Ukraine’s Black Sea operations have a massive trench to climb out of if Europe’s ‘bread basket’ is to get back to exporting grains to levels seen earlier in the year when a United Nations-brokered shipping pact with Russia was still in existence.

In July Russia backed out of the 12-month-old Black Sea Grain Initiative and started to pound Ukrainian port infrastructure both on the Black Sea and along the Danube. In recent weeks, however, Ukraine has retaliated hard with successful skirmishes into naval bases along the Crimean coast, while also pushing to create a new shipping corridor that hugs its coastline and that of its neighbours to the south, NATO members Romania, Bulgaria and Turkey, to kickstart grain exports out of the Black Sea again. Seven merchant vessels have successfully sailed the new route already with Ukraine emboldened by its newfound ability to target Russian warships and deter them from entering Ukrainian waters.

The Black Sea Institute of Strategic Studies has recorded more than 35 attacks this year on Sevastopol, a city on Crimea’s southern tip that houses Russia’s Black Sea fleet headquarters. According to the institute, Moscow has relocated part of its fleet to Novorossiysk, which lies on the eastern shore of the Black Sea and is out of range of many Ukrainian weapons.

The British Ministry of Defense said on Tuesday that it was likely that Russia’s ability “to continue wider regional security patrols and enforce its de facto blockade of Ukrainian ports will be diminished” as a result of the attacks.

“Getting the Black Sea ports open is the single most important thing we can do right now to help the world’s hungry,” David Beasley, executive director of the World Food Programme said last month.

“It will take more than grain ships out of Ukraine to stop world hunger, but with Ukrainian grain back on global markets we have a chance to stop this global food crisis from spiralling even further.”

Overland exports have hit problems with some countries, notably Poland, instituting unilateral bans on Ukrainian grains over fears their exports will flood the markets.

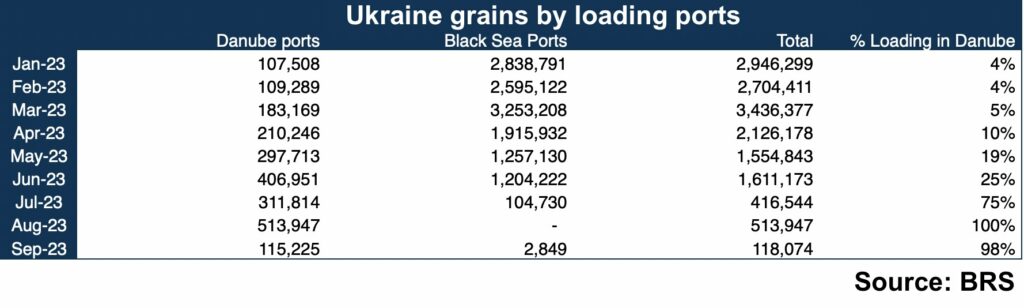

The mountain Ukraine has to climb however in resuscitating its Black Sea exports is illustrated in exclusive data provided to Splash by brokers BRS, which shows year-to-date grain exports by ship and the severe drop in totals since July and a greater switch to the Danube over the past couple of months.

Nevertheless, there are increasing signs that Ukraine has turned a corner in its maritime exports. Cargo order volumes for agricultural commodities loading in Ukrainian ports have more than doubled in the past two weeks, according to online platform Shipfix.

“More activities can be expected in the Ukrainian ports in the coming weeks,” said Ulf Bergman, Shipfix’s senior economist, adding that demand remains very much focused on smaller tonnage.

The demand for seaborne transportation in the past two weeks has been at the highest level since early February, according to Shipfix.

“While the average cargo size remains on the small side, the past two weeks have seen them edging up. An increase in appetite for vessels in the mid-sized segments has partially fuelled the increase. However, this development is still limited in scope,” Bergman told Splash.