Extraordinary volatility of main shipping segments through the pandemic highlighted

Shipping is a notoriously volatile industry, one that has burnt many investors over the years. Yet, even by its own extreme standards, the volatility experienced across all the main shipping segments during the pandemic has been extraordinary, with all sectors experiencing earnings up by at least 100% as well as down by 50% since the start of 2020.

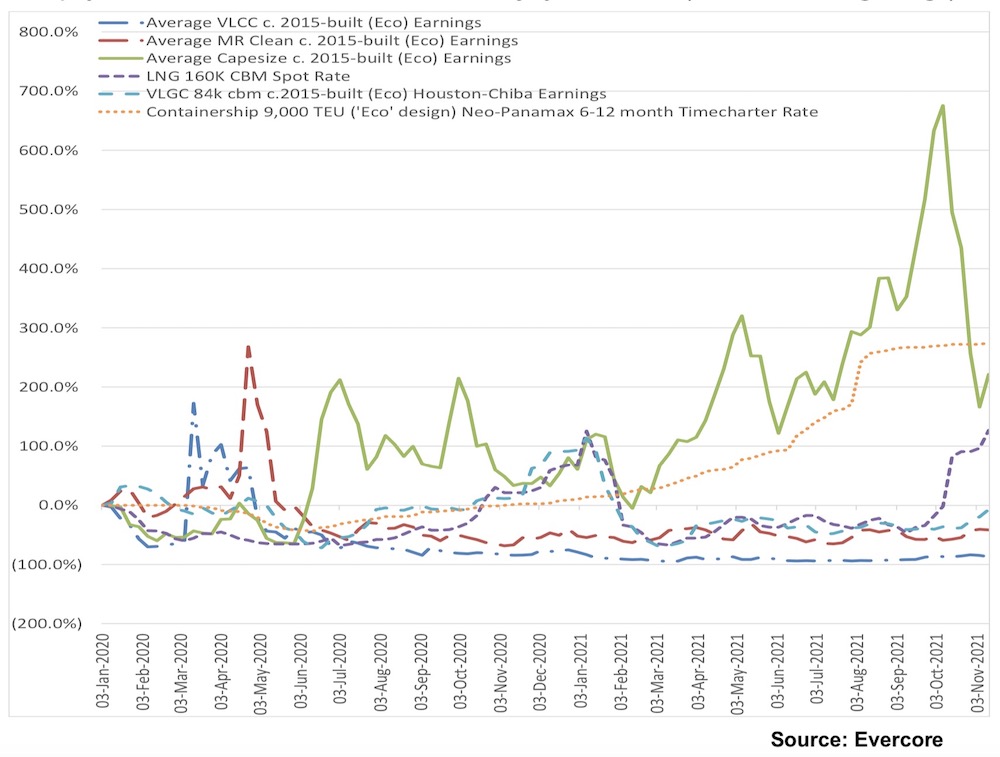

Analysts at investment bank Evercore have charted the indexed performances for VLCC, MR, capesize, LNG carrier, VLGC and neopanamax containership TCE earnings or main trade spot rates since the beginning of 2020 (see chart below) highlighting the extraordinarily fast peak and troughs in earnings for shipping during the Covid-19 era.

“Core fundamentals do not result in this level of extreme volatility, with anomalous factors like port congestion, floating storage arbitrage, and regional commodity shortfalls (and associated arbs) the primary reasons for the massive peaks and valleys. These temporary drivers are not new to the industry, but have reached a new level of impact in the last two years, making it harder for investors to trust what is secular and what is temporary,” Evercore stated in a note to clients.

The level of whiplash over the past couple of years has been bruising even for the most nimble investor

The sharp moves both up and down have made it tricky for shipping stock investors beyond the shortest of time periods, Evercore suggested, noting how in pre-Covid times the supposed appeal of shipping equities have been the sharp cyclical volatility that provides opportunities to capture tremendous upside in tight markets and equally robust downside when the pendulum swings the other way. The “level of whiplash” over the past couple of years, Evercore said, has been bruising even for the most nimble investor.