Danish Ship Finance discusses stranded assets and peak seaborne trade volumes in new report

Danish Ship Finance has released its latest shipping market review. The 69-slide presentation, led by Christopher Rex, has a strong focus on the industry’s pathway to zero carbon vessels. On the markets, the Danish analysts are especially bearish on next year’s prospects for tankers and LPG carriers, and remain concerned for the livelihoods of many of today’s struggling shipyards.

Key data in the report include the facts that average secondhand prices declined 10% during the first ten months of 2020, but sale and purchase activity has been weak. The average newbuilding price declined 2% during the same period.

“The price spread between a five-year-old and a ten-year-old vessel has declined by 7% in 2020, indicating reduced earnings expectations or a shortening of expected economic lifetimes by approximately two years,” Danish Ship Finance noted, going on to discuss the global orderbook, which currently equates to 7% of the world fleet. Three out of four vessels are scheduled to be delivered by the end of next year.

Discussing green stimulus measures being enacted across the world post-Covid-19, Danish Ship Finance analysts mused on stranded ship assets as well as the approaching peak seaborne trade volumes for many sectors.

“The timing of peak seaborne trade volumes is up for review in many segments. This is especially the case for vessels that transport fossil fuels (i.e. Crude and Product Tankers, LNG and Capesize vessels (coal)), but other segments (for other reasons) – Offshore Supply Vessels, large Container vessels and Car Carriers – are also considering whether peak seaborne demand is approaching,” the report suggested.

Given how few ships are being ordered these days, Danish Ship Finance said the knock on effect for vessels that are not set to be scrapped in the short to medium term, their price outlook appears bright.

“We expect their life expectancy to lengthen, as long as few new vessels are delivered and demand grows. If this situation persists into 2021 and beyond, many vessel segments may enter a period of higher freight rates and appreciating secondhand prices. If the situation proves long-lasting, existing vessels may begin to see their economic lifetimes approach their technical lifetimes and, in some segments, even exceed them,” Danish Ship Finance predicted while examining today’s newbuild contracting impasse.

The far fewer shipyards that survive in the next couple of years could be in a position to reap an ordering bonanza by the middle of this decade, Danish Ship Finance predicted as “extraordinary contracting activity” for dual-fuel and/or zero-carbon vessels ought to get underway.

“These vessels may not be ordered at all yards, but the high-end yards that are price competitive could start to see the first signs of a boom in the making,” Danish Ship Finance claimed.

The research house was most bearish on tanker prospects for next year, especially aframaxes, as well as LPG carriers.

On crude tankers, Danish Ship Finance stated: “The short and medium-term outlook is bleak, since the combination of weak oil demand and high inventories implies little new demand for Crude Tankers, while further unwinding of floating storage will increase the available supply of Tankers.”

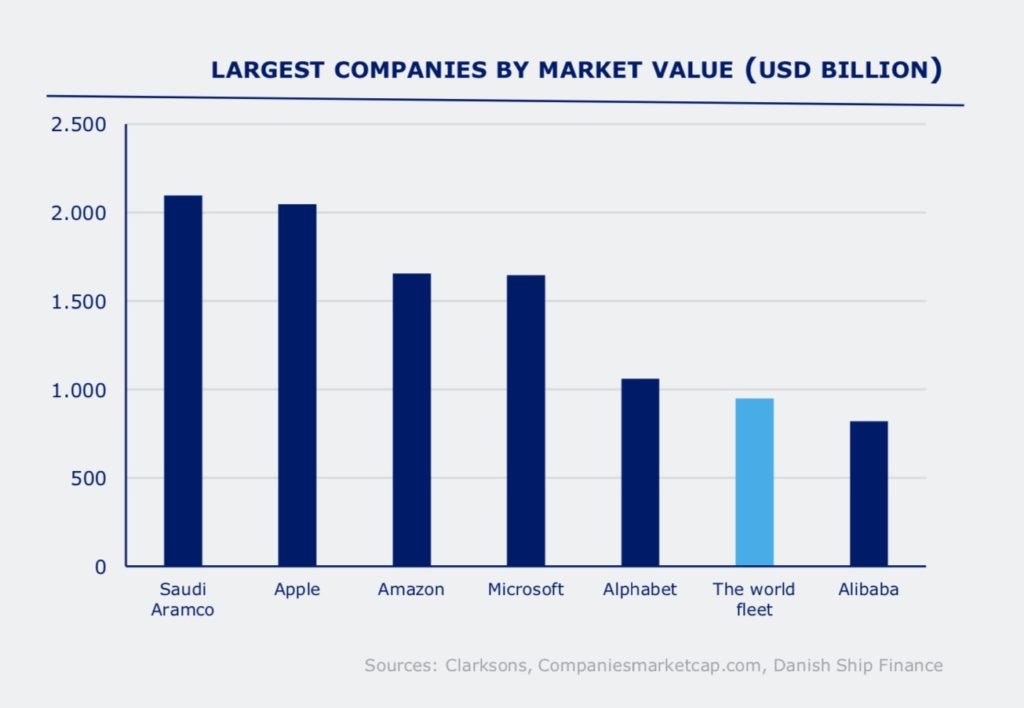

Finally, providing some perspective as to how small shipping is as a global industry, the Danish analysts took the global merchant fleet and compared it to leading conglomerates around the world, such as Apple and Saudi Aramco.