Could Stellar Daisy spark an end to the converted VLOC?

Could a significant chunk of the global dry bulk fleet be set for accelerated scrapping?

With a third elderly Polaris converted VLOC heading for repairs and under fire classification society Korean Registry admitting rule changes could come in the wake of the Stellar Daisy sinking, dry bulk rates might be set for a dramatic swing.

Thirteen days ago the 1993-built Stellar Daisy sank off Uruguay. The ship – originally a VLCC – is reported to have taken on water and split in two very fast. Days later another 1993-built converted ore carrier belonging to Polaris had to reroute for Cape Town for repairs after a hull crack was discovered.

This then prompted the Busan-based owner to launch an urgent fleet wide series of inspections, which in turn has seen a 1992-built converted ore carrier also head off to Cape Town to be fixed.

The spotlight is now on Polaris’s fleet of converted bulkers – and indeed other such ship types around the world. 19 of the 32 ships in Polaris’s fleet are converted vessels.

Last week a spokesperson for the Korean Register, which classed all three troubled Polaris ships, told Splash rule changes in the wake of the Stellar Daisy casualty were a “possibility”, while a local Korean seafarers union has made public its concerns that further accidents involving converted ore carriers could happen.

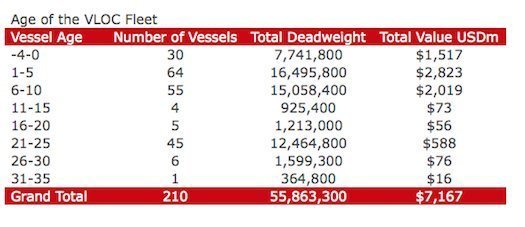

24% of today’s VLOC fleet are converted VLCCs, according to Alphabulk. Data provided for Splash by VesselsValue.com (see bottom of article) shows some 8.37m dwt of the 55.86m dwt global VLOC fleet are converted VLCCs, equivalent to around 47 capesizes in terms of capacity. Moreover, 27 of these converted ships are between 21 and 25 years old, and three of them are between 26 and 30 years old.

Analysts at Alphabulk have dismissed theories that the Stellar Daisy went down because of cargo liquefaction.

“[W]ith no bad weather, no collision, no cargo liquefaction and an ingress of water, this suggests two possibilities or their combination: human error and/or catastrophic structural damage,” Alphabulk mused in its latest weekly report.

The report looked at issues facing ore carrier conversions.

The first potential issue is that a VLCC has no hatchway to access the center tanks, which will be the ones used to carry the iron ore. The deck which provides a big part of the longitudinal strength of the ship has to be cut in order for hatch covers to be put on top of the newly fitted hatch coamings. This decrease in longitudinal strength has to be compensated for by fitting extra brackets, stringers, girders. Welding new steel of one type to old steel of another type is feasible if the procedures, which are extremely strict, are followed. The conversions would have involved kilometres of welding, which has to be done in a very specific way, Alphabulk explained.

The Stellar Daisy however developed a water ingress, which Alphabulk said is likely to have come from a dislocation of the shell plating underwater.

“[T]his could indicate a more trivial cause: simple metal fatigue, which may have been exacerbated by the increased speed of loading iron ore these days,” the report noted.

Concluding its early investigation into the sinking, Alphabulk noted: “We will probably never know the precise reason or, more likely, reasons for the sinking of the Stellar Daisy, but it is likely to be, as always, a combination of causes. This could include the age of the vessel leading to a high level of metal fatigue, some level of unaddressed corrosion, poor quality of welding during the conversion, speed of loading, or even a faulty deballasting sequence (this could be the only human error involved). All these elements could feasibly have coalesced into the sinking of the ship with the tragic loss that ensued.”

Meanwhile, Polaris’s main business partner, Brazilian mining giant Vale, would not be drawn on whether it was looking for changes when contacted by Splash. The Stellar Daisy sank with 260,000 tonnes of Vale’s iron ore.

“Our contracts have confidentiality clauses so we are unable to make any comment,” a spokesperson for the miner said.

sinking, dry bulk rates might be set for a dramatic swing.

sinking, dry bulk rates might be set for a dramatic swing.