippers. In turn, this also means the crisis is a clear opportunity for competitive positioning for some shippers,” Sea-Intelligence stated.

The plight of smaller shippers carrying low value goods being elbowed out of the market because of high shipping costs and limited box availability has been well documented in recent months.

Speaking with Splash last month, James Hookham, a director at the Global Shippers Forum, said: “The killer for many small businesses will be the squeeze on their cash flows as they will need to settle higher shipping bills before they have a chance to renegotiate their contracts with larger customers. Businesses die when they run out of cash not because they run out of goods to sell”.

While there has been signs of spot rates topping out in recent weeks, many analysts are warning it will take many months for prices to truly cool down.

“Despite the dip in rates, congestion and demand are expected to keep delays and elevated rates a reality not only through the end of this year but possibly through the end of 2022 as well,” warned Judah Levine, head of research at global freight platform Freightos.

”Taking merchandise inside an feu worth…….”?

There is no such thing as an ‘feu’!

What this sentence should have said is : ”Taking merchandise inside a 40′ container worth……..”.

How can you take cargo in a forty foor equivalent unit?

Besides the obvious semantics, surely the article is stating the obvious – big business makes bigger gains in a tight market- small business withers and dies – survival of the fittest = QED?

Yes, there is FFE or Forty Foot Equivalent or FEU (Forty Foot Equivalent Unit).

.

Not challenging you since these terms used interchangeably are not known by many let alone the general public. They are usually used by experts and mega players and stakeholders for pricing calculus purposes and strategic reasons surely you understand.

.

As a side note in the last 40 years or so many container lines no longer exist. Went bankrupt or had to be sold.

.

Would anybody sell a business that’s profitable or operating in an industry where competition is not fierce?